-

"These changes reflect adjustments we're making to ensure our staffing levels, locations and expertise align with current business needs; efficiencies we have gained through technology; and progress against our transformation work," the company said in a statement.

January 13 -

President Trump Tuesday told reporters he would not delay announcing his pick to fill a new vacancy on the Federal Reserve Board despite threats from Republican Senators to block any Fed nomination until a recently-disclosed Justice Department investigation into Fed Chair Jerome Powell is resolved.

January 13 -

The Bureau of Labor Statistics reported Tuesday morning that consumer prices rose 0.3% in December, with annual inflation stuck at 2.7%, lending credence to the Federal Reserve's cautious stance toward interest rates heading into 2026.

January 13 -

Financial markets took a tumble Monday morning after Federal Reserve Chair Jerome Powell announced that he was the subject of a Justice Department inquiry concerning the central bank's headquarters renovation. Lawmakers and former Fed officials decried the move as political intimidation.

January 13 -

The survey, taken before Pres. Trump's $200 billion MBS buy demand, finds panelists worried over inflation, but also see employment as the larger downside risk.

January 12 -

But a senior administration official said the DOJ, not Pulte, is behind the subpoena that relates to Powell's congressional testimony about Fed building renovations.

January 12 -

Federal Reserve Chair Jerome Powell said the central bank has been served grand jury subpoenas and been threatened with criminal indictment, moves he called "pretexts" to influence interest rates through "political pressure or intimidation."

January 11 -

Lenders shouldn't expect the latest jobs numbers to yield major monetary policy moves after the unemployment rate came in mostly flat last month, experts say.

January 9 -

US President Donald Trump said he was directing the purchase of $200 billion in mortgage bonds, which he cast as his latest effort to bring down housing costs ahead of the November midterm election.

January 8 -

Yields across maturities were higher by less than three basis points after rebounding from session lows.

January 8 -

Across-the-board decreases across all loan types drove the Mortgage Bankers Association's full credit availability index to its lowest in three months.

January 8 -

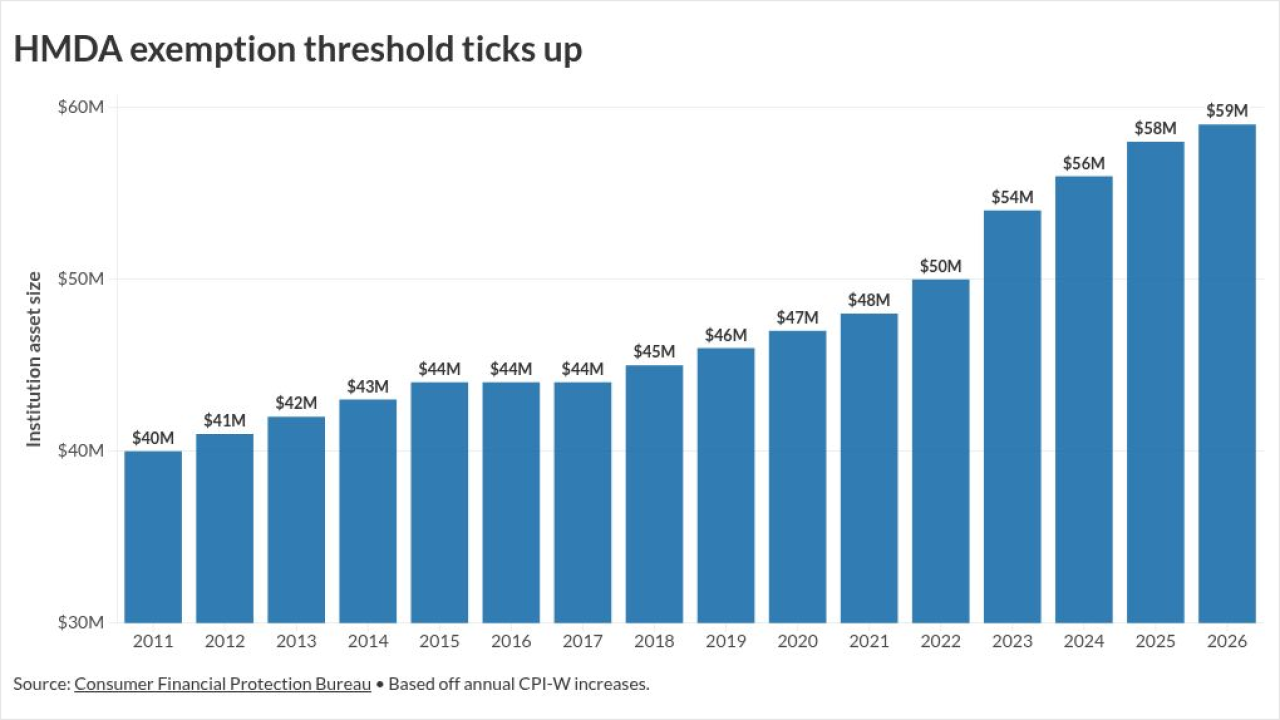

Originators with less than $59 million in assets don't have to share their loan data with CFPB, as the semi-shuttered regulator continues mortgage oversight.

January 8 -

The company was founded in 1986 by current CEO Mat Ishbia's father Jeff and became the No. 1 originator by dollar volume in the third quarter of 2022.

January 7 -

Largely strong credit qualities were offset because by loans on single-family homes in the pool dropping by 0.5%, and that the percentage of loans that received due diligence decreased by 0.4%.

January 7 -

The deal still faces a lawsuit from activist investor HoldCo Asset Management, which contends that Comerica didn't properly shop itself before agreeing to sell to Fifth Third.

January 6 -

With limited seasoning and primarily a clean payment history, OBX 2026-NQM1 had a seasoned probability of default of 33.3% among the AAA stresses and 11.4% among the B.

January 6 -

Yields gravitated back toward session lows — down three to four basis points on the day — after the December ISM manufacturing gauge unexpectedly dropped.

January 5 -

Minneapolis Federal Reserve President Neel Kashkari said on CNBC that both sides of the central bank's dual mandate show signs of imbalance, with the labor market appearing more vulnerable.

January 5 -

The rally sparked by the weekend US arrest of Venezuela's President Nicolas Maduro also faltered as oil prices rebounded from their initial declines

January 5 -

Brinton joins the mortgage industry trade group after previously holding accounting leadership positions at a range of business organizations and nonprofits.

January 2