-

The mortgage delinquency rate fell to a 12-year low, with declines expected to continue as the unemployment rate stays down, according to CoreLogic.

October 9 -

Destruction from Michael's storm surge and flooding has potential to affect 57,000 homes, with a worst-case total of $13.4 billion in reconstruction cost value, according to CoreLogic's latest estimates.

October 9 -

While digital expansion of the mortgage application process increases convenience, it inherently comes with the downside of heightened fraud risk.

October 3 -

Southern California home sales hit a four-year low this past summer as rising costs and a lack of affordable homes cut into home shoppers' buying power.

October 3 -

Homebuyers saving for a down payment contributed to the slowest rate of August price appreciation in nearly two years; and the market could have even less momentum by next summer.

October 2 -

Home shoppers were feeling beat up this spring, often finding themselves vying with up to a dozen other buyers for limited homes amid soaring prices.

October 1 -

The number of Bay Area homes sold in August plunged by 10% year-over-year due to the scarcity of affordable homes.

September 28 -

Florence's flooding and wind destruction affected about 700,000 residential and commercial properties across North Carolina, South Carolina and Virginia, according to CoreLogic's latest estimates.

September 25 -

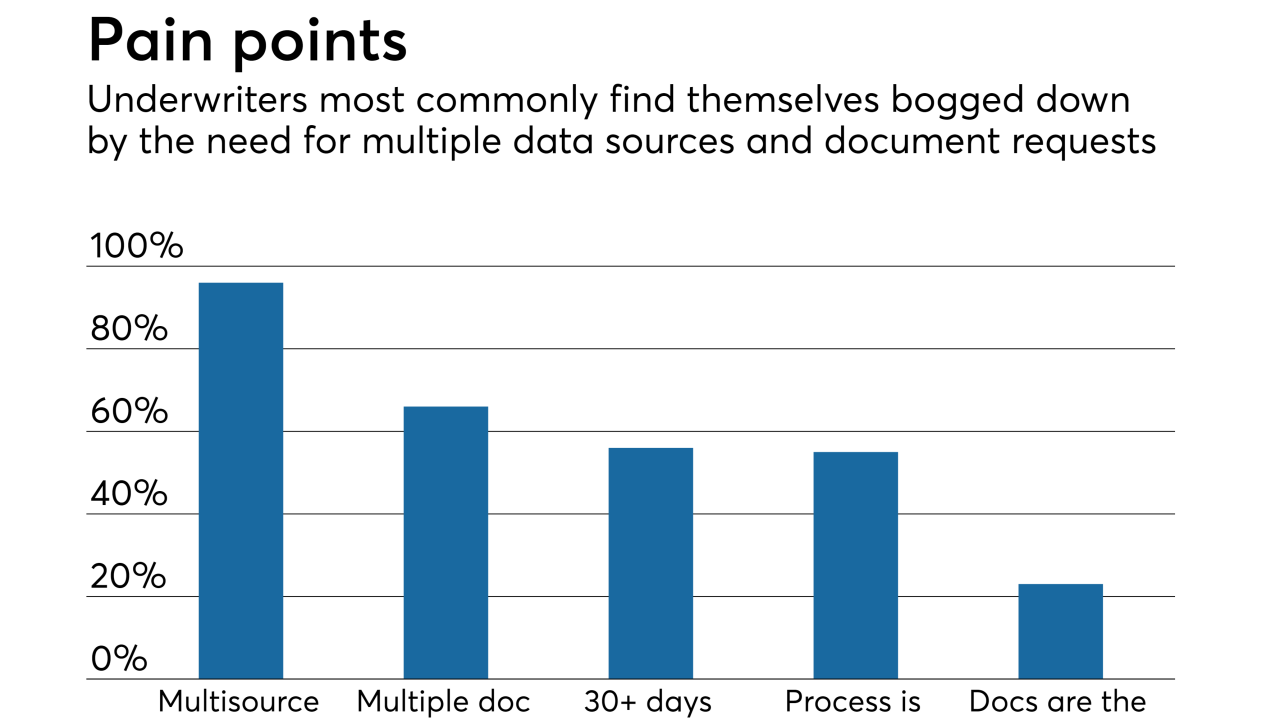

Accessing a mortgage applicants' data from a direct source goes a long ways toward shortening the origination process, according to 96% of mortgage underwriters responding to a recent CoreLogic survey.

September 17 -

While the severity of Florence was reduced prior to Friday morning's landfall, mortgage servicers are taking proactive steps in addressing the emergency situation.

September 14 -

The number of Americans who are behind on their mortgage payments is the lowest in more than a decade.

September 12 -

Houston area home prices rose 5.4% over the last year through July, slightly below the national appreciation rate of 6.2%.

September 10 -

The dollar volume of private-label residential mortgage-backed securities issuance this year is the highest it has been since the Great Recession, despite a decline in new originations.

September 6 -

Sacramento's once hot housing market continued its cooling trend in July, with median prices dipping slightly in five of the six local counties.

September 6 -

The median Bay Area home price fell from June to July but was still up double digits over last year, according to CoreLogic.

September 5 -

Growth in home prices remained churning at a steady pace, with sellers holding out for better returns and suppressing the supply of available housing.

September 4 -

Southern California’s red-hot housing market continued to cool in July as rising home prices and higher interest rates discouraged homebuyers, new housing figures show.

August 31 -

Home buyers in the Twin Cities and beyond will have to wait until at least 2020 for key indicators in the housing market tilting toward buyers, according to a new survey.

August 31 -

For the first time in a year and a half, Washington is no longer the state with the hottest housing market in the country, though not because homes here have suddenly become cheap.

August 14 -

Mortgage delinquency rates dropped on an annual basis, a sign of a strengthening economy, but could soon see a spike due to this year's wildfires, according to CoreLogic.

August 14