-

Blackstone Group, which led Wall Street's initial foray into the single-family rental business, is making a new investment in suburban houses at a time when the COVID-19 pandemic is pressuring traditional commercial real estate.

August 28 -

Refinancing has been one of the bright spots in a difficult year for lending, and the industry has concerns that a fee to be imposed by Fannie Mae and Freddie Mac could slow down the business.

August 28 -

-

Pending home sales rose in July by more than forecast to the highest level since 2005, signaling the housing market’s sharp recovery will continue with borrowing costs to stay low for the foreseeable future.

August 27 -

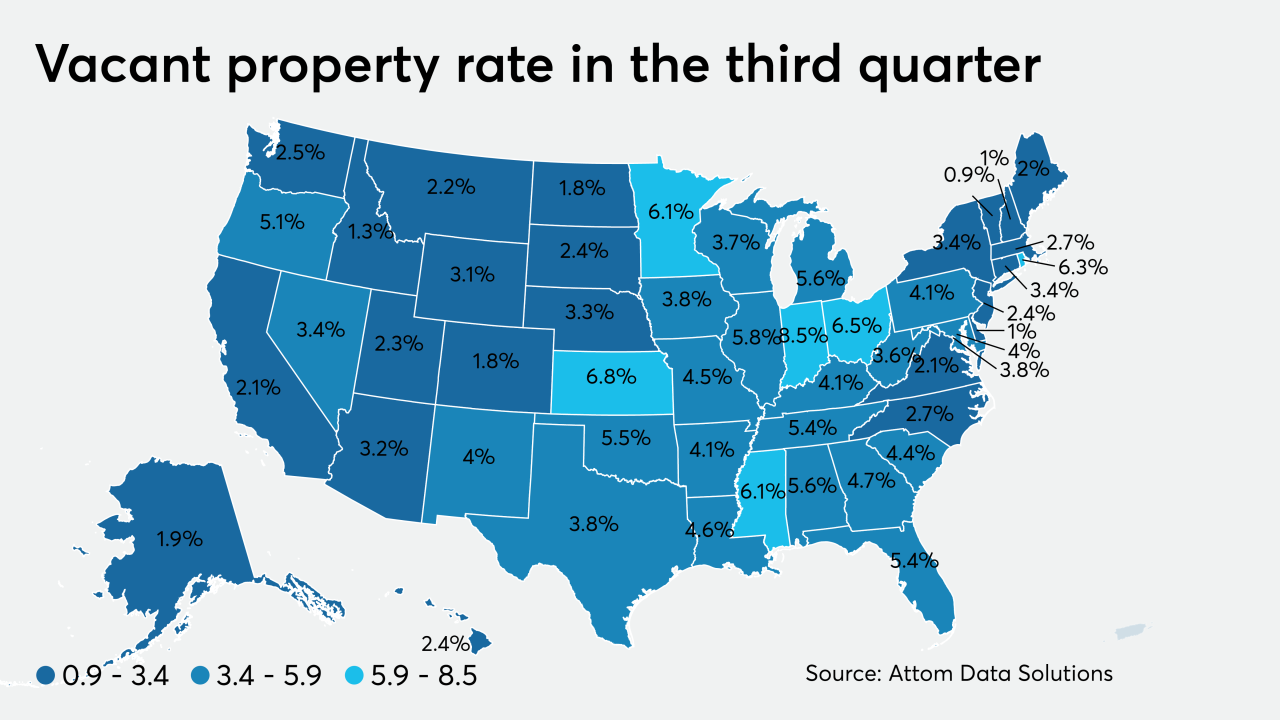

While the overall amount of foreclosures continued to decline due to the coronavirus moratorium, the share of zombie properties grew during the third quarter, according to Attom Data Solutions.

August 27 -

As the end of the first six-month forbearance period arrives, the impact of the new cap is coming into focus.

August 27 -

Many mortgage companies are hoping to operate remotely through year-end and are asking regulators for relief to that end.

August 27 -

Mortgage rates decreased by 8 basis points this week, remaining near record lows, while a strong purchase market should continue into the fall, according to Freddie Mac.

August 27 -

Both the Federal Housing Finance Agency and Federal Housing Administration are extending relief for homeowners and renters due to the pandemic crisis.

August 27 -

Party polarization and racial equity issues make it tougher for trade groups to manage internal divisions while ensuring the field supports those who get their hands on the levers of power.

August 27 -

With mortgage rates and housing inventory both at all-time lows, the majority of consumers would overshoot their budgets for the right home without accounting for future costs, according to LendingTree.

August 26 -

Mortgage application volume decreased 6.5%, falling for the second consecutive week with refinance activity at its lowest since early July, according to the Mortgage Bankers Association.

August 26 -

In the list of numbers summing up the Bakersfield, Calif., single-family home market last month, one figure better than any other explains why buyers are bidding up prices lately.

August 26 -

Like much during the pandemic, the latest news on home prices inspires a definite sense of deja vu.

August 26 -

If it makes landfall as a Category 3 storm as was initially projected, damage from Hurricane Laura's surge could potentially devastate 432,810 residential properties in Texas and Louisiana, according to CoreLogic.

August 25 -

The former SoFi chief’s latest startup, Figure, has created what it says is a transparent marketplace for buying and selling assets. Some banks have embraced the technology, but other blockchain projects have stalled because lenders don't want rivals to see their data.

August 25 -

The mortgage giants were criticized earlier this month for a plan to charge an "adverse market fee" to protect against losses resulting from the pandemic.

August 25 -

The housing market reaped the rewards of new construction increasing before the coronavirus took effect, netting a boost in July sales, according to Redfin.

August 25 -

Fresno is one of the more affordable markets compared to the rest of the state, where the median home value is $258,502 with a rent of $1,395, while the average price across California is $578,267 with a median mortgage of $2,775.

August 25 -

The Federal Reserve could ease capital rules, foster the creation of special-purpose banks and take other steps to strengthen minority communities and businesses without legislation being sought in Congress — if it has the will to do so, experts say.

August 25