Want unlimited access to top ideas and insights?

With its bolstered fundraising cache, the Mortgage Bankers Association Political Action Committee should hold an increased influence over the industry's policy and regulation issues in the coming year.

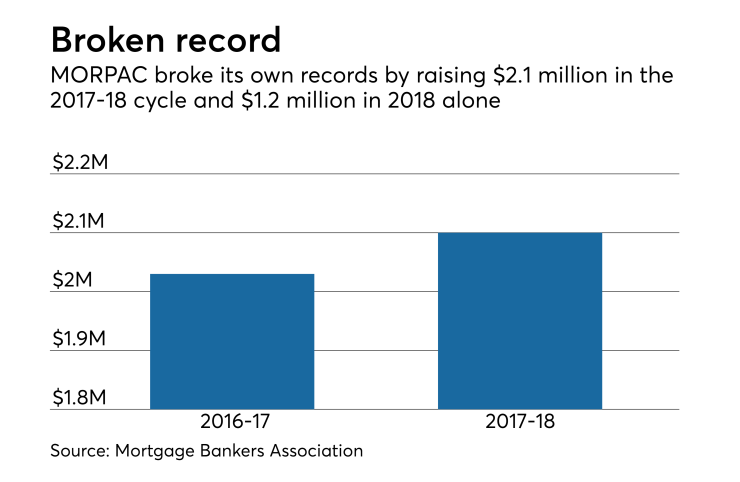

MORPAC raised over $2.1 million in the 2017-18 cycle and a projected $1.2 million for just 2018, setting its single-cycle and single-year fundraising records. The increase was due to a 70% deeper contributor base consisting of 571 new funders from 2017.

The

"On Capitol Hill, we expect the shift in the political continuum will provide additional opportunities to improve access to mortgage credit that build on the successes of 2018. For example, a long-term reauthorization of the National Flood Insurance Program is still awaiting action," the MBA said in a press release.

"

MORPAC led regulatory campaigns in 2018 aimed at policymakers for GSE reform expansion, to prohibit the FHA from insuring loans with pre-existing PACE liens, and in an effort to safeguard veterans against irresponsible serial refinance lending practices.

The committee maintained top-20 trade association PAC status and its contributions went with a win rate of 82% to eligible U.S. House and Senate candidates.

"Our policy successes of the past year would not have been possible without extensive engagement with our members. Through more than 20 committees, forums, networks and working groups, our members helped MBA develop and sharpen our advocacy positions with legislators, regulators and other policymakers," the release stated.

MORPAC is a voluntary, non-partisan committee representing the real estate finance industry in the U.S. political system, raising contributions to support candidates whose views reflect the MBA's interests.