The rate of home sales reached a 33-month peak in December, swinging the pendulum of supply and demand, and pushing value appreciation to a 19-month high,

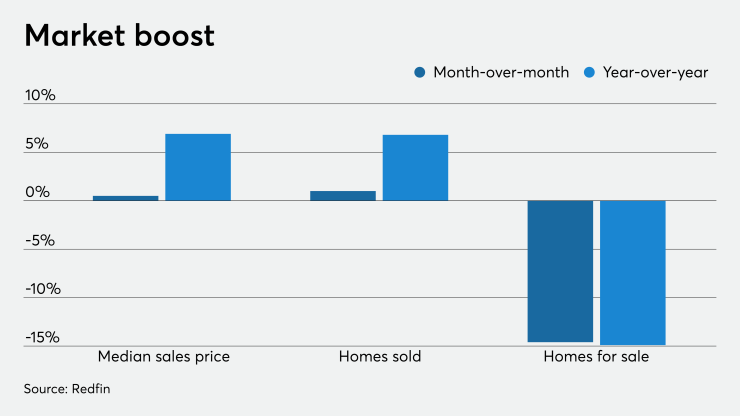

Approximately 276,800 homes sold in December, an increase of 1% month-to-month and 6.8% year-over-year. The surge in sales led to a decrease in the number of properties available on the market of 14.6% from November and 14.9% annually.

December's home-sale prices increased 6.9% annually

"Many homeowners have refinanced their mortgages to take advantage of

Cheaper markets felt the brunt of the price jumps, with 16 of the 20 largest increases coming in metro areas under the national median home value. Memphis, Tenn., led them all with a rise of 15.9% year-over-year, followed by gains of 14.7% in Camden, N.J., and 14.4% in Cincinnati.

Of the 85 largest housing markets in the country, two had annual price declines: New York dropped 2.4% and San Francisco was down 1.7%.

"Low mortgage rates and a strong economy fueled homebuyer demand in December, which boosted both home sales and prices," Fairweather said. "Prices heated up in West Coast metros like Seattle and Los Angeles, which indicates the slowdown of 2019 has officially ended in these markets."