Heading into 2021, mortgage companies had to navigate an irregular landscape when setting their yearly budgets and headcount, guessing at what could lay ahead as coronavirus vaccine distributions begin. And with the refi boom predicted to slow in the near future, lenders should be prepared to reduce costs — but where, and by how much?

Perhaps the largest factor in determining how much contraction may be ahead lies in projecting interest rate movement and subsequent borrower activity. The MBA’s December forecast predicted refinancing volume will decline to $1.191 trillion in 2021 from $2.149 trillion in 2020, mostly because they expect the 30-year fixed-rate mortgage to average 3.2% this year.

“The toughest part about forecasting this business is the unknown in interest rates,” said Don Casey, CEO of Realogy Title Group. “You generally get a good feeling coming into the year, like we have great visibility in terms of the first quarter because the locked volume that's coming in now is going to be closing. If somebody knows what's going to happen in the third and fourth quarters, quite frankly, I'd call them a liar. We're focused on maintaining all the productivity

Mortgage professionals discussed how their spending on tech and talent shifted to account for what they see — and don’t see — happening once the tide of refinances subsides.

Getting technical

If refinance volumes dry up and costs get cut in the coming months, tech tools may be deployed to make up for some types of staff reduction. Bolstering a lender’s technology stack often promises a reduction in menial work combined with compounded long-term savings.

“[Lenders are] hiring and that’s adding to the cost to originate, but I think a lot of companies are trying to offset that with technology investments,” said Ben Duke, head of Richey May’s business intelligence practice. “I think they’re starting to model out what that technology will yield in terms of the expense side of the budget in terms of saving.”

While firms have sometimes been hesitant to take the plunge in the past, COVID-19 restrictions

“A lot of the larger players have already made those investments. You’re seeing more of the middle-market companies make them now,” said Nathan Lee, partner at Richey May.

Interfirst Mortgage Co., based in Rosemont, Ill., plans to apply tech and logistics processes to its call center and then to its wholesale lending expansion to bring down those costs, said chief strategy officer Bryan Filkey.

“In most other industries, use of technology helps reduce the cost to produce, but it is not happening in the mortgage industry,” said Filkey. “When it comes to costs, the focus for the mortgage industry should be examining logistics and manufacturing processes from companies like UPS, Amazon and FedEx.”

While the further modernization of mortgage processes should help streamline workflow and, in turn, loan production costs, the upfront expenses of tech implementation need to be accounted for. Per-loan origination costs rose to an

Continual investments in automation, artificial intelligence and robotics to integrate seamless data flow into underwriting and loan origination systems could help offset that upward trend.

These investments should pay dividends for lenders, with the reduction of manual processes cutting the costs of origination and eventually surpassing the money put in. Technology and staffing

Independent mortgage bankers invested heavily in staffing to keep up with record-high volumes broadly expected to top $4 trillion in 2020 after a $2.5 trillion year in 2019. Volume for 2021 projects closer to $3 trillion and companies could potentially winnow their staffing if activity in the year’s second half slows.

Team building

Employees make up the lion’s share of lender budgeting, even as the shadows of AI and automation loom. Lending is still a people business and modern borrowers want

After the onset of the pandemic put businesses in a wait-and-see holding pattern, consumer demand for mortgages drove growth across the industry. Unless rates dive again and

That shift will likely mitigate lenders’ need to cut employees because of lower overall volume.

“The anticipated shift to more work-intensive purchase lending is expected to maintain a high need for staff,” said Paul Buege, president and chief operating officer at Inlanta. “Our strategy really is while we increased the size of the organization by probably 50% this year via the support teams, we also had a lot of people put in huge amounts of overtime. What we’re thinking is it’s not going to equate to laying off people, it’s that our employees are going to have more of a normal life next year.”

For nascent firms born in the coronavirus era, planning a budget can feel like looking into a crystal ball. Beeline Mortgage hopes a company of its young age can be nimble enough to hit that moving target.

“As far as headcount, we match that up to typical volume and capacity per person and what we expect to be uplifted based on tech developments to create a more scalable business,” said Jess Kennedy, co-founder, general counsel and chief compliance officer at Beeline. “That requires less ballooning accounts so we can keep costs in check. But we've certainly changed over 2020, having to change our assumptions as I'm sure many have.”

Companies need to work out how many loan officers and back office staff they’ll need for an ideal customer experience. They will also look to avoid the short-sightedness of over-hiring when the market’s on fire only to re-evaluate in a few months down the road.

One way to avert that scenario is to have a variable compensation structure in place, where beyond the base salary, back office staff is compensated according to the company’s volume. American Mortgage Network is one example of a company using this structure after its executive team took lessons they learned from roller coaster market cycles of the past.

“We know, just based on having been through this many, many times, the first thing to go is the margins, because [lenders] cut margins,” said David Wallace, executive vice president and chief financial officer of AmNet. “It’s ironic, they cut the margins because they don’t want to lay people off. When the pandemic hit is right around the time we started retail [lending]. And so building up from nothing, having no underwriters, not enough processors and no closers and no post-closers, we've been hiring like crazy and playing a little bit from behind. We feel like we're well positioned for when this market turns.”

On the payroll

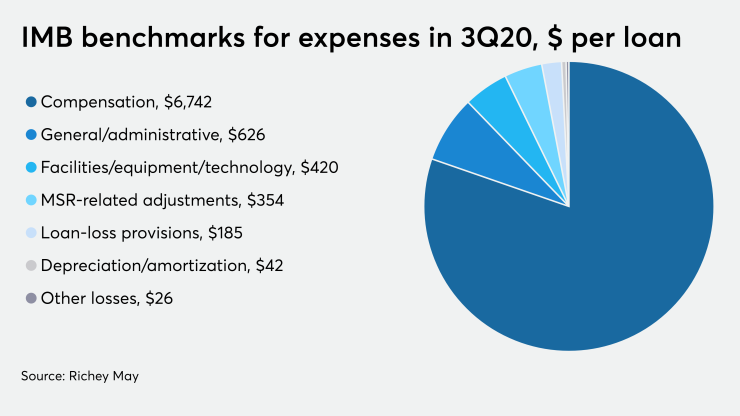

Compensation accounted for 80.3% of the $8,395 in average loan expenses from the third quarter of 2020, based on a survey of independent mortgage bankers conducted by Richey May.

Lenders have gotten creative with payroll structure in order to lower fixed costs on their budgets and be flexible in case of a downturn. Some companies may offer lower base salaries for operations professionals and increase bonus incentives, according to Jim Cameron, senior partner at mortgage consultancy firm Stratmor.

“You can avoid an ongoing cost that could come back to haunt you when volumes drop that way,” said Cameron. “The typical path is to eliminate overtime, any temporary staff and certainly adjust pricing to make sure you’re keeping your loan manufacturing operation running at capacity.”

However, companies will generally want to lean at first on options other than pricing adjustments to avoid putting downward pressure on the overall business’ margins.

“When all lenders start to pull the price lever, then we have the classic market downturn and a race to the bottom,” Cameron said.

Targeting the marketing

A final key element for lender business is deciphering who their next customers will be. Determining where future volume will come from keeps them ahead of the curve. This means moving money into marketing or shifting it to a different emphasis.

The anticipated low interest rates for 2021 should help offset climbing home prices and make buying a home all the more attractive to the growing group of millennials ready to buy and zoomers entering typical purchase ages.

“There has been much more interest in spending money on marketing campaigns geared towards first-time homebuyers,” said Interfirst’s Filkey. “The purchase marketing in general this year has been more of a needs-based necessity. And so there’s much more willingness to spend on those programs.”

While the refinance share will still be strong, purchase will be the area for growth and therefore what lenders will be targeting this year.

“When you talk about marketing programs and budgeting and spend, our lenders are looking at how they can tap into that growth in the purchase market,” said Joe Mellman, senior vice president and mortgage business leader at consumer credit reporting agency TransUnion. “This year, they haven’t had to do much marketing because there’s been so much volume coming in due to the refi pool. And so now our lenders are looking to spend more time focusing on identifying who’s going to be in the market for a purchase program.”