-

Google has allocated $115 million out of a $250 million investment fund for affordable housing projects in the Bay Area.

July 23 -

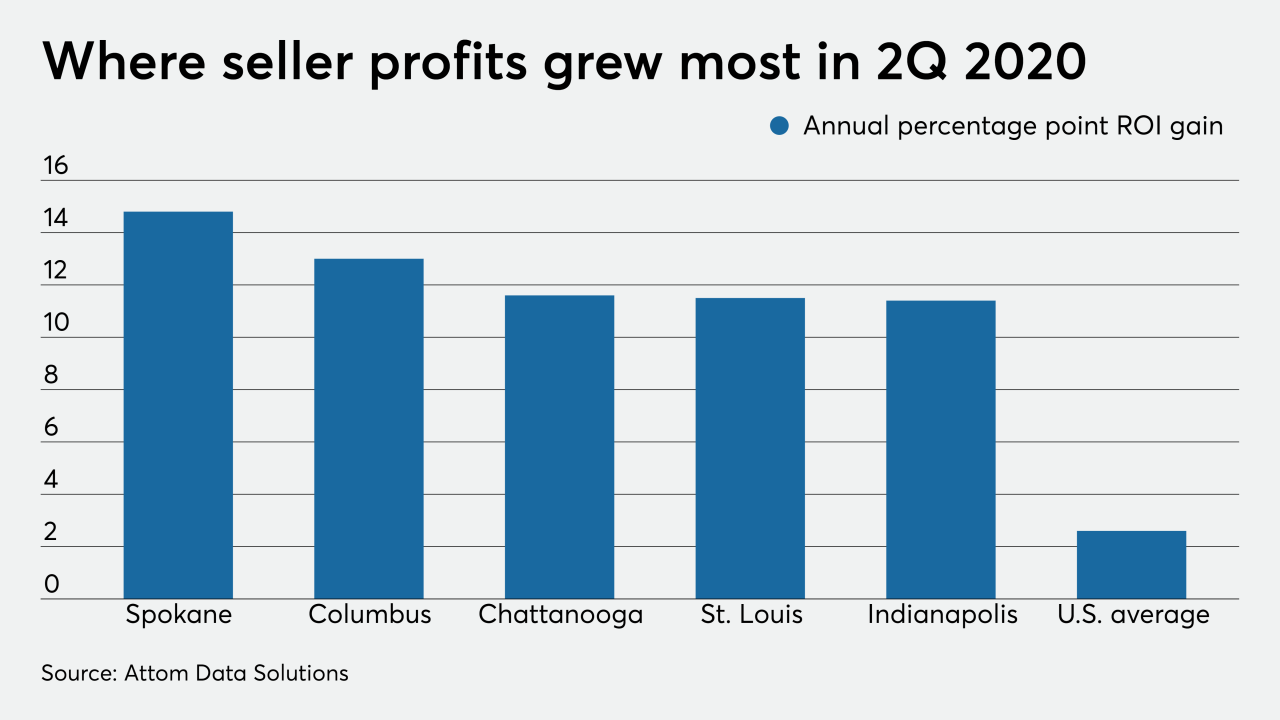

The returns on investment for homes sold in the second quarter of 2020 reached the highest level since the housing bubble collapsed, according to Attom Data Solutions.

July 23 -

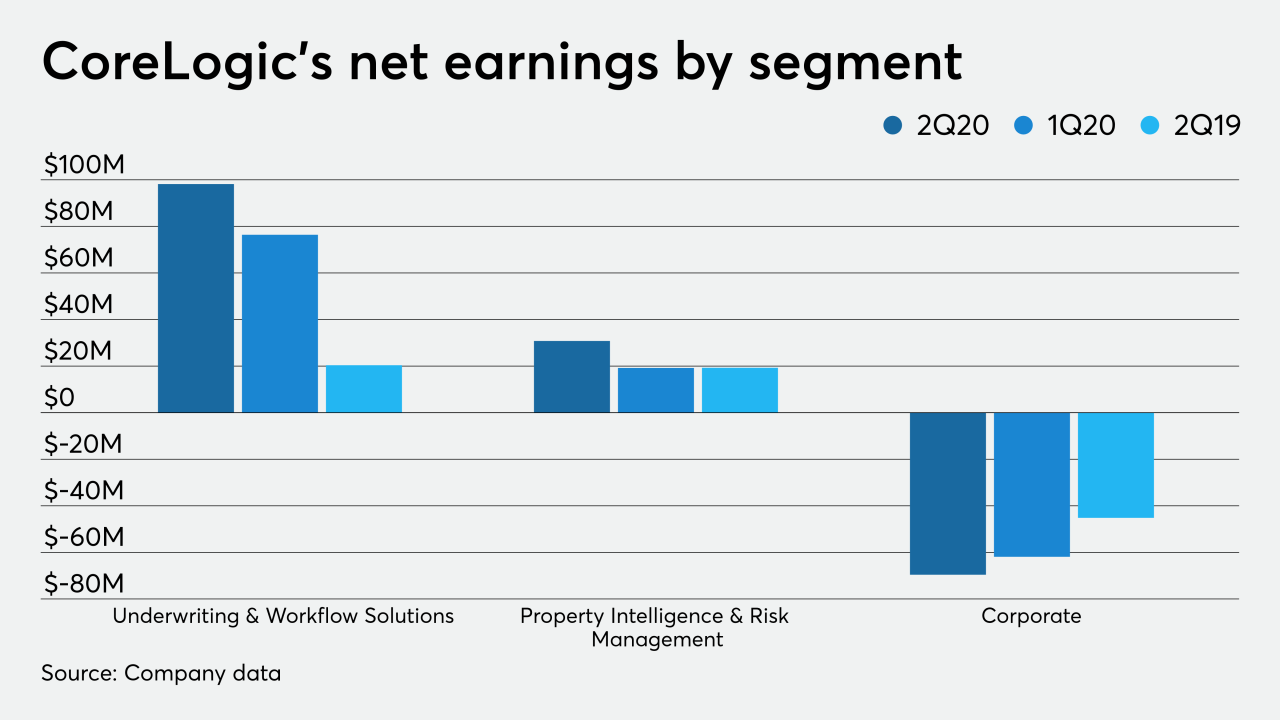

Other moves it is undertaking include business divestitures and increased dividends while defending against a takeover attempt.

July 23 -

After two months of steep drops, home sales leveled off in the Sarasota-Manatee, Fla., region in June.

July 23 -

Mortgage rates rose for the first time in six weeks, going back the above the 3% mark, as spreads to the 10-year Treasury yield widened again, according to Freddie Mac.

July 23 -

Many commercial property owners are locked out of existing coronavirus relief by financing terms that bar them from taking new loans. Under a House bill, they would receive government-backed equity investments.

July 22 -

Other regionals set more aside for loan losses than the Cleveland bank did in the second quarter, and its ratio of reserves to total loans is slightly lower, too. But Key executives say the portfolio is balanced and holding up well despite the pandemic’s economic toll.

July 22 -

The company lost $8.9 million in the second quarter, but its origination and servicing businesses were profitable.

July 22 -

With coronavirus moratoriums still in place, foreclosures fell to the lowest level since at least 2000, while serious delinquencies ballooned by 1.2 million in June, according to Black Knight.

July 22 -

Delinquencies have been ticking up since the start of the coronavirus pandemic and Capital One is warning of more pain unless the government provides additional relief to tenants and landlords.

July 22 -

Fannie Mae and Freddie Mac have imposed heavy price adjustments for loans that were granted relief under the pandemic relief law enacted in March.

July 22 -

Sales of previously owned homes rose in June for the first time in four months as the economy reopened more broadly from coronavirus-related shutdowns and buyers took advantage of record-low mortgage rates.

July 22 -

Fannie Mae could be worthless to public shareholders, according to its newest analyst.

July 22 -

Mortgage applications increased 4.1% from one week earlier as consumers continued to pursue both purchases and refinancings even as conforming rates rose from their record lows, according to the Mortgage Bankers Association.

July 22 -

Commemorating the law's anniversary, the ex-president, joined by former Sen. Chris Dodd and Rep. Barney Frank, said years of tenacious GOP opposition did little to change the post-crisis regulatory regime.

July 21 -

The domestic mortgage insurer could have a portion of its equity sold as an initial public offering if the China Oceanwide transaction were to be terminated.

July 21 -

The Financial Stability Oversight Council’s plan to study the market explains very little about which activities or firms, like Fannie Mae and Freddie Mac, will be designated as systemically important. Here's some clearer guidance.

July 21

-

The measures currently ensuring mortgage companies have sufficient cash to cover advances aren't necessarily sustainable, warns Ted Tozer, a senior fellow at the Milken Institute and a former government official.

July 21 -

The national conversation around systemic racism has compelled large banks to withdraw support from the “disparate impact” proposal. But community banks maintain that the proposed reforms would reduce frivolous claims.

July 20 -

The number of loans going into coronavirus-related forbearance dropped for the fifth straight week, as the growth rate plummeted 38 basis points between July 6 and July 12, according to the Mortgage Bankers Association.

July 20