-

If proposed tax cuts were enacted, Fannie Mae and Freddie Mac would be required to make an initial adjustment that could wipe out their capital.

May 5 -

Employment in the mortgage sector rose for the first time in three months in March, driven by an increase in loan broker hires.

May 5 -

Fannie Mae said it expects to make a $2.8 billion dividend payment to the U.S. Treasury in June after reporting a first-quarter profit driven by a relatively stable mortgage market and a continued decline in delinquencies.

May 5 -

Fannie Mae and Freddie Mac will continue to pursue opportunities for the government-sponsored enterprises to provide liquidity to the single-family rental market, despite opposition from mortgage and real estate industry groups.

May 2 -

No matter what form government-sponsored enterprise reform takes, Federal Housing Finance Agency officials are stressing that it should account for the fact that the GSEs' capital buffer will soon hit zero.

May 1 -

The Treasury secretary on Monday reiterated an aggressive timetable for tackling the future of Fannie Mae and Freddie Mac, an issue that has long flummoxed Congress.

May 1 -

Mortgage Bankers Association President David Stevens is confident that housing finance reform will move forward under the Trump administration, but criticized calls to simply let the government-sponsored enterprises recapitalize and be returned to shareholders without additional reforms.

May 1 -

Senate Banking Committee Chairman Mike Crapo and House Financial Services Committee Chairman Jeb Hensarling said they believed an agreement on housing finance reform could be struck in this Congress.

April 27 -

From a few employees at Hutchinson Credit Union who spent part of their day focusing on better servicing of local home mortgages, Member Mortgage Services has grown in just 13 years into a separate company with 37 employees.

April 26 -

Fannie Mae has made three selling guide changes aimed at helping the growing number of borrowers with student debt qualify for home loans, and may begin testing similar proposals related to this goal.

April 25 -

Incenter Mortgage Advisors is brokering an $898 million alt-A bulk servicing rights portfolio for an undisclosed bank.

April 21 -

The Mortgage Bankers Association released a detailed transition plan Thursday designed to help policymakers turn the government-sponsored enterprises into private guarantors of mortgage-backed securities.

April 20 -

Incenter Mortgage Advisors is accepting bids on behalf of an independent mortgage banker for a $326 million portfolio of Fannie Mae, Freddie Mac and Ginnie Mae mortgage servicing rights.

April 20 -

Vladimir Putin is taking a page from the U.S. housing market to boost homeownership. Call it Russia's Fannie Mae.

April 19 -

DLJ Mortgage Capital Inc. was the winning bidder on all four pools in Fannie Mae's second reperforming loan sale.

April 13 -

Employment in the nondepository mortgage banker and broker sector fell for the second consecutive month in February, a possible sign of growing concern about shrinking demand for mortgages.

April 7 -

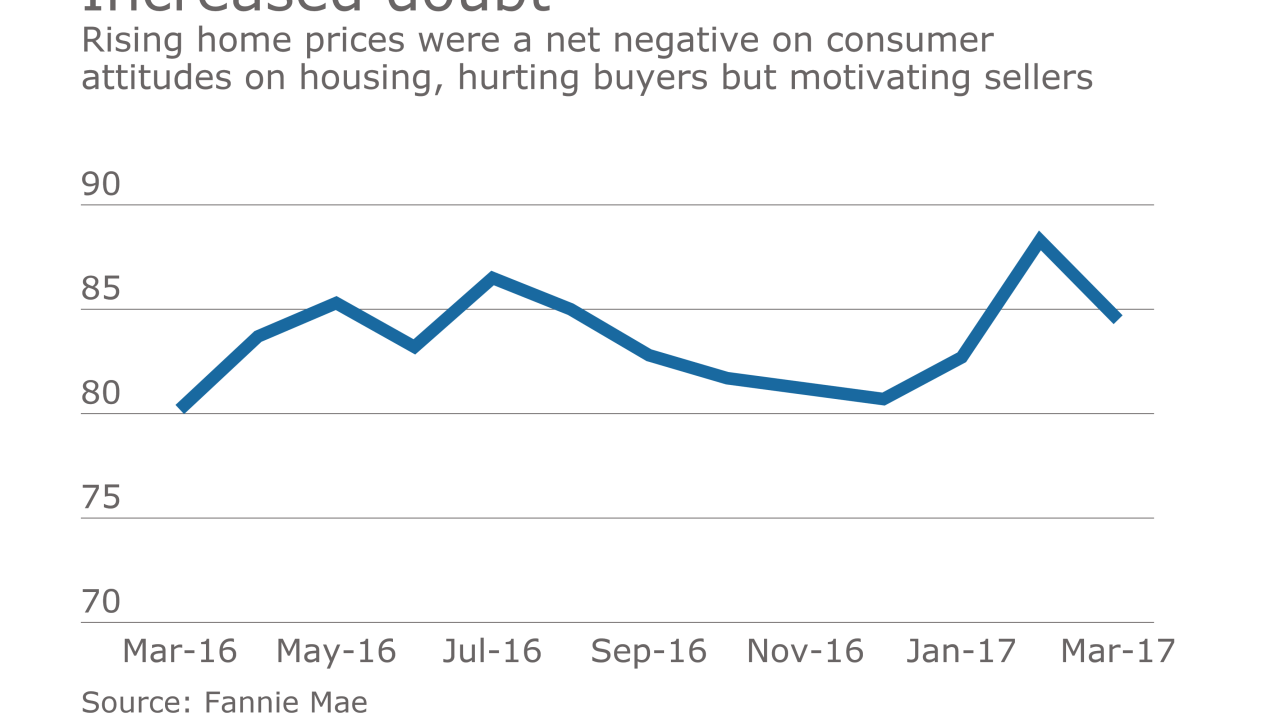

Home price increases combined with rising rates drove consumer confidence in the housing market off of its all-time high.

April 7 -

Private market mortgage insurance companies should better align their buyback and rescission policies with those of Fannie Mae and Freddie Mac, the Federal Housing Finance Agency said.

March 30 -

Post-recession, educational achievement became a factor in determining whether a young adult decided to buy a home.

March 30 -

A bipartisan group of senators told Mel Watt, the regulator who oversees Fannie Mae and Freddie Mac, that he shouldn't allow the companies to recapitalize without congressional approval.

March 30