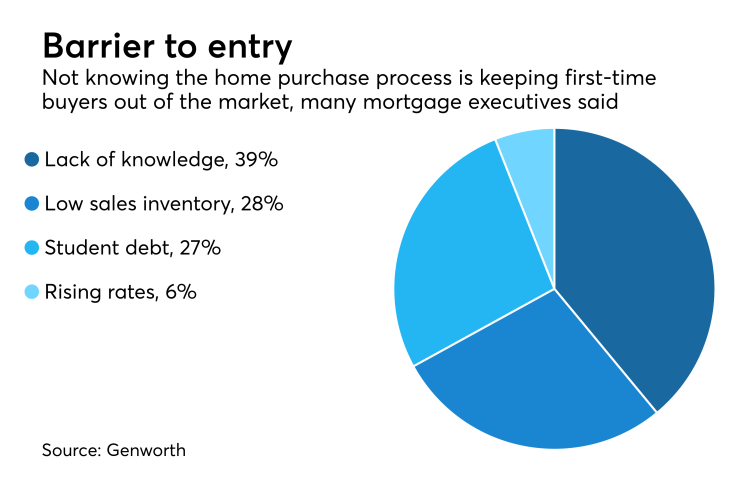

The lack of knowledge around the home purchase process was cited by 39% of mortgage executives as the leading barrier keeping potential first-time buyers from entering the market.

That topped a lack of inventory (29%), excess student loan debt (27%) and rising interest rates (6%), according to a survey taken during the Mortgage Bankers Association's National Secondary Market Conference by Genworth Mortgage Insurance.

Much of the consumer confusion is about the down payment. Almost three in 10 executives surveyed said consumers believe they need to put 20% down to buy a home.

Another 41% of industry executives said that while potential borrowers know that

When it comes to loan underwriting standards, half of those surveyed believed they are currently too tight, resulting in quality borrowers not getting mortgages.

A small minority, 7%, said underwriting standards right now are too loose, with the remaining 43% stating they were appropriate for today's market.