-

While student, auto and credit card balances are at or near record levels, housing debt is shrinking, credit quality is weakening a bit and lending standards, at least in some sectors, are tightening.

February 19 -

The Federal Housing Finance Agency has proposed barring Fannie Mae and Freddie Mac from using credit scores developed by VantageScore over concern about conflicts of interest with the joint venture of Equifax, Experian and TransUnion.

December 13 -

Republicans on the House Oversight Committee concluded that last year’s massive data breach at Equifax was fully preventable, but stopped short of recommending new laws aimed at averting future hacks. Democrats called the final report a “missed opportunity.”

December 10 -

Equifax is supporting mortgage lender customer retention efforts with a new tool that predicts the likelihood that a lead will apply for a loan within the coming months.

November 29 -

Senators at a hearing Thursday discussed a bill establishing an online portal for consumers to monitor their credit reports free of cost.

July 12 -

Credit reporting firms with significant operations in New York will face new cybersecurity and registration requirements to stave off concerns related to a breach of Equifax's systems last year.

June 25 -

Mortgage industry vendors' earnings varied based on the effectiveness of the strategies they used to contend with origination declines and other factors.

April 26 -

Some speculate that the banks who do business with credit reporting agencies may be looking for alternatives after mounting concerns about their ability to keep information private. But breaking up is hard to do.

April 4 -

Some fear that the removal of such data from individual credit reports could lead lenders to believe a consumer is a better bet than they really are.

April 2 -

The Consumer Financial Protection Bureau is among several agencies that "continue to investigate events related to" last year's Equifax brief, the credit reporting firm said in a securities filing.

March 2 -

Equifax, the credit-reporting firm that suffered a massive data breach last year, said it will notify an additional 2.4 million U.S. consumers that they were affected by the hack.

March 1 -

Sen. Elizabeth Warren released a scathing report Wednesday on Equifax's handling of the data breach last year, part of an effort to gain backing for legislation to rein in the credit bureaus.

February 7 -

It is unclear whether the Consumer Financial Protection Bureau is abandoning its supervisory oversight of Equifax or just taking a back seat to the Federal Trade Commission as the latter investigates the credit bureau.

February 5 -

The two senators are set to introduce a bill that would force such firms to pay $100 per customer whose personal information was compromised.

January 10 -

The credit bureau enraged many with its response to a massive data breach this fall, but closing the company down would ultimately harm consumers.

December 29 Consumers' Research

Consumers' Research -

From deregulation to digital innovation, here's a look at the top storylines that defined the mortgage industry in 2017.

December 26 -

Equifax reported earnings that were 27% lower and mortgage services revenue was 2% lower on a year-to-year basis after revealing a major breach and taking steps to improve security.

November 10 -

Calls for less reliance on credit bureaus and Social Security numbers for verification are leading many to envision a future of identity on a distributed ledger.

October 30 -

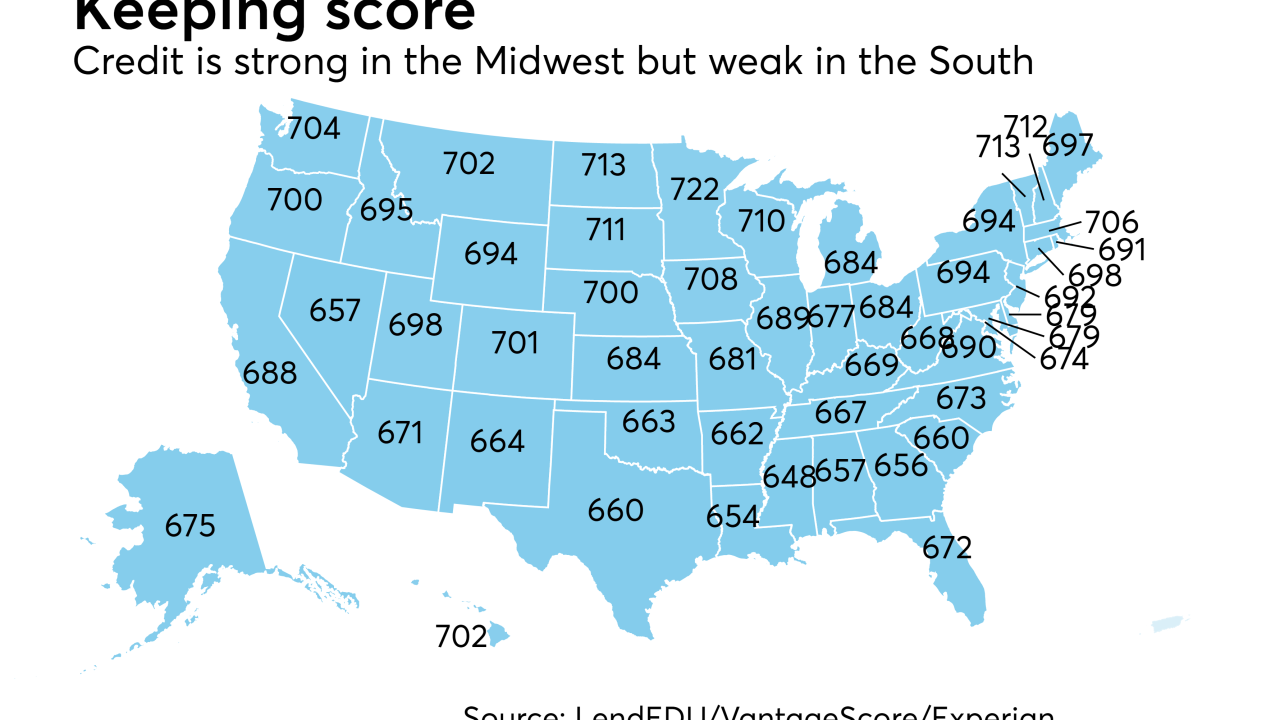

Consumer credit varies nationally due to regional variations in income and the cost of living. To get a sense of where it's strongest and weakest, here's a look at the five best and worst states for consumer credit scores.

October 23 -

Fannie Mae is authorizing additional suppliers of reports that can give lenders immediate representation and warranty relief on certain data, diversifying beyond an exclusive partnership with Equifax in one category.

October 23