The

New-home construction continues to lag as well. There still remains vast amounts of pent up demand for housing, demand that has now been unleashed with the drop in the 10-year Treasury bond yield

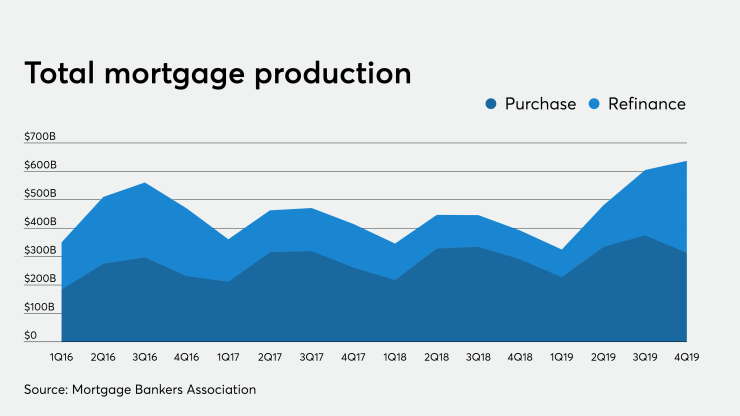

The chart above from

Just about every loan in the $11 trillion market for home mortgages is

With the return of volume and profitability to mortgage lending, it is no surprise that commercial banks are coming back to the market. JPMorgan Chase, Bank of America and Citigroup, to name just a few, have all announced

Why are the banks returning to residential mortgages? For starters, the rest of their respective balance sheets is not exactly brimming with opportunities. Earnings for U.S. banks have been falling for several quarters under the weight of falling yields for loans, leases and securities and rising funding costs. From commercial and industrial loans to

It might surprise some readers of NMN to learn, for example, that residential mortgage lending and issuance of agency residential mortgage backed securities is again an important area of volume growth for U.S. banks going into 2020 and beyond. In particular, the fourth quarter actually saw bank sales of

Sales of residential loans into the secondary market for securitization was once the leading source of non-interest income for banks, but today is less than a tenth of previous peak levels seen in the mid-2000s. Look for U.S. banks to expand their footprint in RMBS over the next several years in a desperate effort to offset weakness in other areas of the bank income statement.

Along with the new commitment by banks to residential mortgage lending, the share of mortgage servicing these depositories hold is again starting to rise after nearly a decade of declines. In the fourth quarter, assets serviced for others by U.S. banks rose back above $6 trillion for the first time since 2016. This is a clear indication that commercial banks are leaning back into the residential mortgage business, albeit still focused on larger loans in the conventional market served by Fannie Mae and Freddie Mac rather than the government loan market

Notice that the total amount of loans servicer by nonbanks has now risen above the level of bank portfolio holdings of one-to-four family mortgages, which have been trending flat to down for more than a decade. It's no accident, non-interest fees paid to banks related to mortgage servicing doubled in the fourth quarter for an implied yield of over 9% for the mortgage servicing rights.

As the total pool of outstanding mortgages grows strongly for the first time in a decade, banks are seeking to grow their share of the pie, again because of the dearth of remunerative opportunities in other asset classes. But as both banks and

Just as bond prices rise when interest rates fall, the value of negative duration assets such as MSRs fall when rates decline. The expectation that existing loans will repay early decreases the estimated value of future cash flows from the MSR. Thus while lenders and investors in MSRs look forward to a new crop of residential loans and juicy gains on RMBS sales, the flip side of the coin is that falling interest rates could result in some enormous write-downs in the value of MSRs for banks, nonbanks and REITs such as Annaly Capital and New Residential.

The good news is that mortgage originations in 2020 could rise by 30% or more from 2019 levels, perhaps reaching more than $2.5 trillion or better in overall production. So long as primary/secondary spreads continue to widen, profitability in the industry could be the best seen in many years. The bad news, however, is that loan prepayments also are likely to reach historic levels, causing pain and some significant losses for investors in whole loans, RMBS and MSRs. But the big news in 2020 is that the commercial banks are back in residential mortgages.