In a study of four metro areas, housing supply and demand gained momentum in the second half of April.

Redfin looked at buyer and seller trends in Chicago — where daily cases of coronavirus are still on the upswing — New Orleans and Seattle — two cities that flattened their respective curves, but still have high concentrations of cases — and Detroit — which flattened its curve but is the only one of the four cities where real estate was not deemed an essential service

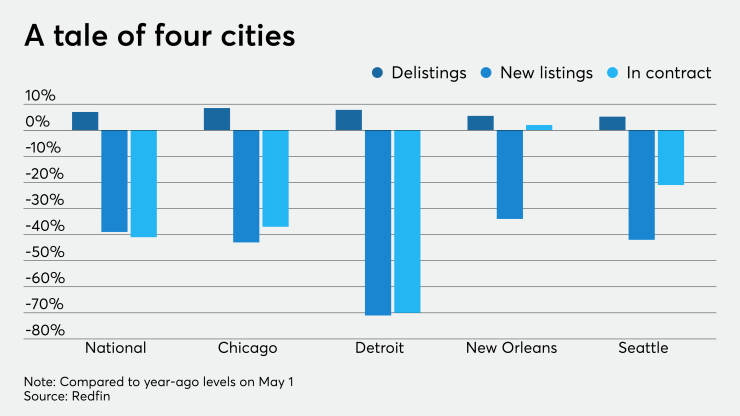

Homes under contract to be sold hit a national low point of 43% below the 2019 average the week ending April 16 at a total of 32,000 units. It edged up to -41% on May 1.

Pending sales in New Orleans are up 2% year-over-year, following a 54% drop during the first week of April. The other three cities recorded pending sales declines that weren't as steep as those recorded two weeks before. In Chicago, pending sales are down 37% compared to last year, an improvement over the 58% year-over-year decline recorded in early April. Seattle went from -55% to -21% between the two periods analyzed. And Detroit’s pending sales went from -80% in early April to -70%.

"While consumers are still hurting from this pandemic, we're starting to see early signs of recovery," Taylor Marr, Redfin’s lead economist, said in a press release. "Supply and demand have begun to strengthen, even in places where COVID-19 is still on the rise, as homebuyers and sellers start to see a light at the end of the tunnel. This has allowed prices to remain stable."

A recent separate study from Redfin showed

The amount of new houses added nationwide is now increasing, according to Redfin's new report. After bottoming out at 48,000 the week ending April 14 — over 50% lower than the year before — 62,000 new homes came for sale the week ending May 1, an annual decrease of 39%.

Seattle's new listings cratered to a 52% annual drop at its lowest point in April and rebounded to 42% below on May 1. New Orleans reached about 55% below and recovered to 34% under the year-ago average on May 1. After hitting a 61% deficit, Chicago's new listings are down 43%.

Most likely tied to real estate not being essential, Detroit recorded the lowest nadir in April of 79% below its annual new listings and only rebounded to 70% below on May 1.

Redfin brokers quoted in the study said they’ve noticed that buyers are resuming their search.

"It feels like buyers are keyed up and ready to start looking again. We've seen a lot of interest in the last 10 days, compared with crickets just three weeks ago," said Amber Allin, a Redfin agent in Tacoma, Wash. "The first-time homebuyer market is still really hot, and properties that are in good condition are moving incredibly well."

Detroit-based agent Tony Orlando reported a similar phenomenon for homes on the lower end of the market.

"Homes going for $250,000 and under are still super competitive. One of my clients toured a $215,000 house in Pontiac, Mich., on a group Zoom call with several other prospective buyers the day it hit the market. Within 30 minutes, there were four offers. The property went for above-asking during a pandemic," Orlando said.

However, not all forecasts paint as rosy a picture for the housing industry. Job distress and the economic instability caused by the virus