-

Housing prices continued to grow in June, maintaining a streak in monthly increases that began in February 2012. But the trend could be reversed in 2021 with the resurgent effects of the coronavirus, according to CoreLogic.

August 4 -

PREIT, which owns a number of large malls, is trimming the salaries of its CEO and chief financial officer while suspending dividend payments as part of a deal with its lenders to stave off default as the coronavirus pandemic continues to take its toll on the troubled company.

August 4 -

The overnight shift to working from home created a number of practical quandaries for mortgage firms large and small, according to a recent survey conducted by Arizent.

August 4 -

The mortgage servicing rights package going up for bid adds to signs that the market for large offerings is becoming more active.

August 3 -

The number of loans going into coronavirus-related forbearance fell for the seventh straight week, but the Mortgage Bankers Association predicts the rate will increase if the number of coronavirus cases continues to rise.

August 3 -

Louisiana ranks second in the nation in the percentage of homeowners who are late on their mortgage payments, according to Black Knight.

August 3 -

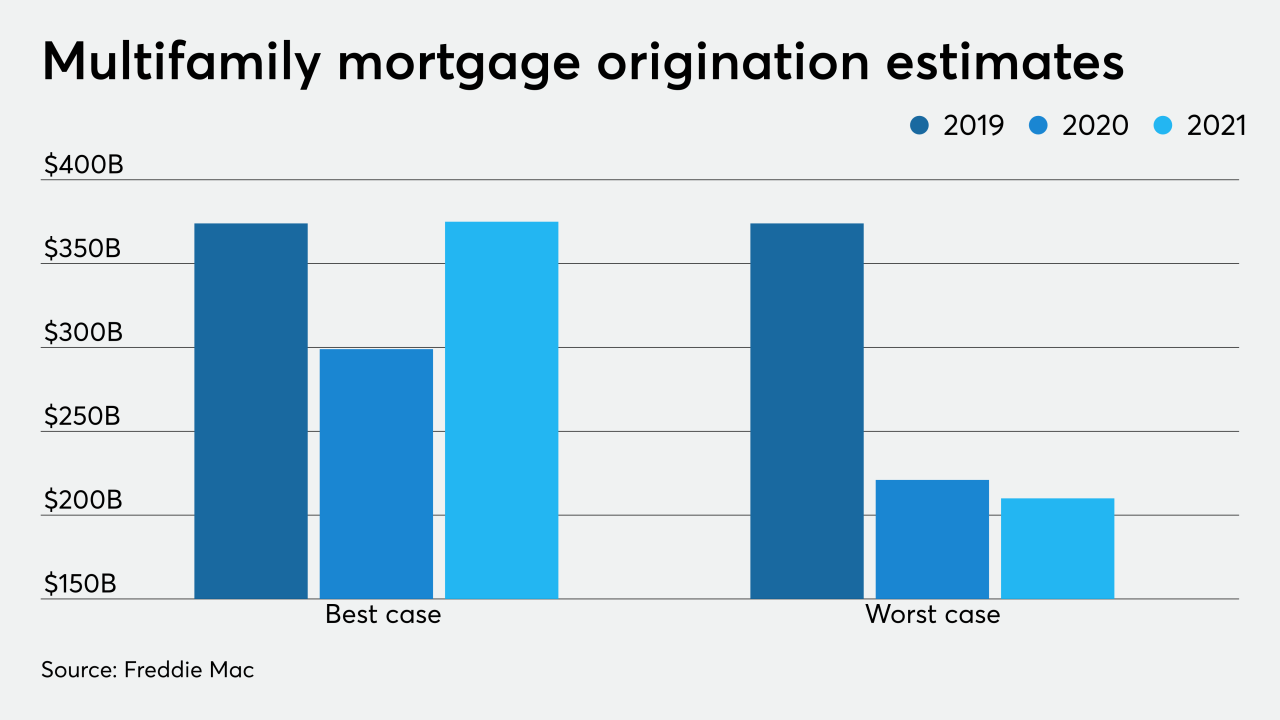

The size of the decline depends on how bad the economy sinks and if the coronavirus spread is halted.

August 3 -

Record-low interest rates allowed homebuyers to purchase $32,000 more house for the same monthly payment compared to last July, boosting affordability to the highest level since 2016.

August 3 -

The year-over-year increase came as homebuying picked up and the company's mortgage lending business boomed.

August 3 -

With low inventory and coronavirus limiting accessibility, nearly half of shoppers made offers sight-unseen in June, according to Redfin.

August 3 -

The pandemic has had a tremendous impact on the global and US economies, household incomes, and consumer spending. The world's most valuable financial services firm is ready to share insight around the global and US effects of COVID-19.

July 31 -

Claudine Gallagher, Head of Americas at PNB Paribas speaks with Arizent CEO Gemma Postlethwaite about servant leadership, sponsorship vs mentorship, and what it will take to attract and retain women in financial services.

July 31 -

Stephanie Epstein, Managing Director, Global Head of Models Infrastructure at BlackRock talked with Gemma Postlethwaite, CEO of Arizent in the early days of the Covid-19 crisis about purpose-led workforce management and how the crisis may have lessons for leadership in supporting the needs of diverse teams.

July 31 -

Fintechs are facing unique challenges in the pandemic. There might be a resurgence in funding on the horizon, but startups are looking to see what they can do now to weather the storm.

July 31 -

Fannie, Freddie also announced they'll face banklike liquidity standards starting Sept. 1.

July 31 -

Home sales in Alabama surged in June as buyers emerged from the coronavirus lockdown ready to take advantage of low interest rates.

July 31 -

The mortgage giants will have to meet benchmarks for covering cash flow needs during stressed periods. The FHFA views the requirements as a prerequisite to the companies exiting conservatorship.

July 31 -

While low interest rates drove up new insurance written, the increased defaults stymied overall performance.

July 30 -

Kathy Kraninger told the House Financial Services Committee that she supports proposed action to revamp the bureau's leadership framework following a major Supreme Court decision.

July 30 -

The government-sponsored enterprise's earnings were up tenfold as it stabilized mortgage market liquidity amid the coronavirus.

July 30