-

Fannie Mae is allowing in some situations where mortgage payments are made by someone other than the borrower for the full monthly housing expense to be excluded from debt-to-income calculations.

November 1 -

Fannie Mae is testing a conforming loan product that makes use of a New Hampshire law that lets manufactured housing in resident-owned communities get treated like units in a co-operative building.

October 27 -

Most secondary market outlets, along with the non-qualified mortgage lenders, remain reluctant to lend to legal cannabis workers because of the source and nature of their compensation, but opportunities are beginning to emerge.

October 25 -

Fannie Mae is staging more pilot projects with lenders and vendors, including one that consolidates submissions of different types of loan data potentially eligible for immediate representation and warranty relief.

October 23 -

Cannabis businesses are legal in 29 states, but compliance questions on the federal level are keeping mortgage lenders from making loans to the industry's workers.

October 23 -

Fannie Mae is authorizing additional suppliers of reports that can give lenders immediate representation and warranty relief on certain data, diversifying beyond an exclusive partnership with Equifax in one category.

October 23 -

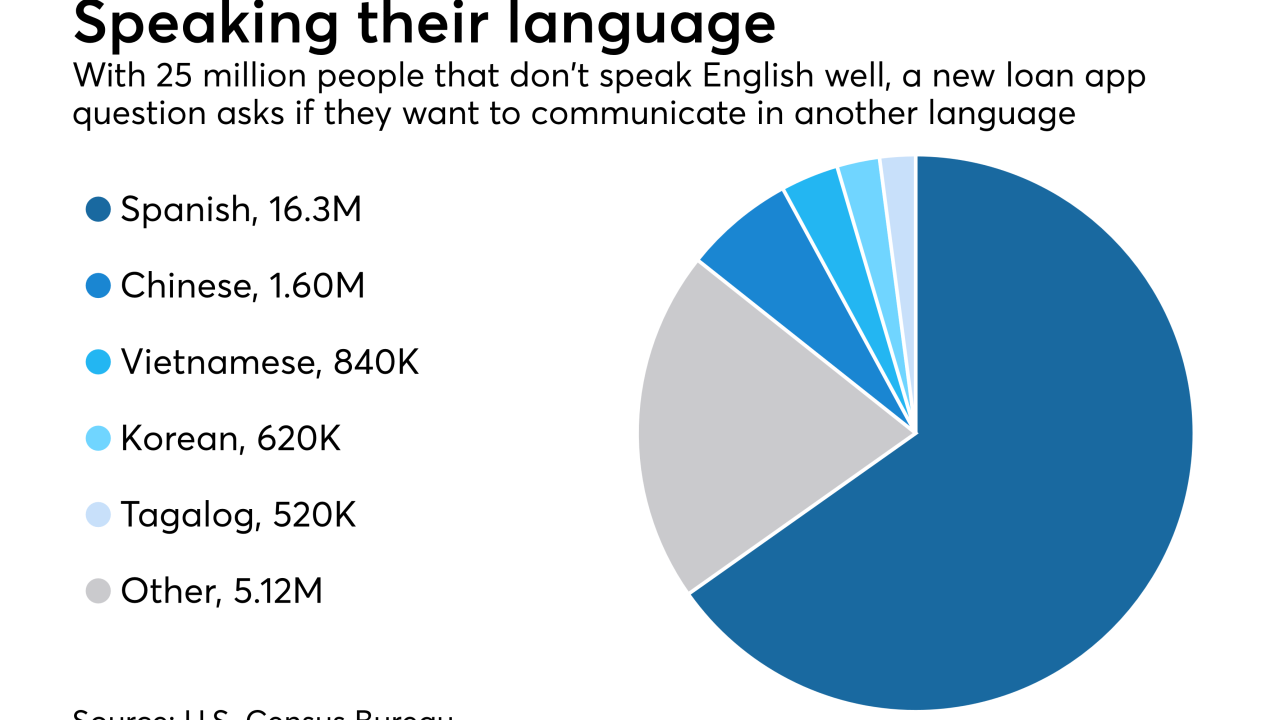

The Federal Housing Finance Agency added a language preference question to the loan application, rejecting the mortgage industry's wishes.

October 20 -

Originators and real estate agents are considered more trustworthy and credible by home purchasers than online sources about mortgage information, a Fannie Mae study found.

October 19 -

In a moment of rare unity, the Independent Community Bankers of America and National Association of Federally-Insured Credit Unions sent a joint letter to FHFA arguing to stop the GSEs' profit sweep.

October 19 -

Called Structured Agency Credit Risk Securitized Participation Interests, the new securities are backed by mortgage loans, and are not general obligations of the government-sponsored enterprise.

October 18 -

Many of the prime jumbo loans backing the transaction, JP Morgan 2017-4, were contributed by originators with limited history in that product, according to DBRS.

October 18 -

From debating the future compliance landscape to developing a digital mortgage strategy, here's a preview of the top issues, ideas and themes on tap when the industry convenes in Denver for the Mortgage Bankers Association's Annual Convention & Expo.

October 17 -

Government-sponsored enterprises Fannie Mae and Freddie Mac's guarantee fee pricing last year kept the playing field fairly level for different-sized lenders.

October 17 -

Fannie Mae used last year's Home Mortgage Disclosure Act data to increase its origination projections for both 2017 and 2018 even as its overall economic outlook remained unchanged from September.

October 17 -

Sens. Dean Heller and Catherine Cortez Masto of Nevada called on mortgage industry leaders to provide relief and financial assistance to victims of the Oct. 1 mass shooting at the Route 91 Harvest Festival in Las Vegas.

October 16 -

Recently exposed security vulnerabilities in an Equifax tool used extensively in the mortgage industry are raising new questions about the reliability and veracity of the beleaguered credit bureau's employment verification service.

October 13 -

Fannie Mae is putting more than $2 billion in reperforming loans up for bid and also marketing a smaller package of more than $1 billion in nonperforming loans.

October 12 -

Fannie Mae and Freddie Mac were not affected by a hacking incident against the accounting giant Deloitte, the companies said Tuesday, after a British newspaper alleged a server containing emails from government agencies was compromised.

October 10 -

Overall housing confidence rose in September, with renters becoming particularly optimistic, according to Fannie Mae.

October 10 -

A change in the formula that banks use to calculate borrowers’ debt-to-income ratios, announced by Fannie Mae in April, appears to be spurring more lending.

October 6