The Treasury Department and federal banking regulators could slow the growth of Fannie Mae's and Freddie Mac's mortgage portfolios using their existing authority, according to the regulator of the two government-sponsored enterprises.While Congress is working on legislation to limit the size of the GSEs' portfolios, there are existing safeguards to address the portfolios and potential problems they pose to the financial system, said Stephen Blumenthal, acting director of the Office of Federal Housing Enterprise Oversight. "First, the Treasury Department currently has the authority to limit debt issuance by the GSEs," he said. Second, federal regulators could limit bank investments in GSE debt. Congress should recognize that "addressing systemic risk requires a collective effort of GSE and financial services regulators as well as participants in the financial system," he said. OFHEO has not taken a position on portfolio limits, Mr. Blumenthal told a Hong Kong meeting of The Bond Market Association. "We view that as a public policy decision that lies exclusively within the discretion of elected representatives," he said. However, OFHEO supports the legislation because it would create a new and stronger GSE regulator. "If Congress does not act, OFHEO will continue to do its job, but it will face the increasing pressure of inadequate regulatory authority," he said.

-

The New York City-based lender, whose roots lie in taxi lending, believes an expanded home-improvement loan operation will generate mid-teen loan growth this year.

February 19 -

The increase in borrower activity came as housing starts ended 2025 on a high note, while mortgage rates were a percentage point lower year-over-year.

February 19 -

The impact of insurance costs, availability and related state rules also were top of mind at the Mortgage Bankers Association servicing conference.

February 19 -

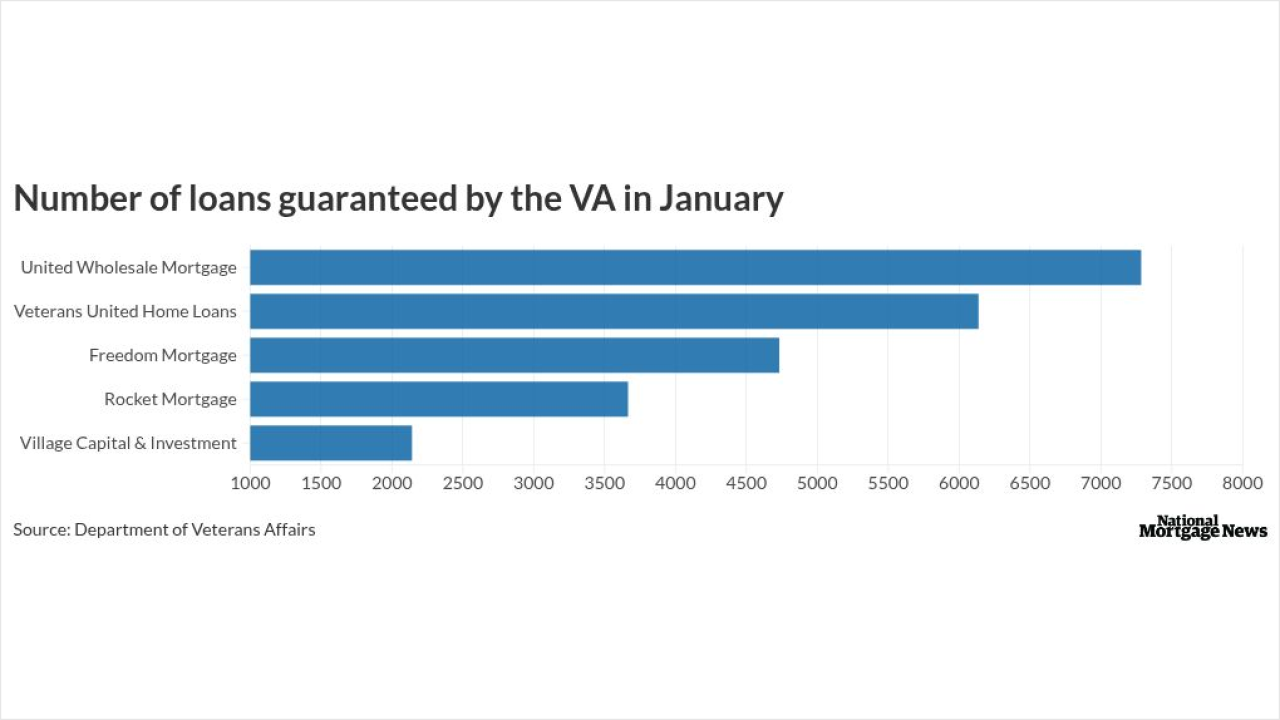

The lawsuit accuses Veterans United of deceptively suggesting it's part of the Department of Veterans Affairs and steering clients to more costly loans.

February 19 -

While the Freddie Mac survey recorded a weekly decline, the benchmark 10-year Treasury yield had moved back up by 6 basis points around midday on Thursday.

February 19 -

About 1.3% of residential properties in the United States were vacant at the beginning of the year, Attom found.

February 19