-

Fannie Mae and Freddie Mac remain in conservatorship nearly a decade after the financial crisis, and there’s still no end in sight.

August 1 Calvert Advisors LLC

Calvert Advisors LLC -

An increase in millennials making home purchases is a call to the mortgage industry for a quicker, more efficient digital process.

August 1 -

The agency said multiple stakeholders had requested more time to evaluate the proposal.

July 31 -

The D.C. movers and shakers at the center of the financial crisis — and the government’s response — have all moved on to new positions. Here's a look at what they did afterward.

July 30 -

Mel Watt's term as director of Federal Housing Finance Agency ends in January, but his exit may be accelerated if the accusations in a new report prove true.

July 27IntraFi Network -

Fannie Mae has issued securities supporting the transition away from the London interbank offered rate; something that could become more pressing for lenders if adjustable-rate mortgages were to become more prevalent.

July 27 -

Whoever succeeds current Director Mel Watt will have a front-and-center role in efforts to reform Fannie Mae and Freddie Mac.

July 26 -

Nonbank mortgage-backed securities servicers increase their exposure to agency loans as the housing market distances itself from last decade's crash, according to Fitch Ratings.

July 24 -

Michael Bright co-wrote a paper in 2016 that envisioned making the agency a backstop for the housing finance system, but appeared to distance himself from the proposal at his confirmation hearing.

July 24 -

The announcement comes as Fannie Mae promoted David Benson to serve as president of the government-sponsored enterprise.

July 23 -

The Federal Housing Finance Agency is suspending its ongoing review of new credit scoring models and will instead move forward with creating a regulatory framework for providers of alternative credit scores to apply and be evaluated for use by Fannie Mae and Freddie Mac.

July 23 -

The fees that Fannie Mae and Freddie Mac charge for low down payment mortgages disproportionately reflect their risk exposure and make homeownership more difficult for underserved borrowers.

July 23 Milken Institute Center for Financial Markets

Milken Institute Center for Financial Markets -

As purchase mortgages continue to dominate overall industry volume, lenders aren't letting the extra work required to close these loans affect their productivity.

July 18 -

Rising median home prices and tight housing inventory led purchase and overall mortgage application volume to fall although refinances rose.

July 18 -

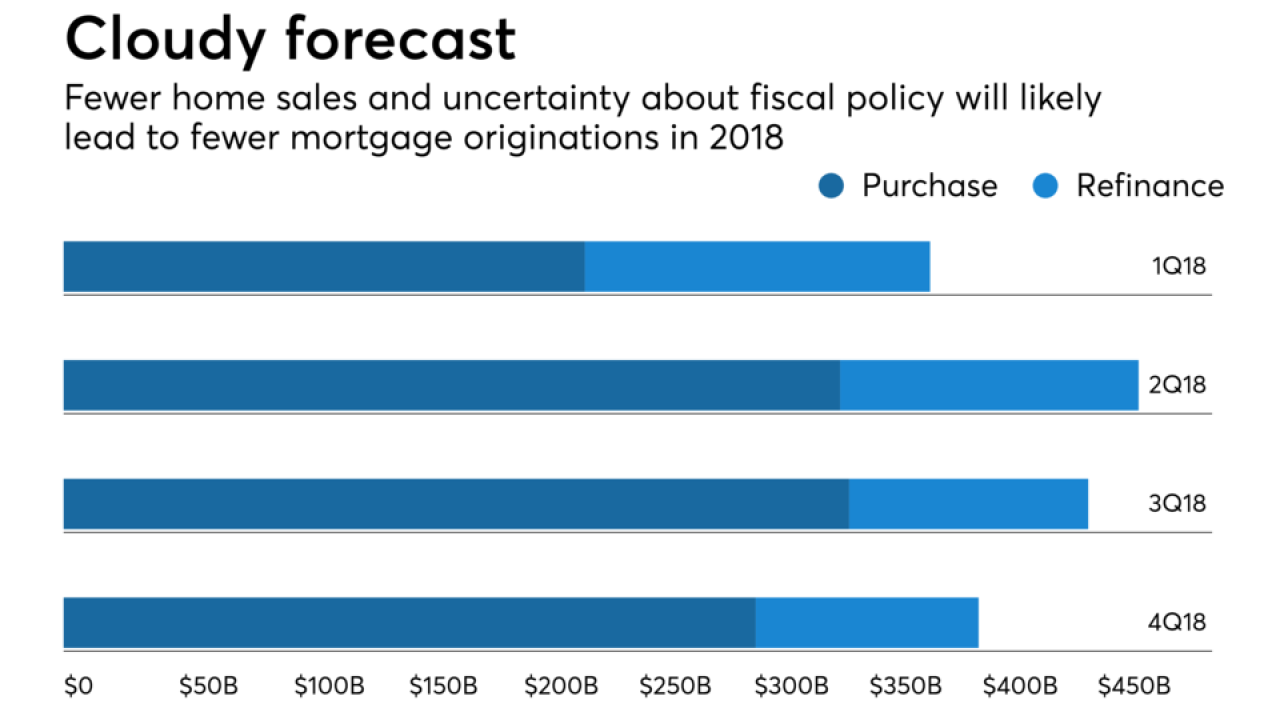

Fewer sales of existing homes and uncertainty around future fiscal policies will result in fewer mortgage originations than previously expected, according to Fannie Mae.

July 17 - Finance and investment-related court cases

With ruling in GSE case, the two agencies are emerging as the test subjects for a legal showdown over their authority.

July 17 -

A federal appeals court in Texas agreed with Fannie Mae and Freddie Mac shareholders that the FHFA, led by a single director, violates the separation of powers.

July 17 -

The collateral includes both QM and non-QM loans; however, certain loans are designated as QM even though the borrower’s DTI may be above 43%, due to a temporary exemption for GSE-eligible loans.

July 13 -

Fannie Mae and Freddie Mac may need to tap into U.S. Treasury funds when they adopt CECL, a new accounting rule that makes companies set aside money upfront for expected loan losses.

July 12 -

A Fannie Mae test to handle the private mortgage insurance process for lenders may raise concerns that it's going outside the scope of its secondary market mission. But the effort reflects its mandate to explore new credit-risk transfer alternatives, a company executive said.

July 10