The potential for existing-home sales rose on a monthly and annual basis in July and that growth should continue as mortgage rates are expected

But actual sales could be constrained because "you can't buy what's not for sale," Mark Fleming, First American Financial's chief economist, said in this month's Potential Home Sales Model.

"The limited supply of existing homes for sale will continue to be an issue, and it will take builders years at a faster pace to build enough new supply to make up for the imbalance between supply and demand," Fleming said.

That shortage "is now undermining price stability and threatening to further quell home sales activity," HouseCanary CEO Jeremy Sicklick wrote in the company's latest Market Pulse report.

"The lack of housing supply is keeping prices unexpectedly high across the country, making it difficult for potential homebuyers to purchase properties despite access to credit and low mortgage rates," Sicklick said. "Homeowners appear very reluctant to list their homes due to the recessionary environment, political uncertainty and pandemic unknowns."

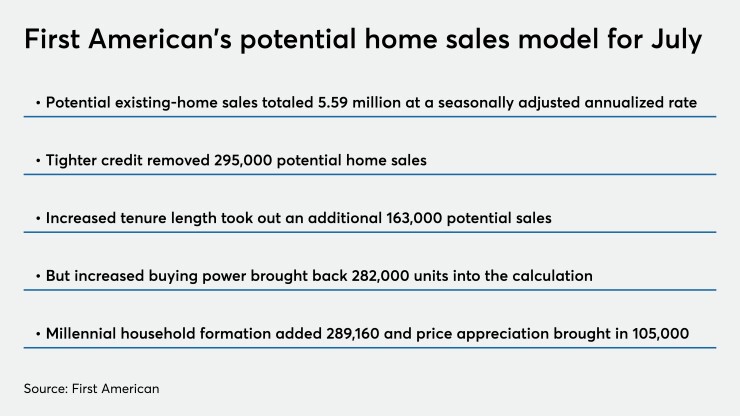

Potential sales in July totaled 5.59 million units on a seasonally adjusted annualized rate basis, according to First American, up 1.9%

First American noted it has updated its model and that its data inputs had been especially volatile in recent months — two factors that could lead to revisions to prior results.

Home buying power — a measurement that looks at household income and

Finally, the growing wealth effect caused by house price appreciation increased the market potential by nearly 105,000 sales.

On the other hand, pandemic-related credit tightening reduced potential by nearly 295,000 sales. People staying in their houses longer — tenure length was up 4.2% from one year ago — cut another 163,000 sales, while the lack of inventory took out 2,100 units of potential sales.

Housing, for now, "continues its impressive V-shaped rebound," Fleming said. But besides the inventory constraints, other factors could stifle the market.

"Even though credit standards have loosened in recent months, they are anticipated to remain tight by historical standards, as long as economic uncertainty persists," he said. "The economy will follow the path of the virus, but the housing market has largely bucked that trend, and we remain cautiously optimistic for what's to come."