-

Southern California's housing market weathered the slowest October in seven years, prompting a debate over where the market is headed.

December 6 -

The lack of housing affordability, caused by rising home prices and mortgage rates, remains a roadblock to homeownership.

December 4 -

Bay Area home sales ground down in October, with seasonal slowing and further indications that buyers are taking a wait-and-see approach before plunging into a record-setting market.

December 3 -

The Woolsey Fire in Southern California destroyed or damaged as much as $6 billion in real estate, a new estimate shows.

November 28 -

The 48,390 homes dubbed at extreme or high risk from the California wildfires burning through the state could cost $18 billion in reconstruction, according to a CoreLogic analysis.

November 14 -

The mortgage delinquency rate dipped to a 12-year low, but overvalued housing markets and eventual reversal in the unemployment rate present risk for future delinquencies, according to CoreLogic.

November 13 -

Eighty percent of millennials said they plan on moving within the next five years, while nearly three-quarters claim affordability as their biggest hurdle in the buying a home.

November 6 -

Signaling a market in transition amid a surge in new listings, the median price paid for a new or existing Bay Area home or condo last month was $815,000, down 1.8% from August but up 9.3% from September 2017, CoreLogic reported.

November 5 -

All four national title insurance underwriters saw an increase in third-quarter net earnings compared with one year prior even as new orders declined because mortgage origination volume fell this year.

October 25 -

Home prices increased nationally by 5.5% year over year from August 2017, while in the Bradenton-Sarasota-North Port, Fla., region they grew by 3.95%, CoreLogic said.

October 9 -

The mortgage delinquency rate fell to a 12-year low, with declines expected to continue as the unemployment rate stays down, according to CoreLogic.

October 9 -

Destruction from Michael's storm surge and flooding has potential to affect 57,000 homes, with a worst-case total of $13.4 billion in reconstruction cost value, according to CoreLogic's latest estimates.

October 9 -

While digital expansion of the mortgage application process increases convenience, it inherently comes with the downside of heightened fraud risk.

October 3 -

Southern California home sales hit a four-year low this past summer as rising costs and a lack of affordable homes cut into home shoppers' buying power.

October 3 -

Homebuyers saving for a down payment contributed to the slowest rate of August price appreciation in nearly two years; and the market could have even less momentum by next summer.

October 2 -

Home shoppers were feeling beat up this spring, often finding themselves vying with up to a dozen other buyers for limited homes amid soaring prices.

October 1 -

The number of Bay Area homes sold in August plunged by 10% year-over-year due to the scarcity of affordable homes.

September 28 -

Florence's flooding and wind destruction affected about 700,000 residential and commercial properties across North Carolina, South Carolina and Virginia, according to CoreLogic's latest estimates.

September 25 -

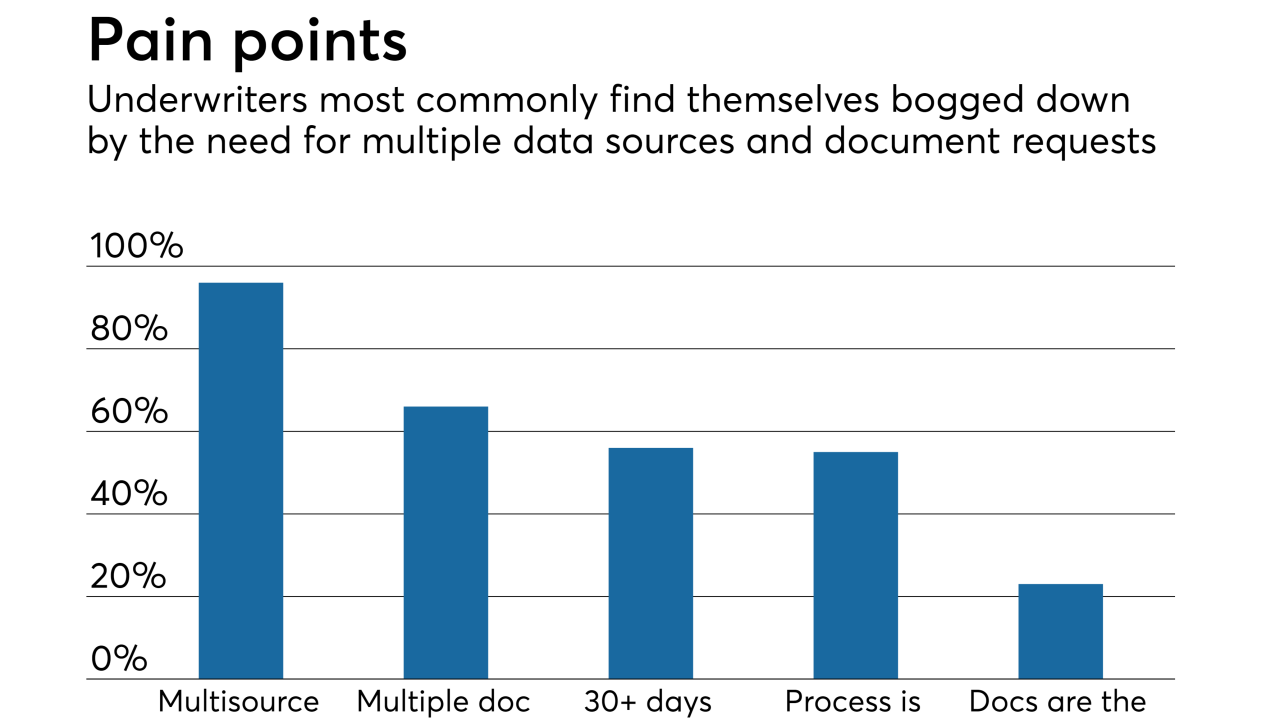

Accessing a mortgage applicants' data from a direct source goes a long ways toward shortening the origination process, according to 96% of mortgage underwriters responding to a recent CoreLogic survey.

September 17 -

While the severity of Florence was reduced prior to Friday morning's landfall, mortgage servicers are taking proactive steps in addressing the emergency situation.

September 14