-

The Consumer Financial Protection Bureau has moved ahead with an earlier proposal to postpone the full adoption of the qualified-mortgage ability-to-repay rule, citing a need to maximize borrowers' credit access.

April 28 -

It would be available to homeowners making 80% or less of their area’s median income who weren't eligible to tap into low rates last year.

April 28 -

After a one-week reprieve, mortgage activity waned again with decreased demand for refinances and extremely low inventory for homebuyers.

April 28 - LIBOR

The modifiable templates are a follow-up to a similar notification the organization created in 2019 for lender use.

April 27 -

The suit, filed in the U.S. District Court for the Middle District of Florida, seeks class action status.

April 27 -

For a lot of IMBs facing shrinking backlogs and falling secondary market spreads, the attraction of hitting a bid and taking the easy way out via an acquisition may become irresistible, writes Chris Whalen.

April 27 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Despite falling from quarter to quarter, Flagstar’s mortgage revenues remained strong, while its servicing portfolio grew.

April 26 -

More than two-thirds of the economists surveyed expect the Federal Open Market Committee will give an early-warning signal of tapering this year, with the largest number — 45% — looking for a nod during the July-September quarter.

April 26 -

Three months into President Biden’s term, the White House has yet to select a nominee to run the Office of the Comptroller of the Currency or pick an acting chief. That inaction will make it more difficult for Democrats to unwind Trump-era policies, critics say.

April 23 -

Inflation, an improving economy and the increased federal budget deficit make rate increase inevitable this year, the Mortgage Bankers Association said.

April 22 -

The Consumer Financial Protection Bureau disputes a district court ruling that misconduct claims against the company were already covered by a previous settlement.

April 22 -

The persistently slow reduction in the number of borrowers at risk of default indicates that while loan performance overall is improving, a substantial pool of mortgages will need workouts when forbearance ends.

April 22 -

While purchase volume is seeing its usual seasonal pickup, lower rates caused a spike in activity among existing homeowners looking to refinance.

April 21 -

Federal Housing Finance Agency Director Mark Calabria said he wants to work with the consumer bureau on an “exit strategy” for borrowers approaching the end of their forbearance periods.

April 20 -

“You all will not let me breathe” is just one example in the Consumer Financial Protection Bureau's complaint database where a consumer likened alleged mistreatment by a financial institution to social injustice. An artificial intelligence firm uses technology to help companies flag such language.

April 20 -

The agency's new policy requires collectors seeking to evict tenants to provide written notice of their rights under a federal moratorium.

April 19 -

The government sponsored enterprise’s latest forecast calls for a nearly $4 trillion year for 2021.

April 16 -

And with demand far outweighing supply, the average new-home purchase loan ascended to another record high.

April 15 -

The Michigan lender agreed in 2012 to pay $133 million to resolve civil fraud charges tied to government-backed mortgages. But the deal with the Justice Department came with a catch that eventually allowed Flagstar to pay far less.

April 15 -

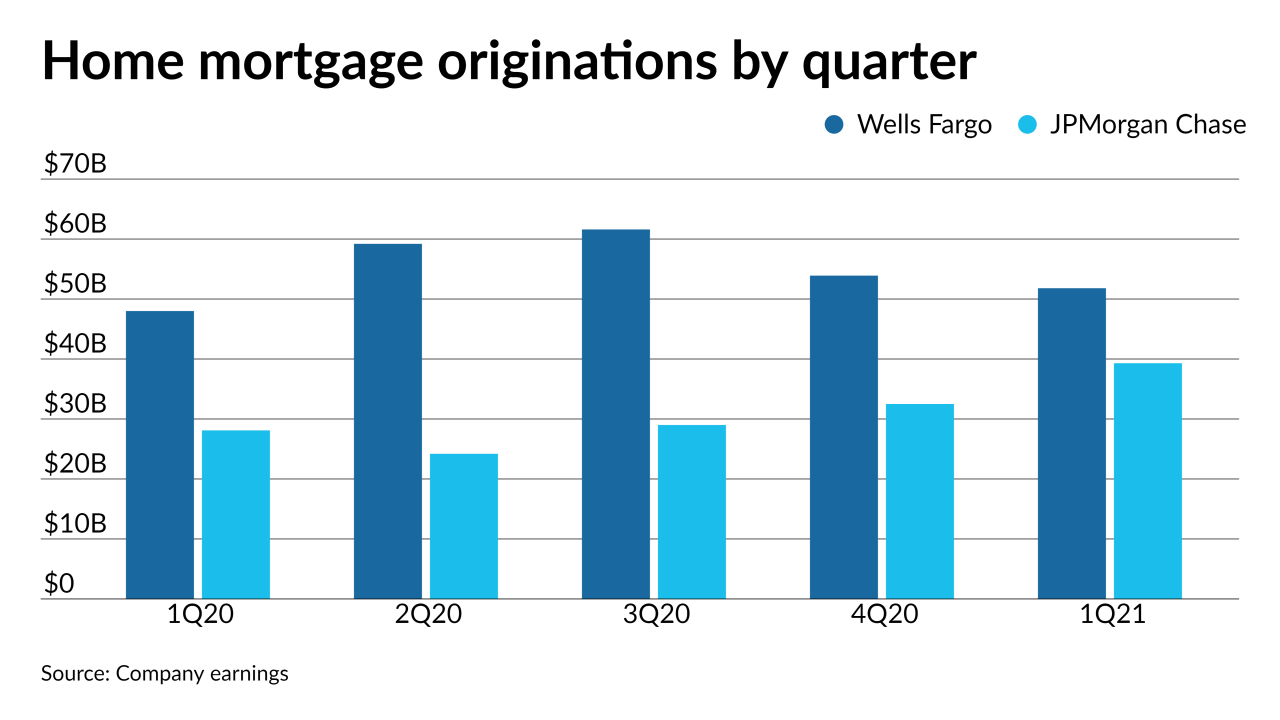

Their numbers suggest that the quarter’s home lending may be stronger than industry forecasts for a 6 to 13% decline.

April 14