-

The Consumer Financial Protection Bureau disputes a district court ruling that misconduct claims against the company were already covered by a previous settlement.

April 22 -

The persistently slow reduction in the number of borrowers at risk of default indicates that while loan performance overall is improving, a substantial pool of mortgages will need workouts when forbearance ends.

April 22 -

While purchase volume is seeing its usual seasonal pickup, lower rates caused a spike in activity among existing homeowners looking to refinance.

April 21 -

Federal Housing Finance Agency Director Mark Calabria said he wants to work with the consumer bureau on an “exit strategy” for borrowers approaching the end of their forbearance periods.

April 20 -

“You all will not let me breathe” is just one example in the Consumer Financial Protection Bureau's complaint database where a consumer likened alleged mistreatment by a financial institution to social injustice. An artificial intelligence firm uses technology to help companies flag such language.

April 20 -

The agency's new policy requires collectors seeking to evict tenants to provide written notice of their rights under a federal moratorium.

April 19 -

The government sponsored enterprise’s latest forecast calls for a nearly $4 trillion year for 2021.

April 16 -

And with demand far outweighing supply, the average new-home purchase loan ascended to another record high.

April 15 -

The Michigan lender agreed in 2012 to pay $133 million to resolve civil fraud charges tied to government-backed mortgages. But the deal with the Justice Department came with a catch that eventually allowed Flagstar to pay far less.

April 15 -

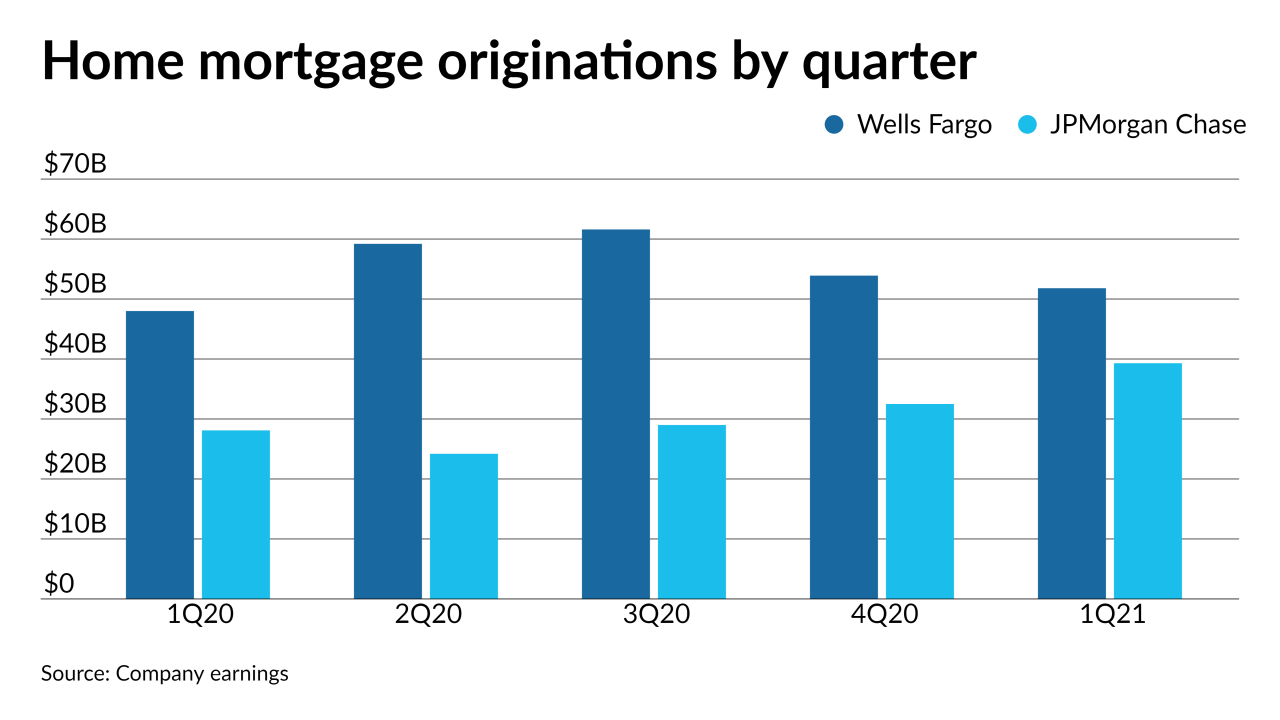

Their numbers suggest that the quarter’s home lending may be stronger than industry forecasts for a 6 to 13% decline.

April 14 -

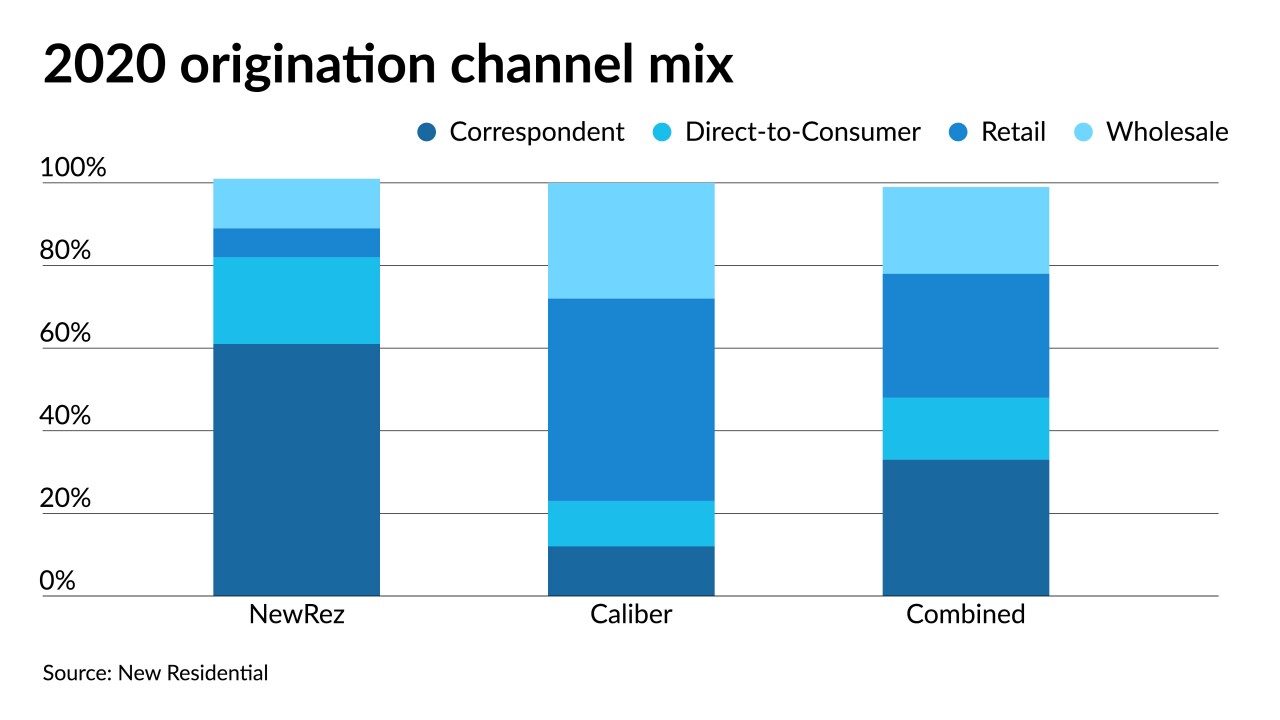

The REIT is planning its own stock sale to pay for the all-cash purchase from Lone Star Funds.

April 14 -

The Department of Housing and Urban Development will revive a 2013 rule that makes lenders liable for practices that were unintentionally discriminatory as well as 2015 guidelines for how local jurisdictions comply with the Fair Housing Act.

April 14 -

But the percentage of weekly applications in that category was closer to 60%, the Mortgage Bankers Association found.

April 14 -

The conduit transaction will carry a $120 million portion of a $750 million debt financing package for Facebook's newly built Oculus R&D center near San Francisco.

April 13 -

However, companies were largely unable to use that cash infusion to make investments that lower their costs, since they had to pay out more in compensation.

April 13 -

The Consumer Financial Protection Bureau's revocation of a Trump-era policy on abusive practices could mean higher fines and penalties for violators. But it still isn't clear what makes a practice abusive.

April 13 -

The markets and the Fed are not on the same page about the future of inflation. Luke Tilley Senior Vice President and Chief Economist at Wilmington Trust will discuss the economy and inflation.

-

However, the decline in Black Knight’s numbers may stem from a previous deadline that policymakers have since extended.

April 9 -

The Financial Stability Oversight Council has struggled to find its footing since its creation in Dodd-Frank. The Treasury secretary has signaled a more aggressive role for the panel, including reviving its authority to target nonbank behemoths.

April 8 -

The new rules are disproportionate particularly in light of the GSEs’ recent record of profitability, the director of the Community Home Lenders Association writes.

April 8 Platinum Home Mortgage Corp.

Platinum Home Mortgage Corp.