-

Five MBS pools of predominantly non-QM mortgages have been launched into the market by originators and loan aggregators, according to ratings agency presale reports published since Monday.

February 13 -

Whether a deal involves a minority stake or a whole company carve-out, buyers and sellers should be aware of five issues that may pose transaction risk in the mortgage market.

February 11 Mayer Brown

Mayer Brown -

The administration proposed to end the housing trust funds now financed by Fannie Mae and Freddie Mac, and to subject numerous agencies to the congressional appropriations process, among other things.

February 10 - LIBOR

The government-sponsored enterprises’ plan to cease accepting loans pegged to the London interbank offered rate a year ahead of its scheduled expiration is expected to hasten action in securitized markets.

February 10 -

Despite a drop in multifamily loan volume, industrial, health care, office and retail originations pushed overall multifamily and commercial mortgage lending to unprecedented heights, according to the Mortgage Bankers Association.

February 10 -

Consumer sentiment about purchasing a home nears its record high as almost half of those surveyed said mortgage rates will stay at the current low levels, according to Fannie Mae.

February 10 -

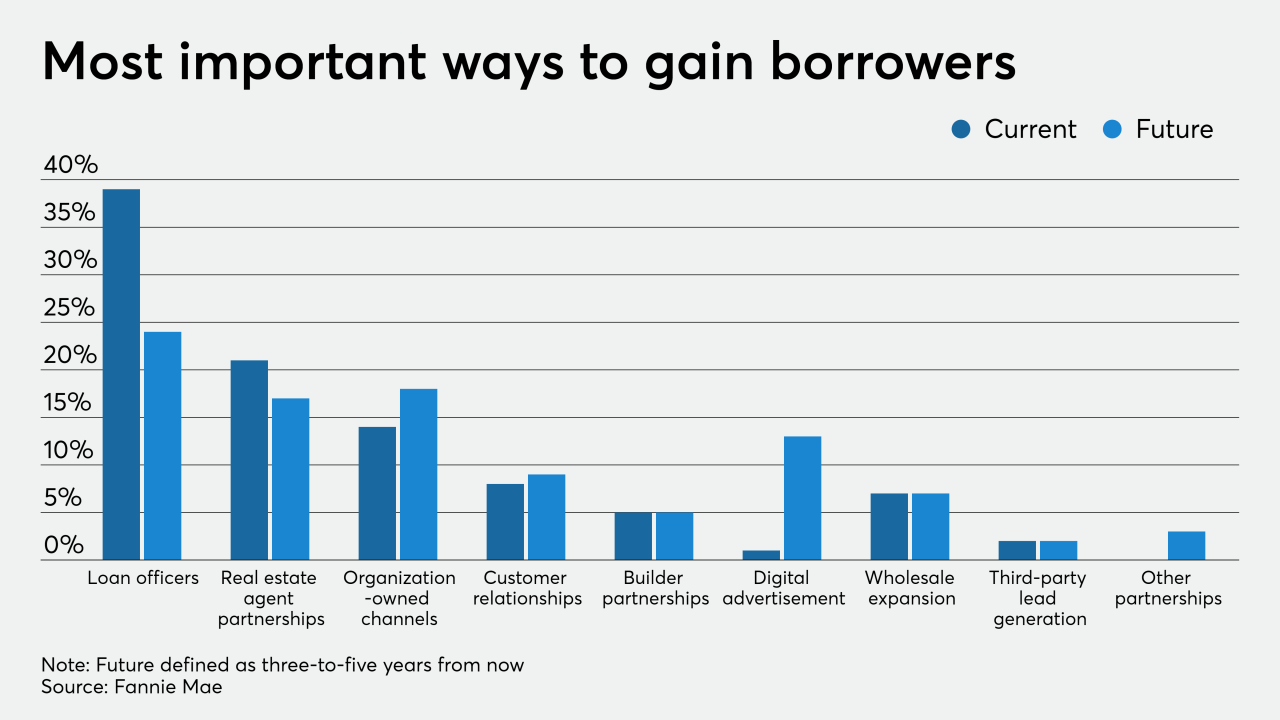

While loan officers will remain mortgage lenders' leading business development tool in the future, those originators believe business will come from a more diversified source pool, a Fannie Mae survey found.

February 7 -

The U.S. mortgage insurance business remained a bright spot for Genworth Financial, as fourth quarter adjusted operating income increased 29% and new insurance written rose nearly 95% over the prior year.

February 5 -

In letters to Freddie Mac and Fannie Mae, six Democrats asked how the mortgage giants are factoring extreme weather into their risk modeling.

February 4 -

With policymakers focused on ending Fannie Mae and Freddie Mac’s conservatorship, their regulator is reorganizing key units and adding staff to position itself for the long term.

February 4 -

Now that the Consumer Financial Protection Bureau says it will scrap an unpopular standard for so-called qualified mortgages, the big question is what will take its place.

February 3 -

The regulator said the investment bank and financial services company will help in the process of strengthening Fannie Mae and Freddie Mac’s capital standing for their eventual exit from conservatorship.

February 3 -

FICO plans to release a new suite of scores that could reduce defaults on newly originated mortgages by 17%, but home lenders may not use it unless the government-sponsored enterprises do.

January 23 -

Trade associations representing mortgage lenders and securities market participants are asking the Federal Housing Finance Agency to rethink a plan to restrict pooling options for loans sold into uniform mortgage-backed securities.

January 22 -

The agency is sending a strong message that it won't rush to end an exemption for Fannie Mae and Freddie Mac while also signaling longer-term changes that will affect all lenders.

January 21 -

Director Kathy Kraninger has told lawmakers that the agency will delay the expiration of the so-called QM patch, now set for January 2021.

January 21 -

A former Fannie Mae employee is facing more than six years in federal prison for participating in a scam involving discount sales of properties owned by the government-sponsored enterprise.

January 15 -

Fannie Mae is sponsoring a $1.03B CRT transaction, while Caliber Homes Loans, New Residential and Onslow Bay fill the non-QM pipeline

January 14 -

The U.S. Supreme Court may soon decide if it will intervene in a high-stakes fight over the government-sponsored enterprise net worth sweep.

January 10 -

Getting Fannie Mae and Freddie Mac out of conservatorship has been an elusive goal. It will remain elusive, says DeMarco, in the absence of broader reform of housing finance, something that will require bipartisan support.

January 7