-

Jamie York has taken the helm at Neighborhood Mortgage Solutions as CEO Greg Wischmeyer prepares to retire.

April 8 -

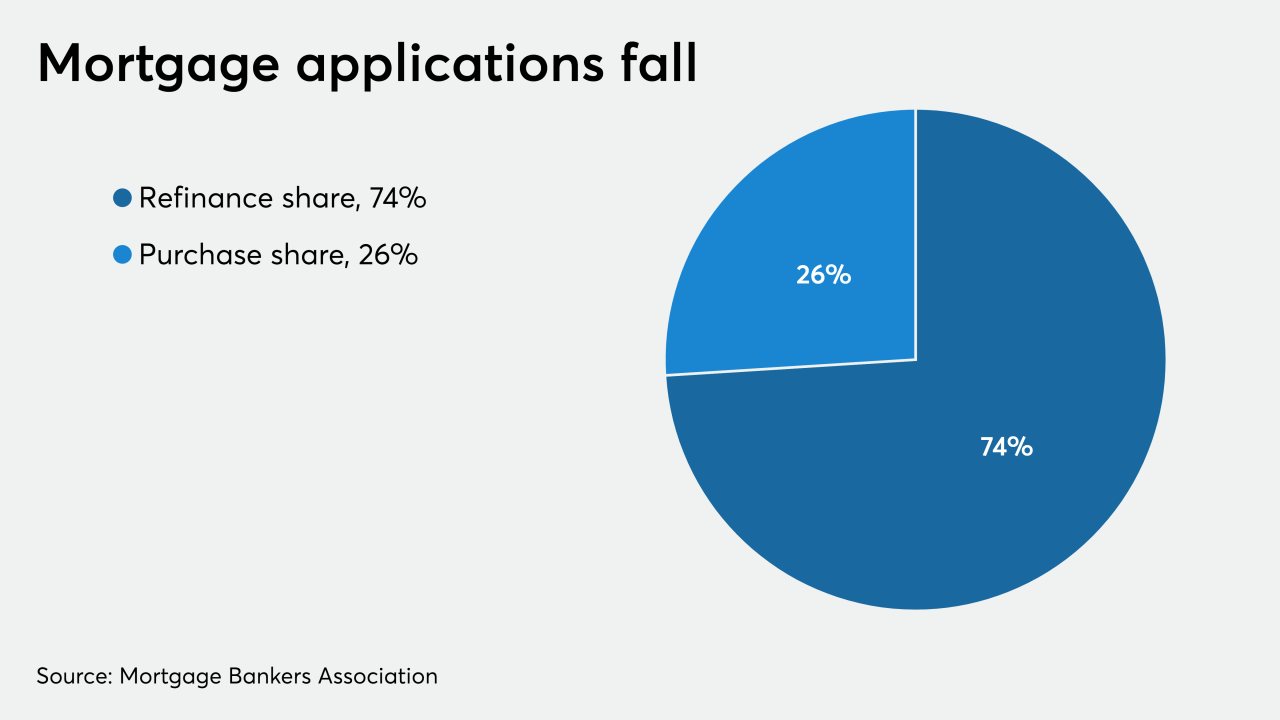

Mortgage applications decreased 17.9% from one week earlier, as coronavirus-related volatility affected consumer sentiment, according to the Mortgage Bankers Association.

April 8 -

Consumer confidence for home buying fell to its lowest point since December 2016, according to Fannie Mae.

April 7 -

Attom ranked 483 counties across the country based on 4Q foreclosure notices, local wages and other factors.

April 7 -

Five Democrats on the Senate Banking Committee sent a letter to Director Kathy Kraninger calling the agency's response to COVID-19 “tepid and ineffectual at best.”

April 7 -

The share of borrowers seeking payment relief rose more than tenfold as COVID-19 concerns grew and authorities encouraged the practice, according to the Mortgage Bankers Association.

April 7 -

The CARES Act does not define what a covered period is when it comes to residential mortgage borrower requests for forbearance.

April 7 McCarter & English LLP

McCarter & English LLP -

The Cincinnati company will hire about 950 workers to meet heightened demand for loan deferrals and other forms of relief clients are seeking to weather the economic fallout of the coronavirus outbreak.

April 7 -

Servicers' obligations to advance or temporarily absorb unpaid funds could range from $3 billion to $13 billion per month, according to Black Knight.

April 6 -

The government lock-down on real estate sales loosened last week — agents and other professionals were deemed essential workers — but strict Bay Area guidelines banned open houses and close contact.

April 6 -

The coronavirus relief legislation could result in private mortgage insurers having to hold more capital, a B. Riley FBR analyst report said.

April 6 -

Ginnie Mae and the FHA provided temporary liquidity relief for mortgage servicers bracing for higher delinquencies, but the industry continues to pressure Treasury and the Fed to provide more comprehensive support.

April 6 -

Ocwen Financial has approximately $749 million of liquidity from various sources to deal with servicing issues arising from the coronavirus, a company press release said.

April 3 -

Nonbank mortgage employment estimates show payrolls in February leveled off after an unusually strong winter, but anecdotal reports of selective hiring persisted through March amid a broader coronavirus-related drop in U.S. jobs.

April 3 -

Community banks and credit unions could carve out an opportunity by refinancing mortgages from larger institutions.

April 3 Finastra

Finastra -

Mortgage lenders are preparing for the biggest wave of delinquencies in history. If the plan to buy time works, they may avert an even worse crisis: Mass foreclosures and mortgage market mayhem.

April 2 -

The worsening economy brought on by the coronavirus pandemic has big banks rethinking who they will lend to.

April 2 -

Bank employment of mortgage loan officers rose slightly last year, but that was before the coronavirus spread and resulted in social distancing measures that raised questions about broader employment prospects.

April 2 -

Finance of America Reverse agreed to pay $2.5 million to settle allegations that a company it acquired violated the False Claims Act for loans submitted for Federal Housing Administration insurance in 2010.

April 2 -

Mortgage rates dropped for the second consecutive week, falling 17 basis points, but that is not attracting homebuyers back into an uncertain market, according to Freddie Mac.

April 2