In the year following

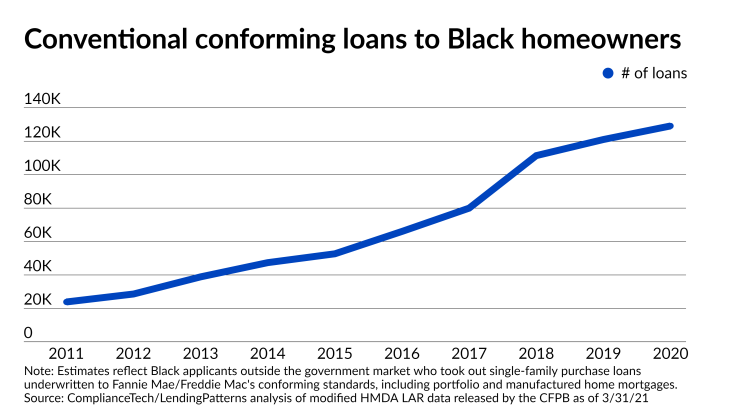

Conforming loans taken out by Black borrowers rose 7% in 2020, to 129,131, but that’s down from the previous year’s growth of 9%, according to an analysis of 2020 Home Mortgage Disclosure Act data by ComplianceTech’s LendingPatterns software. Some portfolio loans are included in that mix.

While the GSEs have a limited legislative mandate to create a secondary market for mortgages on homes for very low-, low- and moderate-income families (

Also,

In conjunction with that, former Treasury Secretary Steve Mnuchin called for the GSEs to limit purchases of

The Democratic administration certainly has signaled that it wants to take steps to

“What you’re seeing is a conversation that could move things along. I think the GSEs need to move from talking about it to getting more done,” said Lesli Gooch, CEO at the Manufactured Housing Institute, when asked about Fannie and Freddie’s actions relative to Black homeownership in the past year.

A tension within manufactured housing, which is a lower-cost type of housing that may appeal to the preponderance of Black homebuyers who lack wealth, serves as a small example of a bigger challenge the GSEs face when it comes to bettering their efforts to close racial gaps.

While manufactured housing generally prices well below the median for a traditional home, the sector has a relatively higher end that Fannie and Freddie recently have done more to support by providing more competitive financing rates for hybrid structured loans like

However, the GSEs have been gun shy about buying “chattel” loans, given that they are not secured by real estate but cover only the manufactured home, which is often priced for less than $100,000. If Fannie and Freddie were to buy these loans, borrowers would be able to access a broader range of less-expensive homes at lower price points.

“[Increasing minority homeownership] is bigger than manufactured housing, but I think generally actions like moving away from chattel loans are detrimental when it comes to ownership for minorities and others who are looking for affordable homes,” Gooch said.

In other words, the loans Fannie and Freddie have purchased are generally a little closer to the higher end of the low-income spectrum and the GSEs have been somewhat limited in the assistance they can offer to Black consumers and others with less wealth as a result. Further constraining the loans available was lender underwriting in the past year. While

To be sure, the government-sponsored enterprises do indeed appear to be key contributors to Black homeownership overall and did play a role in an incremental increase from 41.8% to 45.7% between the first quarter of 2019 and 1Q20, as noted on the FHFA’s website. HMDA numbers show that the GSEs purchased 43% of the subset of all conforming loans that were made to low- and moderate-income Black borrowers in the conforming market.

However, even in years when there have not been additional restrictions on lending due to the pandemic or regulatory changes, the percentage of loans in the conforming market that go to Black borrowers is notably lower than in the Federal Housing Administration-insured market due to the fact that FHA standards offer relatively more accommodations for lower-income borrowers. The share of conventional conforming loans historically run in the single digits as compared to the low double digits in the FHA market and there is evidence that underwriting standards are likely a contributing factor. There was a slight lift in conforming lending to Black borrowers after the GSEs introduced loans in 2014 that allowed for 3% down payments more competitive with those in the FHA market.

Black and other low-income homeowners’ relative lack of access to the conforming market as an option presents concerns particularly because FHA insurance is structured such that borrowers may pay more for it. FHA insurance involves