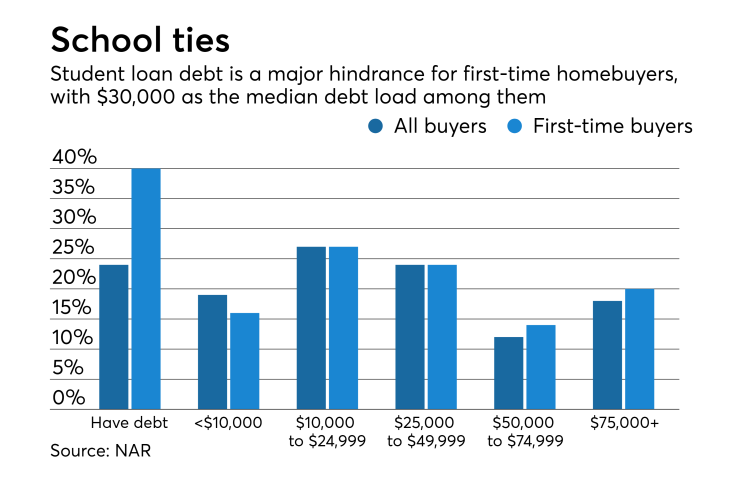

Student debt continues to weigh down potential homebuyers, as the share of first-timers decreased for the third-consecutive year, according to the National Association of Realtors.

Of those who said saving to buy a house is the biggest challenge they face, half claimed it was due to their student loans. First-time buyers constitute a third of the market in 2018, a decline of one percentage point from last year. The share hasn't reached 40% since 2010.

"Even with a thriving economy and an abundance of job opportunities in many markets, monthly student loan payments coupled with sky-high rents and rising home prices make it exceedingly difficult for potential buyers to put aside savings for a down payment," Lawrence Yun, NAR chief economist, said in a press release.

Increased down payment sizes made it more difficult for first-timers, too. The median first-time buyer put down 7% of the purchase price in 2018, the highest amount since 9% in 1997 and up from 5% last year. On the whole, the median down payment was 13%, the highest percentage since 2005 and up from 10% a year ago.

Of course, the low inventory, rising home prices and climbing mortgage rates took their toll as well, as

"With the lower end of the housing market — smaller, moderately priced homes — seeing the worst of the inventory shortage, first-time homebuyers who want to enter the market are having difficulty finding a home they can afford. Homes were selling in a median of three weeks and multiple offers were a common occurrence, further pushing up home prices," said Yun.