-

Its modifications aim to help two government-sponsored mortgage investors manage risk and rebuild capital while retaining enough flexibility to fulfill their affordable housing missions, said the Federal Housing Finance Agency’s acting director, Sandra Thompson.

February 25 -

Fannie Mae delayed a scheduled residential mortgage bond on Thursday due to market volatility spurred by Russia’s invasion of Ukraine, according to people with knowledge of the matter.

February 25 -

"The quality of our new business is high. The pricing of that business does not reflect the capital requirements of our regulatory rule," CEO Hugh Frater said.

February 15 -

Housing rights advocates said minority home-buyers and homeowners in 39 U.S. metropolitan areas will receive the funds as a result of a legal action alleging racial discrimination in the government-sponsored enterprise's foreclosure practices.

February 8 -

Compounding factors of low inventory and high costs also helped lead to another decline in Fannie Mae’s Home Purchase Sentiment Index.

February 7 -

Former principal economist at the Federal Housing Finance Agency Paul Manchester breaks down how the targets have been calculated and discusses the implications for the set determined for 2022 to 2024.

January 31 Federal Housing Finance Agency

Federal Housing Finance Agency -

The co-founder of Arch Capital Solutions reviews the changes made to reporting disclosures on mortgages for condominiums and units located in HOAs that were part of a response to the tragic condo collapse in Surfside, Florida.

January 28 Arch Capital Solutions

Arch Capital Solutions -

However, the unusual profitability residential finance firms have previously enjoyed, and a strong housing market, could help to sustain their bottom lines.

December 15 -

Chryssa Halley, who has been with the company since 2006, was named CFO and Jim Holmberg was named controller.

December 2 -

Tight inventory and heightened competition kept prime purchasers at bay as property values continued their summer surge, according to Fannie Mae.

August 9 -

While the hot market’s actual and forecast home price gains were key drivers of Fannie’s results, they also present a challenge to the affordable housing mission that it’s working to address.

August 3 -

The dynamic between housing market players diverged to an even greater degree amid intense demand and surging home prices, according to Fannie Mae.

July 7 -

The justices on Wednesday threw out a key part of a challenge brought by firms including Paulson & Co., Pershing Square Capital Management and Fairholme Funds to the government’s collection of more than $100 billion in profits from Fannie Mae and Freddie Mac.

June 23 -

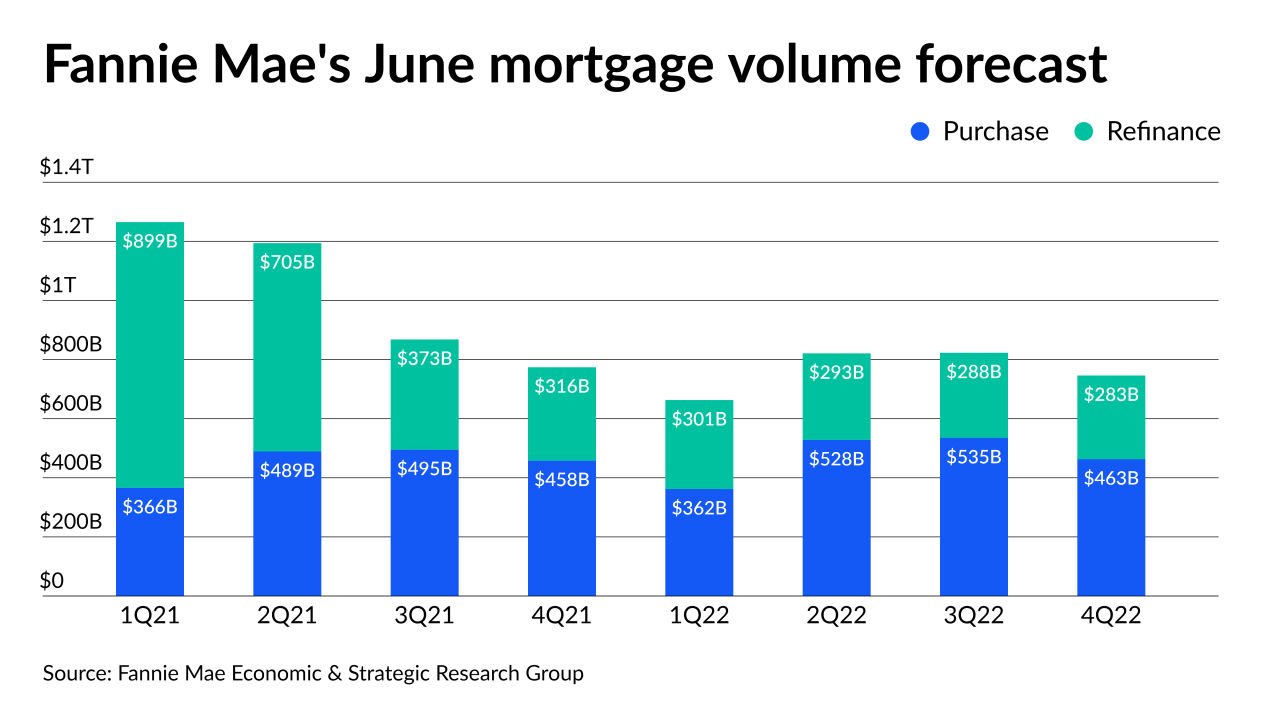

But the government-sponsored enterprise raised its total origination volume forecast for 2021 based on slightly stronger than expected refinance activity.

June 16 -

More than two-thirds surveyed said they expect to make less money over the next three months as price reductions ramp up along with a market shift to purchases.

June 10 -

The government-sponsored enterprises have been returning to normal underwriting and are buying more loans than last year, but annual limits they have in place could become a concern.

June 8 -

While a growing share of consumers feel optimistic about the economic recovery underway, the extreme seller’s market made the majority of prospective borrowers pessimistic for only the second time in 10 years, according to Fannie Mae.

June 7 -

For two decades, Alfred Pollard served as the general counsel for Fannie Mae and Freddie Mac’s regulator. He had a front-row seat for the establishment of the Federal Housing Finance Agency, the government’s subsequent seizure of the mortgage giants amid mounting losses in 2008 and the more recent legal dispute over the FHFA’s authority.

June 7 -

The former senior vice president and credit officer takes over the role that Andrew Bon Salle left at the end of 2020.

May 27 -

In spite of an improving economy, acute competition and supply scarcity soured homeshoppers on the purchase market in April, according to Fannie Mae.

May 7