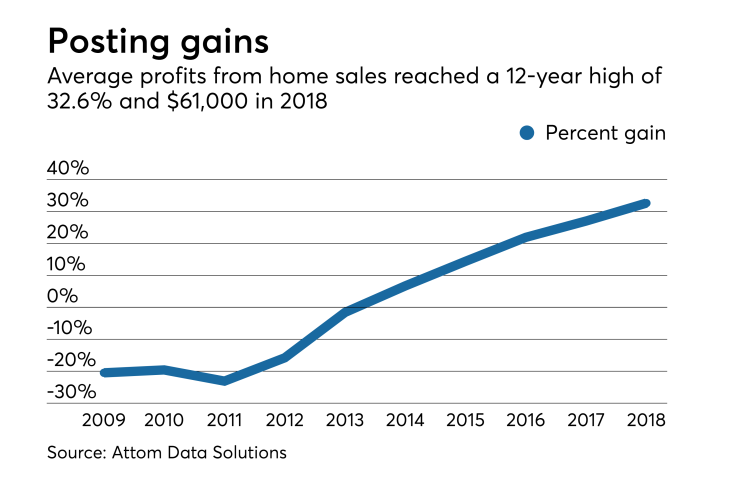

While home sellers gained the most money on their houses since 2006, the fading impact of tax cuts and slow rise of mortgage rates could shorten upcoming margins, according to Attom Data Solutions.

Sellers posted average returns of 32.6% on their investments reaching a mean profit of $61,000. Year-over-year, those margins are up from 27% and $50,000.

"While 2018 was the most profitable time to sell a home in more than 12 years, those along the coasts reaped the most gains. However, those are the same areas where homeowners are staying put longer," Todd Teta, chief product officer at Attom Data Solutions, said in a press release.

"The economy is still going strong and home loan rates remain historically low. But there are potential clouds on the horizon. The effects of last year's tax cuts are wearing off as limits on homeowner tax deductions are in place and mortgage rates are ticking up ever so slowly, so this could dampen the potential for home price gains in 2019," Teta continued.

The West Coast accounted for the top housing markets by returns. San Jose, Calif., led with an average 108.8% gain, while San Francisco, at 78.6%, and Seattle, at 70.7%, followed.

"Home price growth in the Seattle area has started to soften, something that homebuyers have been waiting for, and a trend that we can expect to continue in the coming year," said Matthew Gardner, chief economist at Windermere Real Estate.

"Seattle is still benefiting from