Based on how they feel about the market, buying a house may be more of a waiting game for some shoppers.

Consumers see softening home prices and mortgage rate declines on the horizon, and more are reporting significant increases in income over the past 12 months. While these suggest positive sentiments on conditions for buyers, they signal rewards for those who wait.

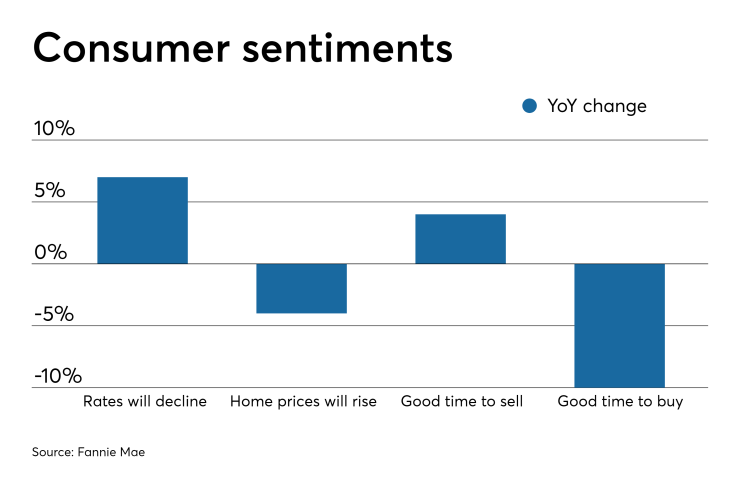

This could be why the net share of consumers thinking it's a good time to sell nearly doubled the amount who reported it's a good time to buy, according to Fannie Mae's Home Purchase Sentiment Index.

The net share of consumers claiming it's a good time to sell a house leaped 13 percentage points in March from the prior month to 43%. It's also up 4 percentage points on an annual basis.

Ahead of a hot spring market, the share of consumers who think it's a good time for a house purchase did increase 7 percentage points between February and March. However, it still dropped 10 percentage points from the same period a year ago, and only sits at 22%.

The share expecting home prices to rise over the next 12 months declined 4 percentage points from a year ago. Those anticipating mortgage rate declines over the same period grew 7% both month-over-month and year-over-year.

Consumers confident about not losing their job shot up 9 percentage points from last year, and the amount claiming their household income is significantly higher in the past 12 months increased 3 percentage points in March.

Positive housing sentiments pushed up Fannie's overall HPSI to 89.8%, which increased 1.5 percentage points year-over-year and 5.5 percentage points month-over-month.