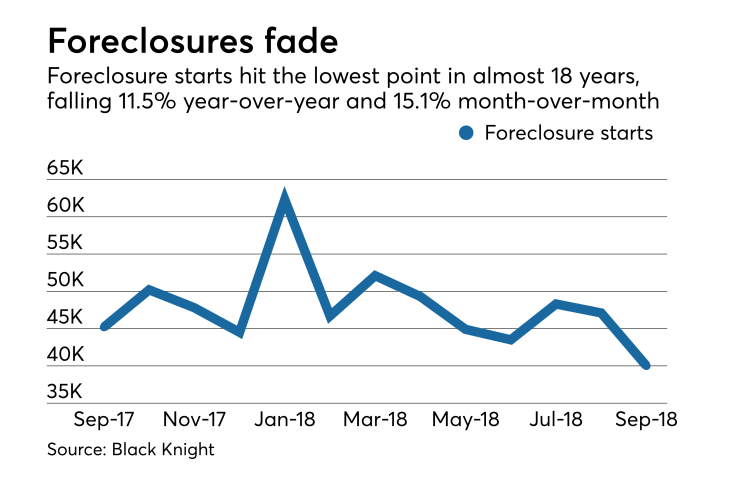

Excellent credit quality and strong performance of post-housing-crisis originations resulted in a steep decline in foreclosure starts in September, according to Black Knight.

September's 40,000 foreclosure starts fell year-over-year by 5,200 or 11.5% and month-over-month by 7,100 or 15.1%. The continued recovery and lessons-learned from the recession drove the amount of starts to a nearly 18-year low.

"This month's data also showed that the national inventory of loans in active foreclosure has fallen to pre-recession averages for the first time since the financial crisis. The improvement is actually even more impressive than it may seem," Ben Graboske, executive vice president of Black Knight's Data & Analytics division, said in a press release. "At the current rate of reduction (a six-month average annual decline of 27%) active foreclosure inventory would hit a record low in September 2019, with fewer than 200,000 cases nationwide."

On the other hand, mortgage delinquencies had its largest month-to-month spike in almost 10 years, rising 13.22%.

Since 2000, Septembers have the highest monthly change in delinquency, with an average increase of 5.2%. However, when Septembers end on a Sunday — a day servicers are unable to process last-minute payments on the final two calendar days of the month — the delinquency rate spikes an average of 13.2%, about the same change as this year.

All 50 states saw mortgage delinquency increases in September. North Dakota led the way with a 24% jump, followed by increases of 23% for North Carolina and 22% for South Carolina, the result of Hurricane Florence.