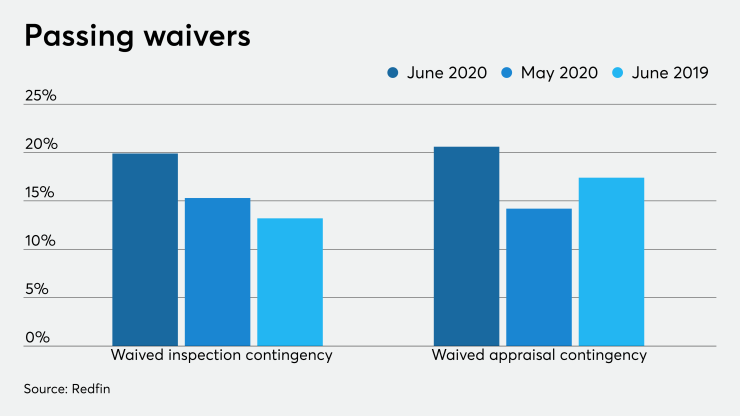

With inventory tight and demand compounded from the missed spring home-buying season, a fifth of all buyers waived inspection or appraisal contingencies to win bidding wars,

Buyers adhered to this strategy to strengthen their bids, taking on risk and cutting out stumbling blocks and uncertainty — something even more attractive to sellers in the midst of the pandemic.

A 20.6% share of successful offers waived appraisal contingencies in June — the highest since Redfin started tracking this data in 2018. That's up from 17.4% the year prior and 14.2% in May. Similarly, 19.9% waived inspection contingencies, up from 13.2% year-over-year and 15.3% month-over-month.

"The situation is out of control," Lindsay Katz, a Redfin agent in Los Angeles, said in a press release. "I put a house on the market the other day and within about 24 hours I already had 42 showings booked. The $770,000 winning offer wasn't even the highest bid. We could've gotten another $30,000 for the house, but we opted to take the safe bet over the highest offer because there was so much uncertainty due to the pandemic."

The number of bidding wars continued to grow, with 53.7% of Redfin offers in June receiving competition, up from 51.8% in May and 44.4% in April. Pushing that share, active listings declined annually for the 10th month in a row, falling 20.7% year-over-year in June.

While