Without the baggage of living through the Great Recession, homeownership rates for Gen Z should exceed that of millennials, a plurality of respondents to a Zillow survey said.

The younger group should also face

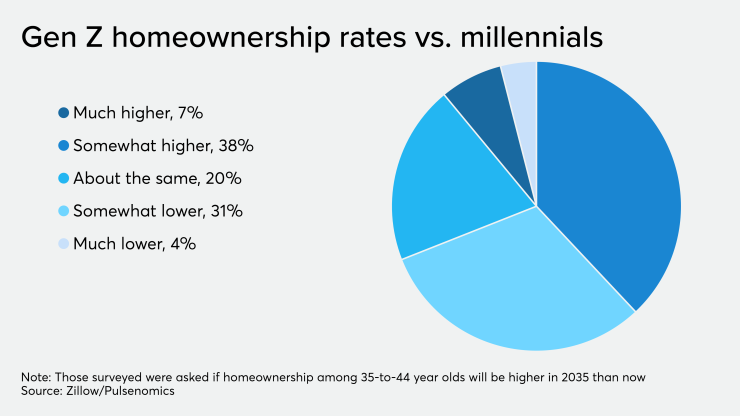

Approximately 45% of survey respondents expect the homeownership rates for those in the 35-to-44 age group in 2035 to be higher than it is for similarly aged millennials — although a scant 7% of that group believe it will be much higher.

Meanwhile 20% of respondents said homeownership rates for that group will be about the same as they currently are, while 35% said they should be somewhat or much lower.

Pulsenomics conducted the quarterly

"The uncertainty of housing experts is tied up in the fact that this past decade has been anything but normal," Skylar Olsen, Zillow's director of economic research, said in a press release. "When experiencing unfamiliar dynamics, we must ask whether we will eventually revert to historic patterns or if pillars like preferences, affordability, policy and technology have shifted sufficiently to make this the new normal.

"Some of the reasons cited by experts as drivers of the future homeownership rate are big and exciting bets, including a belief by many that the home supply will be less constrained."

How that will happen is the big question.

"Will more jurisdictions up-zone suburban neighborhoods to allow for smaller units and greater density? Will prefab construction take off? Will more big companies relocate headquarters or open satellites in more affordable metros? Time will ultimately have to tell. But in the meantime, it's fun to speculate," Olsen said.

Those surveyed agreed that many of the same factors — which besides the inventory shortage includes the

"We're in the eighth year of the supposed housing recovery, but persistent uncertainty about the relative appeal and affordability of homeownership, future housing policies and supply trends leaves the experts far from a consensus," Pulsenomics founder Terry Loebs said.