-

Government-sponsored enterprises Fannie Mae and Freddie Mac are in a race to offer services and technology that help mortgage bankers raise cash from mortgage servicing rights.

May 23 -

For nearly a decade, the FHFA has restricted Fannie Mae and Freddie Mac from trying to influence the raging debate over whether they should live or die.

May 18 -

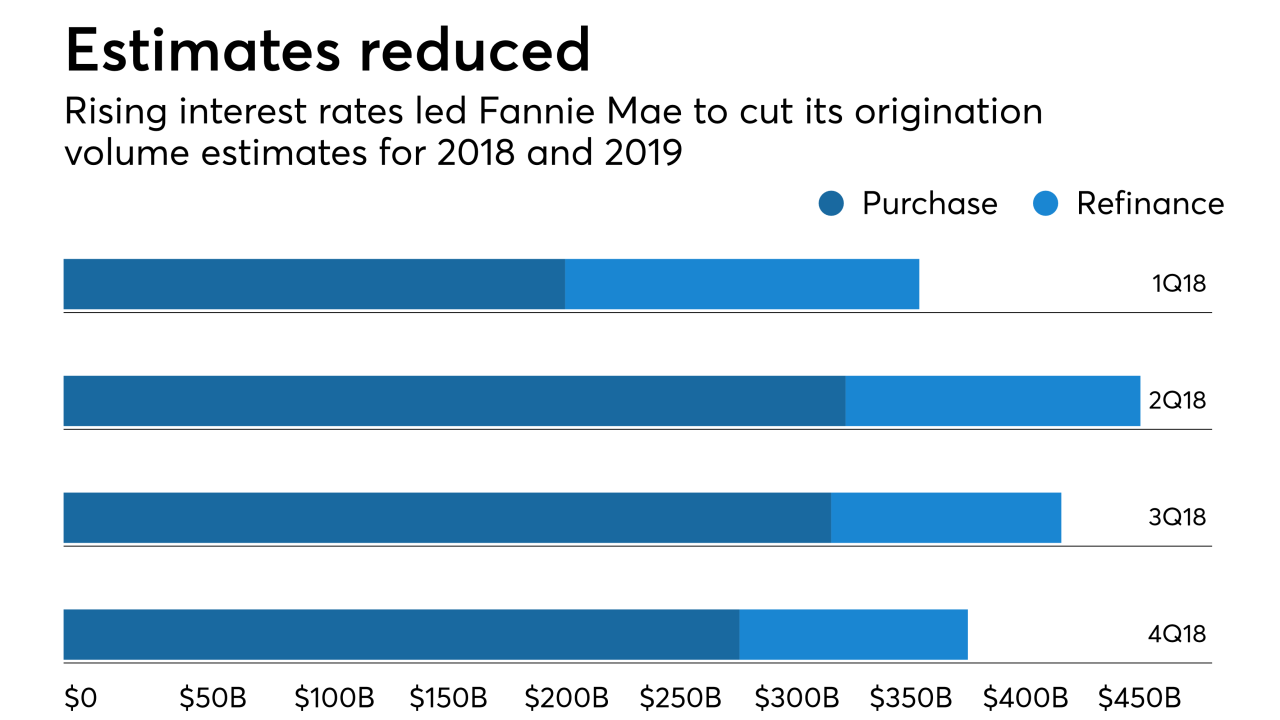

Fannie Mae reduced its mortgage origination volume forecast for 2018 and 2019 as rising interest rates are affecting refinancings now, and will curtail purchase activity going forward.

May 17 -

Unlike the sponsor's previous four deals, which were backed at least in part by jumbo loans, all of the collateral for FSMT 2018-3INV is eligible to be purchased by either Fannie Mae or Freddie Mac.

May 15 -

President Trump has nominated Michael Bright, the current acting president and chief operating officer of Ginnie Mae, to head the agency full time.

May 15 -

In a bid to cut time and costs from the mortgage process, Fannie Mae is testing whether appraisers can accurately determine a home's value without actually visiting the property.

May 7 -

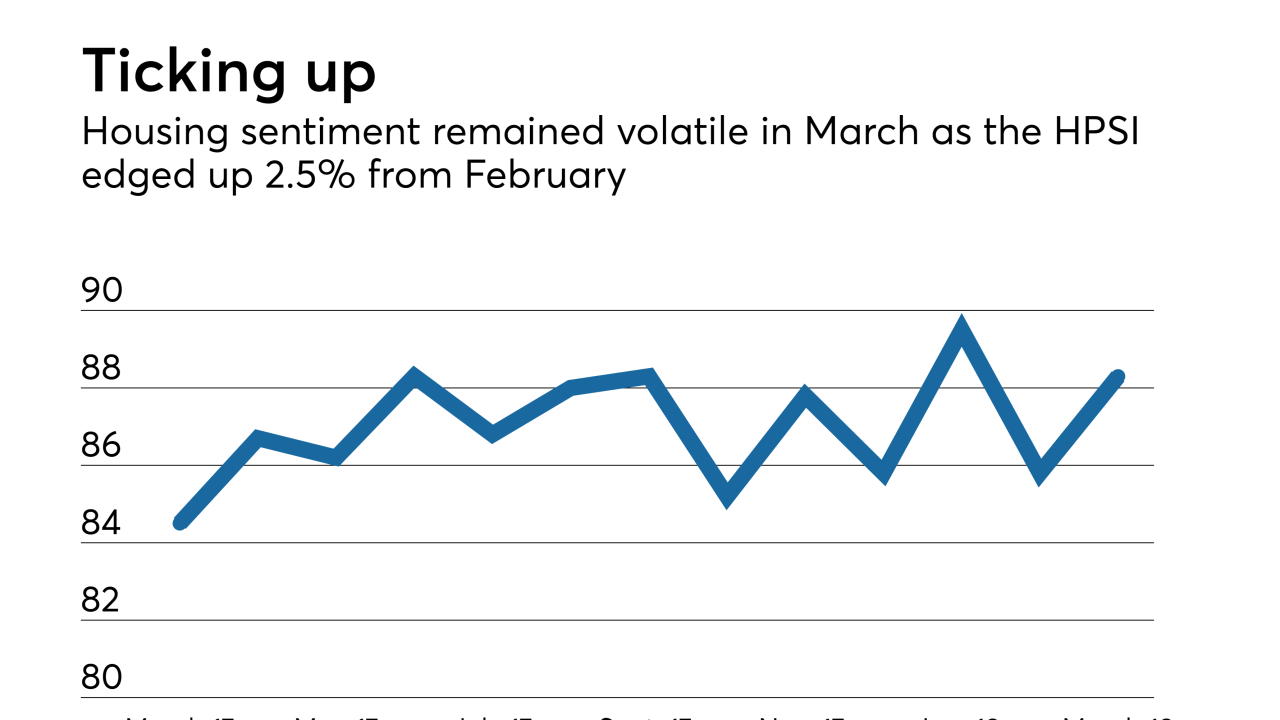

Housing confidence hit an all-time high as more consumers report it's a good time to sell, while also anticipating a rise in home prices but a drop in mortgage rates, according to Fannie Mae.

May 7 -

Freddie Mac has quietly started extending credit to nonbanks that issue mortgages, a move it says will help the companies maintain access to a crucial stockpile of cash if their home loans go sour.

May 7 -

Fannie Mae's first-quarter profits were enough for it to rebuild its minimum capital buffer and pay the Treasury Department dividend after being forced to take a draw during the previous fiscal period.

May 3 -

The Treasury secretary said reforming Fannie Mae and Freddie Mac will come into focus more in 2019, when Federal Housing Finance Agency Director Mel Watt’s term will end.

April 30 -

The Federal Housing Finance Agency's plan to combine Fannie Mae and Freddie Mac mortgages into a single security starting in June 2019 promises to bring both benefits and challenges to the mortgage sector.

April 27 -

Mortgage and title insurance companies licensed in New York need to file disaster response plans this year in line with increased state attention to business continuity planning.

April 25 -

Fannie Mae increased its second-quarter mortgage origination projection by $7 billion as refinance volume is remaining stronger than previously expected.

April 16 -

Cloudvirga, in collaboration with Freddie Mac, has created the capability for loan officers to submit mortgage loan data to both government-sponsored enterprises' automated underwriting systems simultaneously with a single click.

April 12 -

The use of appraisal management companies does not result in higher quality property valuation reports, according to a working paper published by the Federal Housing Finance Agency.

April 11 -

The future secondary mortgage market entities will receive high investment grade ratings, even as there is no clarity on their scope or form, Fitch Ratings said.

April 10 -

The reserve bank's proposal to address banks and nonbanks that remain "too big to fail" does not include two of the largest such institutions: Fannie Mae and Freddie Mac.

April 9

-

Housing sentiment remained volatile in March as consumers reporting that now is a good time to buy a home rose from the previous month, according to Fannie Mae.

April 9 -

The annual progress report on the Fannie Mae and Freddie Mac conservatorships reiterated that a new credit score model will likely not be operational until after the implementation of a new Single Security Initiative.

March 29 -

After several years of preparation, Fannie Mae and Freddie Mac will start issuing a new, common mortgage-backed security starting June 3, 2019, the Federal Housing Finance Agency said Wednesday.

March 28