-

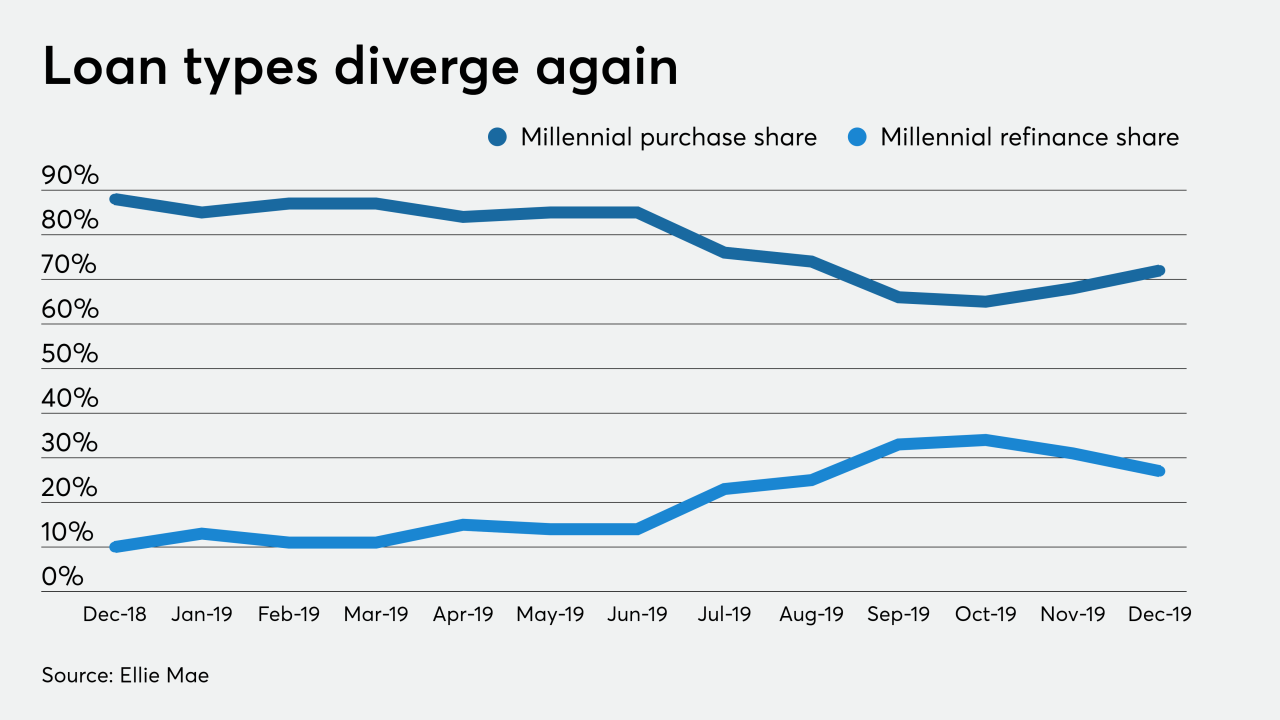

With mortgage rates plummeting, the refinance share of closed loans from millennial borrowers rose for the third straight month, to the highest level since Ellie Mae began tracking the data in 2016.

May 6 -

As lenders scale up on their remote capabilities in response to the pandemic, the software companies that service them see exponential growth.

April 27 -

The Federal Reserve's $2.3 trillion loan stimulus includes plans for outstanding commercial mortgage-backed securities and newly issued collateralized loan obligations.

April 9 -

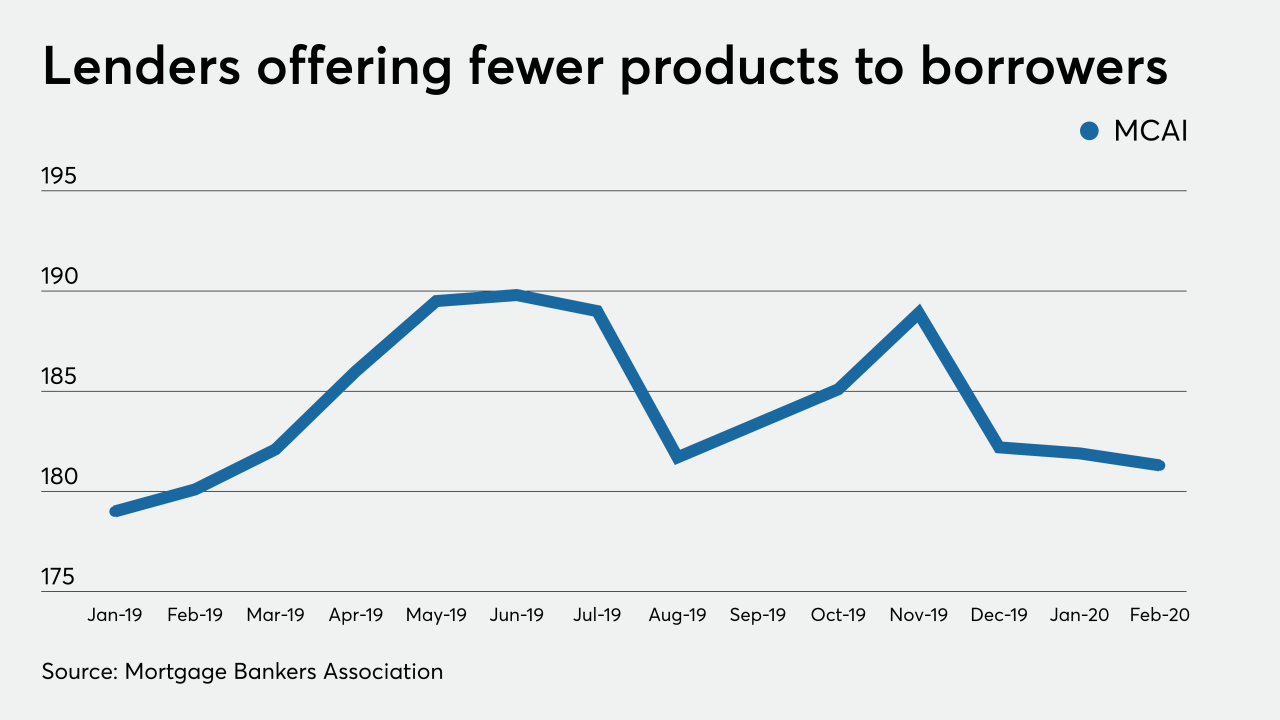

Mortgage credit availability dropped slightly in February, making three consecutive months of tightening, but that streak will likely end with falling interest rates, the Mortgage Bankers Association said.

March 10 -

January's plummeting mortgage rates led to a spike in the share of millennials refinancing their home loans, a trend that should carry into February and March, according to Ellie Mae.

March 5 -

Women are becoming more and more empowered in home purchasing, thanks in part to the digitization of the mortgage and real estate industries, according to a report from Compass and Better.com.

March 4 -

Low mortgage rates are setting the stage for growth, not just in refinancings, but in purchase volume as well during 2020, according to Ellie Mae.

February 19 -

A larger percentage of newly originated mortgages to millennials shifted toward purchase loans as interest rates stayed low, according to Ellie Mae.

February 7 -

There was less credit available for the first time in four months in December, when lenders offered fewer conventional and government products, particularly Veterans Affairs-guaranteed loans, the Mortgage Bankers Association said.

January 13 -

While the refinancing boom took a step back, millennials purchasing power grows in the low mortgage rate environment, according to Ellie Mae.

January 9 -

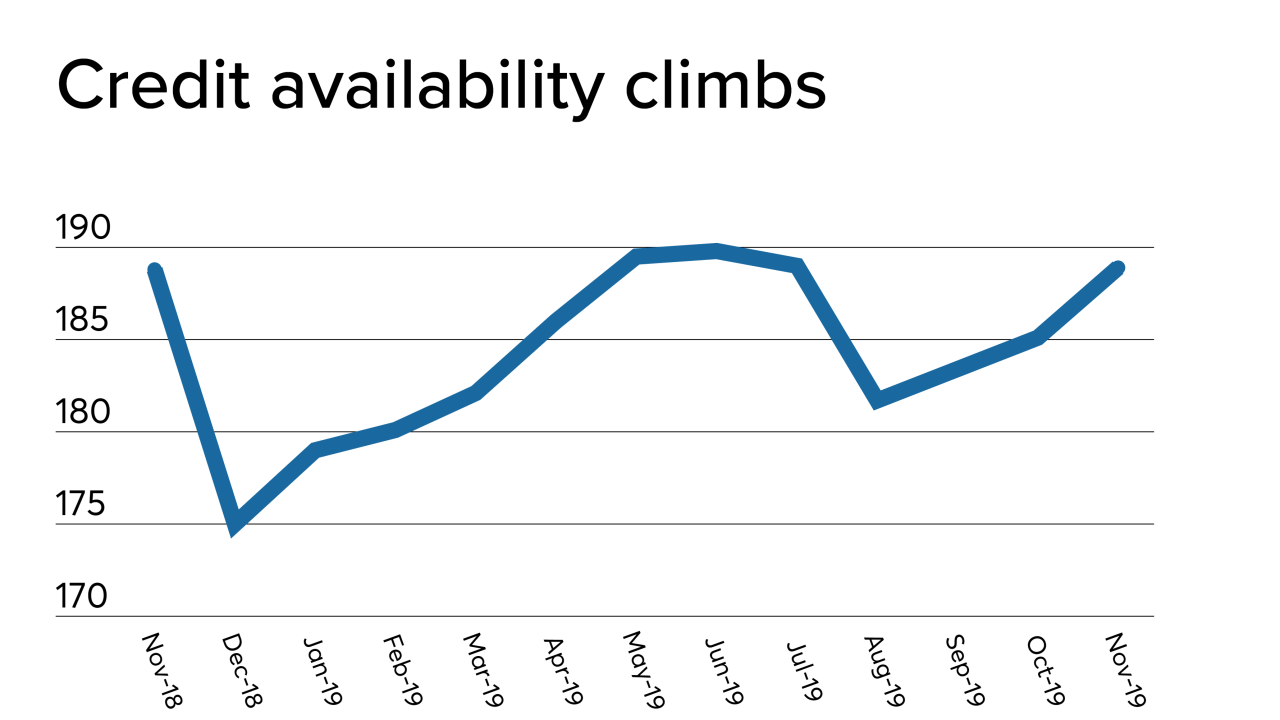

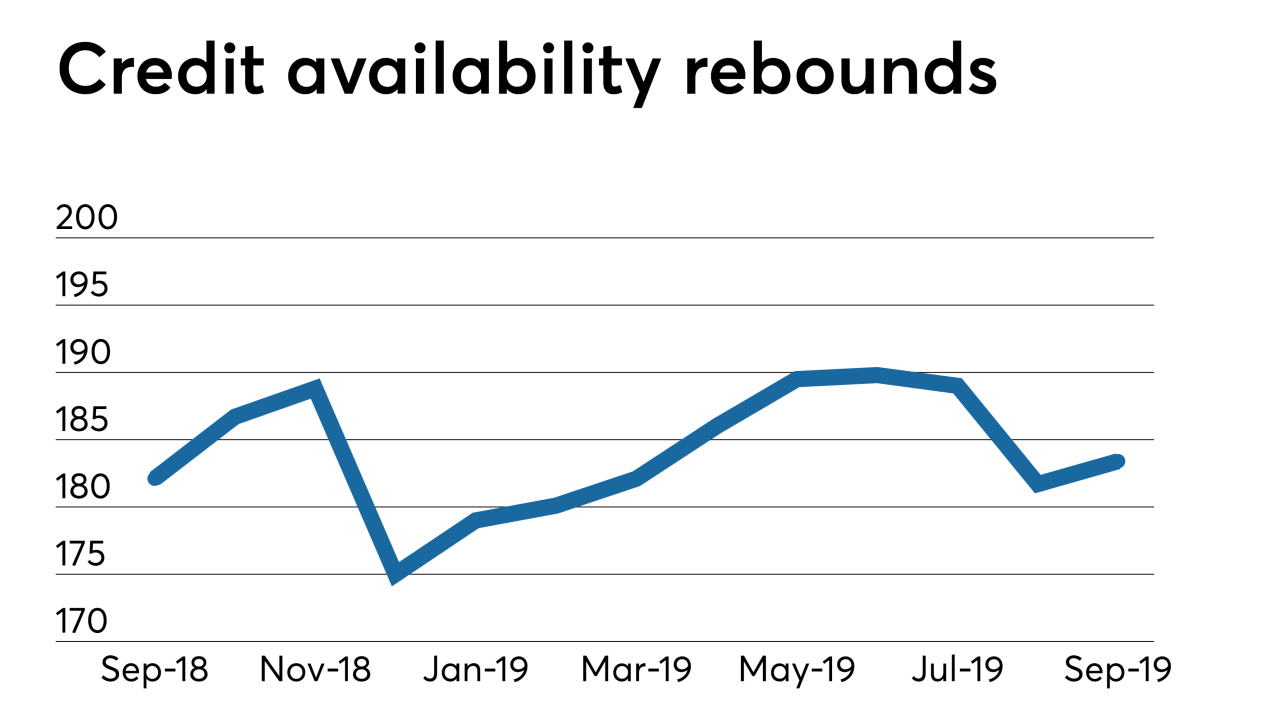

The availability of mortgage credit jumped in November from the previous month as jumbo activity and refinancing in the government market increased, according to the Mortgage Bankers Association.

December 5 -

Millennials took advantage of the low mortgage rate landscape in October, boosting their refinance share to a survey-record high, according to Ellie Mae.

December 4 -

Mortgage lenders are operating in a refinance-dominated market again for the first time in years, but it may offer diminishing returns.

November 20 -

Mortgage credit availability increased in October from the previous month, as mortgage lenders increased their product offerings outside the government market, according to the Mortgage Bankers Association.

November 12 -

Aaron King of Snapdocs, Brent Chandler of FormFree, Tim Mayopoulos of Blend, and Chris Backe of Ellie Mae talk about system fragmentation, data access issues, personnel management and other hurdles that still stand between the industry and comprehensive digitalization.

November 7 -

Loan origination system provider Ellie Mae has agreed to purchase mortgage technology firm Capsilon, citing the growing appeal of artificial intelligence-driven automation and interest in becoming more active as an acquirer.

October 29 -

September's increase in mortgage credit availability was driven by the expansion of jumbo products to record levels, which overcame a retrenchment in both conforming and government programs, the Mortgage Bankers Association said.

October 8 -

The majority of first-time homebuyers participating in a recent survey preferred online or phone interactions when receiving counseling that is a prerequisite for some loan programs.

October 3 -

Millennials took advantage of mortgage rates falling to near three-year lows in August, increasing their refinance share to the highest percentage since December 2015, according to Ellie Mae.

October 2 -

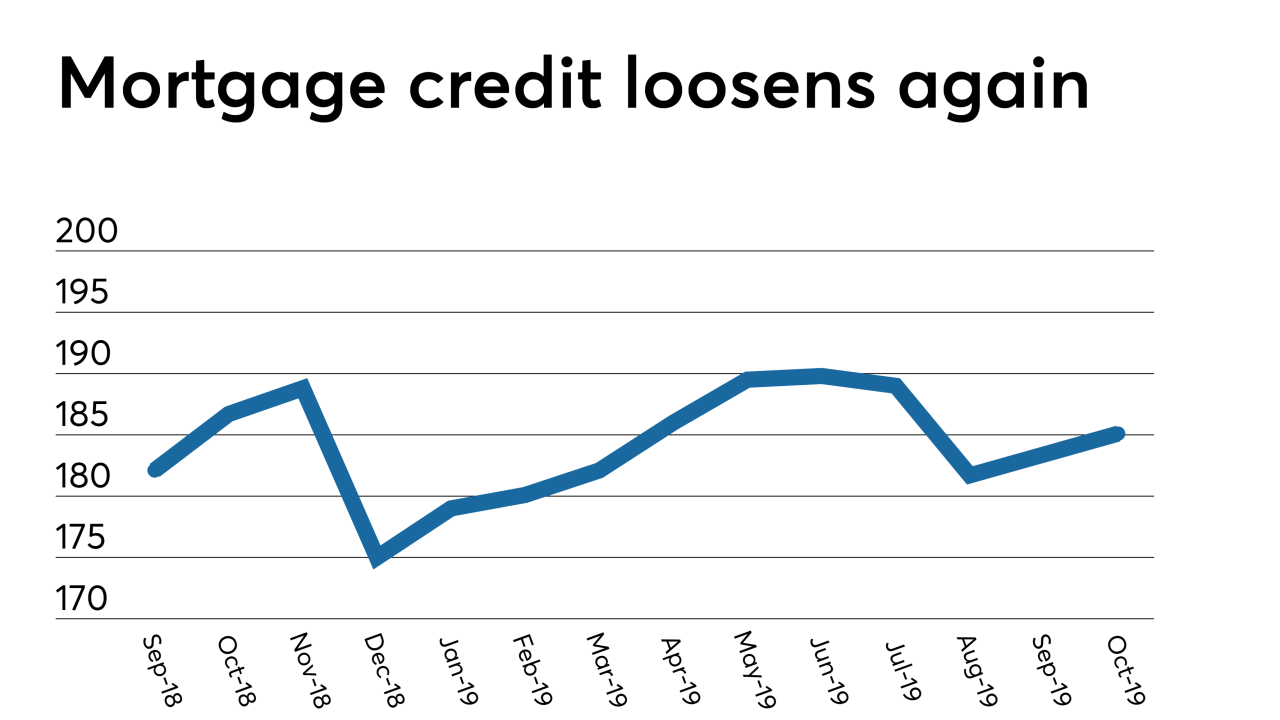

Mortgage credit availability tightened in August by the most since the end of last year, even though falling interest rates sparked a strong uptick in refinancings, the Mortgage Bankers Association said.

September 12