The sales of existing single-family detached homes in California were down 22.7% in July from the level recorded a year earlier, according to the California Association of Realtors.The seasonally adjusted annualized rate of closed-escrow resales totaled 350,980 in July, down from the 453,980-unit rate recorded in July 2006, CAR reported. The median price of an existing single-family detached home in California totaled $586,030 in July, up 3.2% from a revised $567,860 a year earlier, the association said. "With credit drying up in recent weeks, we expect further weakness in sales over the next few months," said CAR president Colleen Badagliacco. "It is too early to say how long the current credit crunch will continue, but we are hopeful that we will avoid a prolonged credit crisis that might cause sales to decline over a longer period of time." CAR can be found online at http://www.car.org.

-

Judges on the U.S. Court of Appeals for the District of Columbia struggled to find a resolution to an injunction issued last year that halted reductions-in-force by the Consumer Financial Protection Bureau.

4h ago -

The Federal Housing Finance Agency said it is reviewing more than 9,000 pages of records tied to fraud tips submitted through a hotline launched last April.

6h ago -

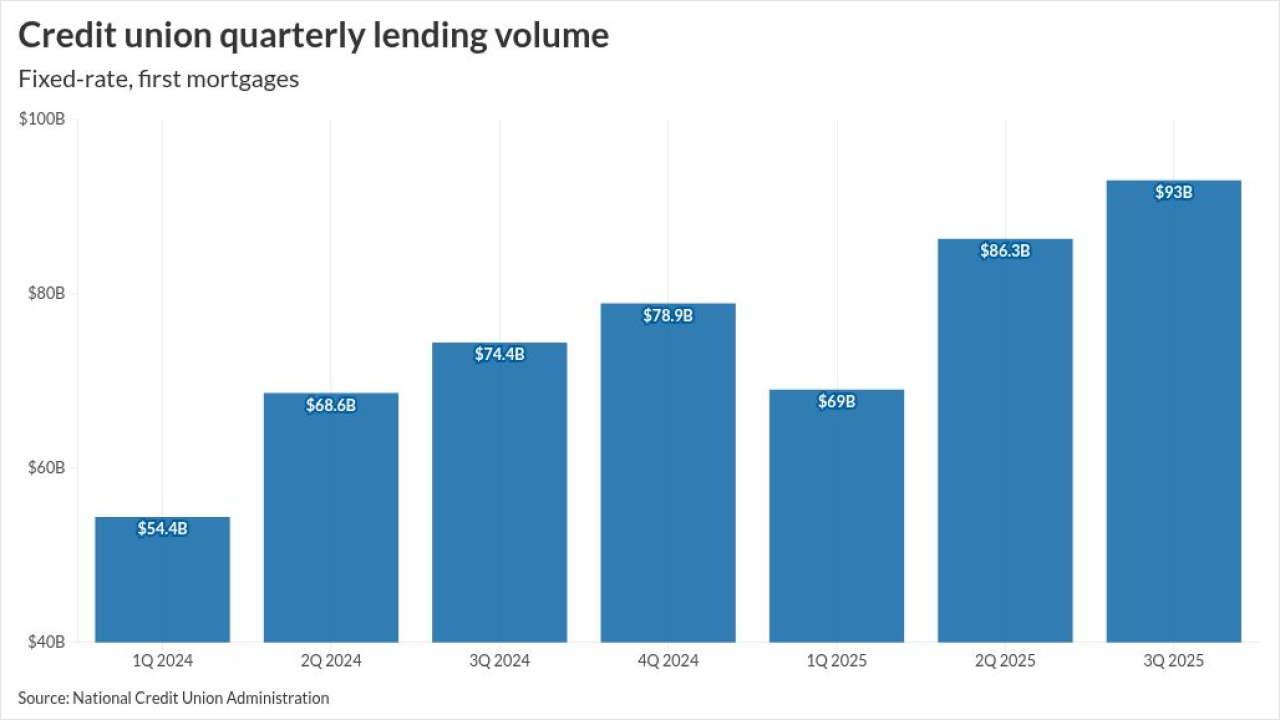

The agreement between servicing technology platform Vertyx and Great Lakes Credit Union arrives as the mortgage industry sets its focus on borrower retention.

6h ago -

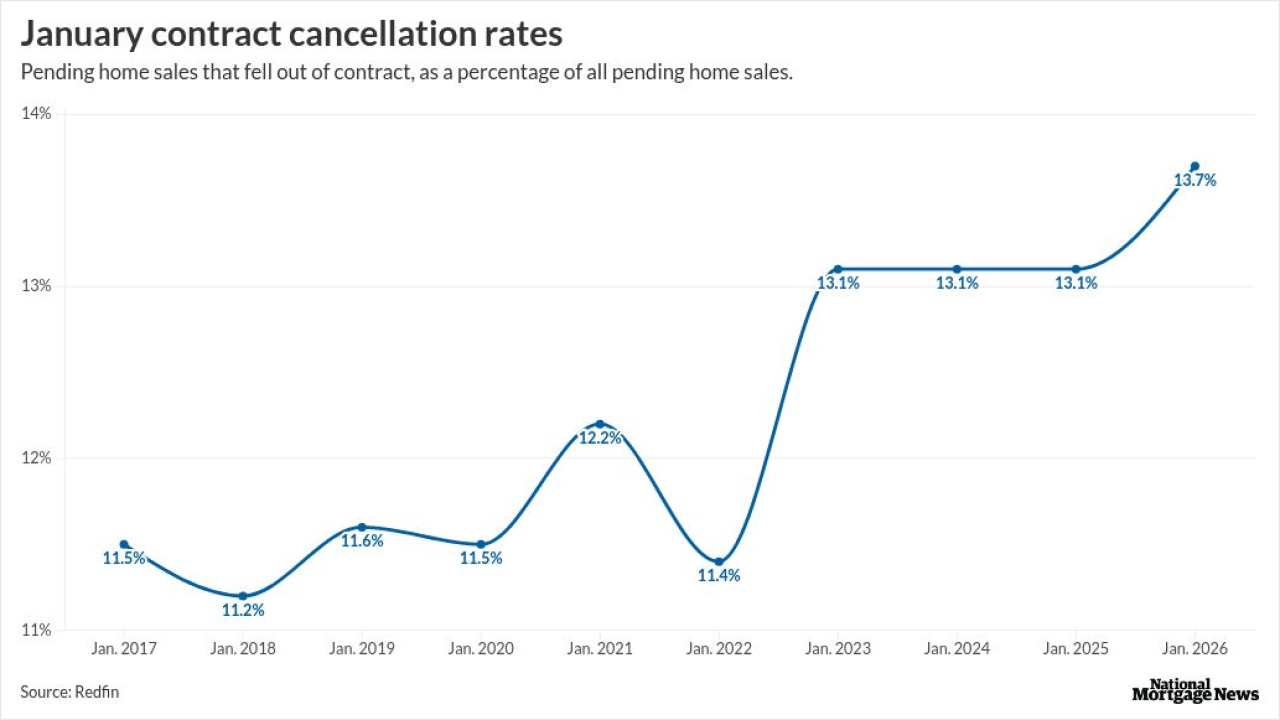

Nearly 14% of homes that went under contract last month were cancelled, up from 13.1% last year and the highest January share in records, according to Redfin.

7h ago -

Federal Reserve Gov. Lisa Cook said AI could boost productivity, but warned the transition may raise unemployment and force difficult tradeoffs between inflation and jobs.

9h ago -

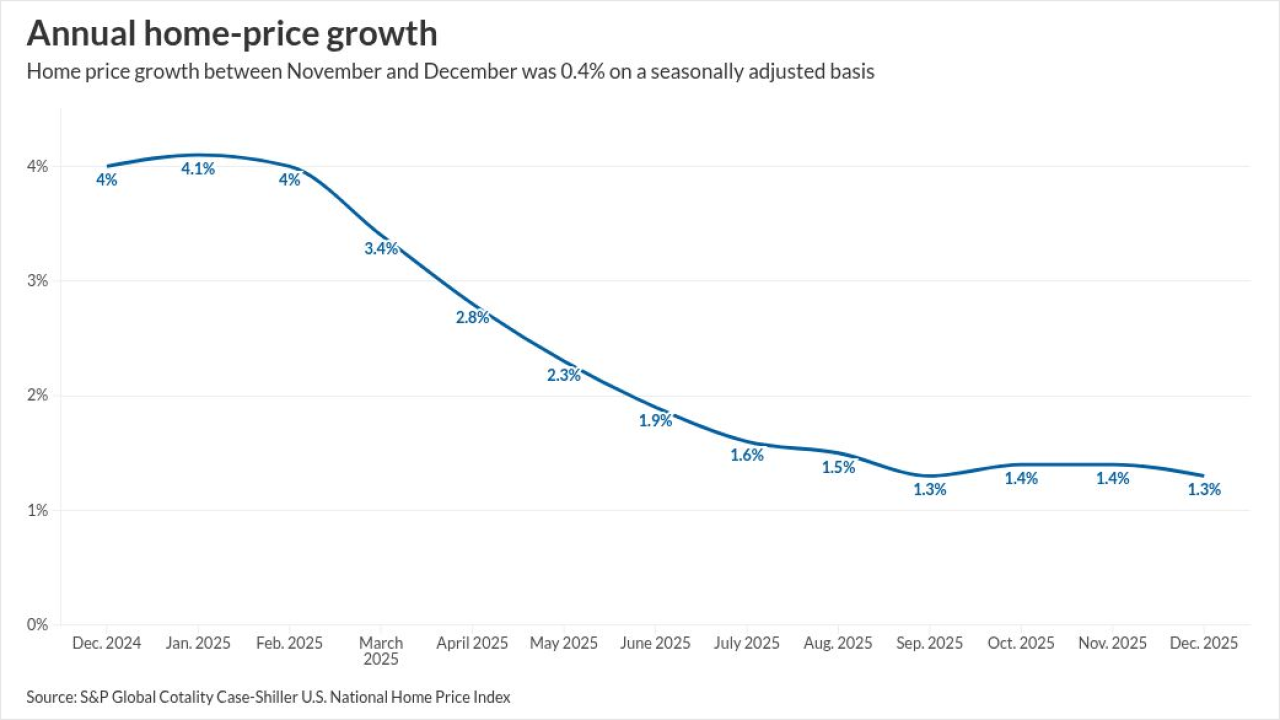

Home prices edged up nationwide, but gains were modest and uneven. Major indexes agree on direction, differ on size, as 2025 posted weak growth.

February 24