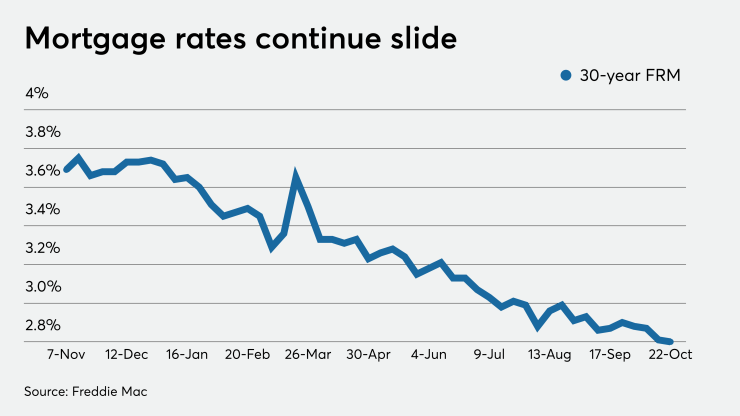

Mortgage rates fell this week to another record low, and are now over a full percentage point below where they were five years ago, according to Freddie Mac.

Because rates remain very low, they are "providing homeowners who have not already taken advantage of this environment ample opportunity to do so," Sam Khater, Freddie Mac's chief economist, said in a press release.

Furthermore, that one percentage point drop "means that most low- and moderate-income borrowers who purchased during the last few years stand to benefit by exploring refinancing to lower their monthly payment," Khater added.

The 30-year fixed-rate mortgage averaged 2.8% for the week ending Oct. 22,

The 15-year fixed-rate mortgage averaged 2.33%, down from last week when it averaged 2.35%. A year ago at this time, the 15-year fixed-rate mortgage averaged 3.18%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 2.87% with an average 0.3 point, down from last week when it averaged 2.9%. A year ago at this time, the five-year adjustable-rate mortgage averaged 3.4%.

Zillow, whose rate tracker measures offers made to consumers on its site, reported what it termed as a "minor" increase this week.

However, "the upward momentum in rates was an eye opener after weeks of very little change," Matthew Speakman, an economist with Zillow, said in a comment following its weekly release on Wednesday. "Growing confidence among investors for a new fiscal spending package lifted bond yields in recent days to their highest levels in months, a move that nudged mortgage rates higher.

"This optimism is unlikely to abate in the days before the federal election, so a near-term downward move in mortgage rates is probably not on the horizon. That said, investors are no doubt aware of the substantial levels of risk posed by the recently rising coronavirus cases across much of the country. This uncertainty will likely keep mortgage rates mostly stable in the coming days, but with major events looming, more substantive moves in rates could be in store in the coming weeks."