-

Observers said the Supreme Court likely will allow Federal Reserve Gov. Lisa Cook to remain at her post while she challenges her purported removal by President Donald Trump. But her continued presence would slow, rather than stop, the president's quest for a voting majority on the central bank board.

January 22 -

The Federal Deposit Insurance Corp. Thursday finalized a framework for banks to appeal supervisory determinations, replacing the agency's existing appeal committee with an independent three-member panel, one member of which must have industry experience.

January 22 -

The $13 billion auction was awarded at 4.846%, about a basis point lower than its yield in trading just before 1 p.m.

January 21 -

The Supreme Court Wednesday appeared skeptical of the Justice Department's argument that removal of a Federal Reserve governor is unreviewable or that the president's preference for Fed governors outweighs the harm to the Fed from curbing the central bank's political independence.

January 21 -

Treasury yield breakouts signal technical damage, with higher yields likely before any recovery despite choppy markets, according to the CEO of IF Securities.

January 21 AD Mortgage and IF Securities

AD Mortgage and IF Securities -

The justices will weigh whether to let Trump fire Fed Governor Lisa Cook over mortgage-fraud allegations that she denies.

January 21 -

Treasury Secretary Scott Bessent said Tuesday morning that banks should focus on the sweeping deregulation the administration has enacted as the industry pushes back on President Trump's proposed 10% credit card interest rate cap.

January 20 -

Freddie Mac's investment in affordable housing increased by 17% in 2025 compared with the year prior, the government-sponsored entity said.

January 16 -

Shares of Fannie Mae and Freddie Mac extended days-long losing streaks amid mounting unease about the impact of President Donald Trump's policy moves on efforts to release the mortgage-finance giants from government control.

January 16 -

The notes are expected to pay coupons of 4.94% on notes in the A1FCF tranche, rated AAA from KBRA and Fitch Ratings, to 6.78% on the B1 notes.

January 16 -

Federal Reserve Vice Chair for Supervision Michelle Bowman warned that labor market conditions could weaken further and said the central bank should avoid signaling a pause in monetary policy.

January 16 -

A pair of fair housing attorneys fired by the Department of Housing and Urban Development testified the agency has stopped enforcement of those laws.

January 16 -

A handful of former Fed officials noted that the markets' measured response to a probe into Fed Chair Jerome Powell was a result of pushback from Trump allies.

January 15 -

The government securitization guarantor could move forward with more big-picture initiatives as well this year now that it officially has a confirmed president.

January 15 -

Foreclosure filings were reported on more than 360,000 properties in the United States last year, up 14% from 2025 and 3% from 2023, according to Attom.

January 15 -

The San Francisco-based banking giant reported solid gains in credit card and auto lending as credit remained in check and quarterly operating costs declined from a year ago.

January 14 -

The megabank's net income declined by 13% during the fourth quarter as a result of a $1.2 billion pretax loss on sale related to the divestiture of its remaining operations in Russia.

January 14 -

In the fourth quarter of 2025, America's second-largest bank posted earnings that came in just above Wall Street's forecasts.

January 14 -

Kelman chose to step down from the company, which he had spent 20 years running, a week before its second phase of integration with Rocket.

January 13 -

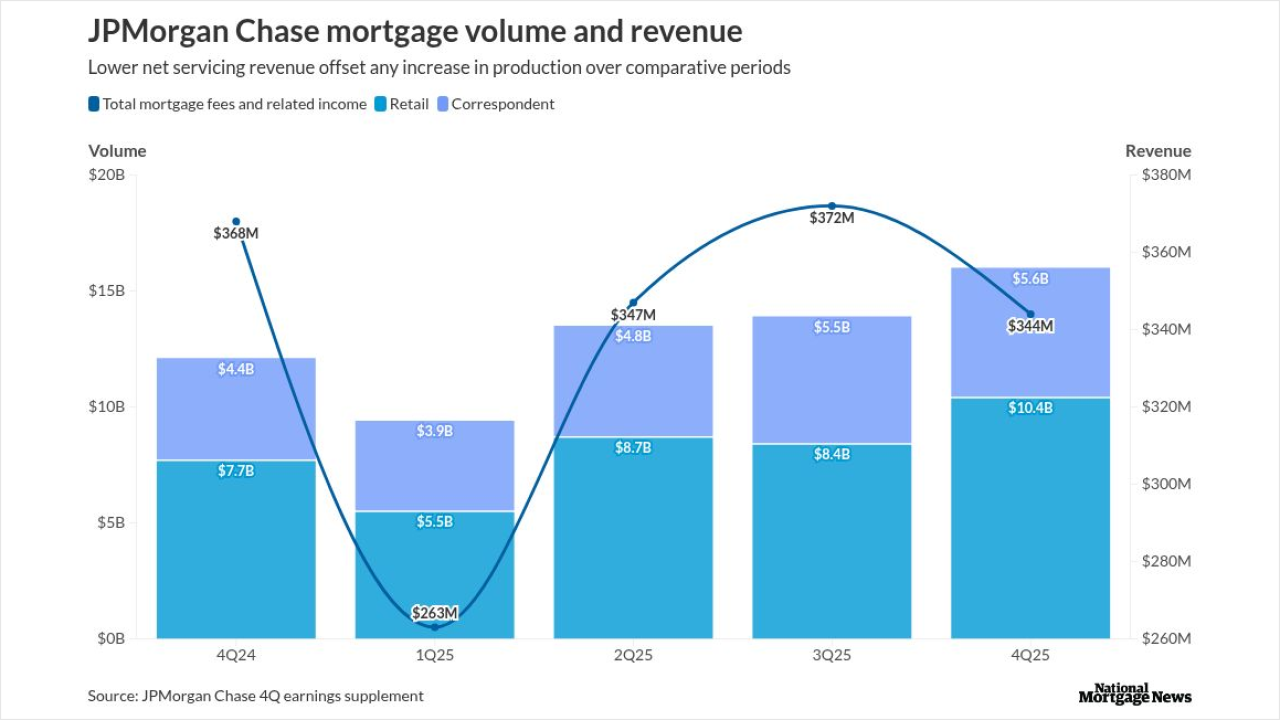

The bank did $16 billion of originations during the final three months of 2025, with the quarter-to-quarter increase beating industry-wide growth forecasts.

January 13