Federal Reserve

Federal Reserve

-

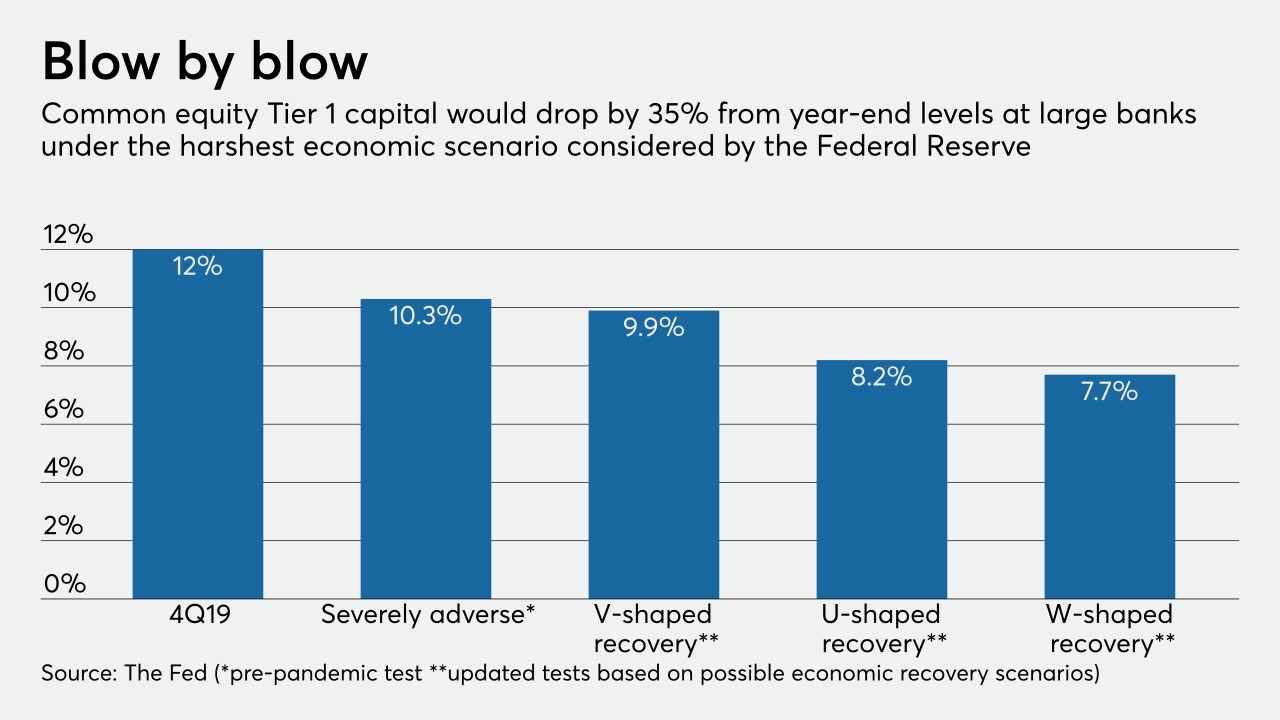

In the most sweeping capital distribution order since the financial crisis, the Federal Reserve says it will prohibit big banks from buying back their stock in the third quarter and limit dividend payments to second-quarter levels.

June 25 -

Mortgage rates increased slightly for the second consecutive week, buoyed early on by positive economic news such as the jobs report that came out last Friday, according to Freddie Mac.

June 11 -

The Federal Reserve pledged to maintain at least the current pace of asset purchases and projected interest rates will remain near zero through 2022, as Chairman Jerome Powell committed the central bank to using all its tools to help the economy recover from the coronavirus.

June 10 -

Mortgage investors can take heart knowing the Federal Reserve considers agency MBS a primary arena through which to conduct monetary policy.

June 10 -

Millennial refinance activity hit a new high-water mark behind historically low mortgage rates, up 40 percentage points from the year before, according to Ellie Mae.

June 3 -

Just like volatility begets volatility, calmness helps support continued calm.

June 2 -

Mortgage investors have yet to enjoy robust returns this year despite the Federal Reserve providing $688 billion of support to the sector since mid-March.

June 1 -

The Federal Reserve's actions should keep interest rates down and bring home sales back in June, according to NerdWallet.

June 1 -

Even after the Fed eased some limitations in April to promote emergency lending, the bank has had to make some “tough choices” to heed the $1.95 trillion growth ceiling set by regulators in the aftermath of its phony-accounts scandal.

May 29 -

Democrats’ latest proposal to back debt collectors, enable loans for nonprofits and provide other relief could help steer negotiations with the Senate on more stimulus.

May 15 -

Mortgage rates remained generally steady this past week, even with the continuing market volatility, and that is helping the purchase market, according to Freddie Mac.

May 14 -

The head of the U.S. central bank said its emergency credit programs were not designed to prop businesses up over the long term.

May 13 -

With mortgage rates plummeting, the refinance share of closed loans from millennial borrowers rose for the third straight month, to the highest level since Ellie Mae began tracking the data in 2016.

May 6 - LIBOR

Regulators on both sides of the Atlantic have spent the better part of three years trying to kill the London interbank offered rate. Now, they're looking to it once again to underpin hundreds of billions of dollars in loans as they seek to rescue their economies.

May 6 -

Lenders implemented stricter underwriting across all loan types in the first quarter as the pandemic upended the economy, the Federal Reserve said in its survey of loan officers.

May 4 -

The Federal Reserve's emergency rescue of the U.S. mortgage market should have set off celebration among lenders trying to keep up with demand from borrowers. Instead, executives at Quicken Loans got a hefty margin call.

May 4 -

Federal Reserve officials restated their pledge to hold the benchmark interest rate near zero and will keep buying bonds, judging that the coronavirus pandemic "poses considerable risks to the economic outlook over the medium term."

April 29 -

Financial institutions could testify before the bipartisan commission overseeing the unprecedented economic aid for industries hit by the COVID-19 pandemic. But without subpoena authority, the panel’s impact may be limited.

April 22 -

Mortgage rates slipped this week as the coronavirus keeps affecting the overall U.S. economy, according to Freddie Mac.

April 16 -

The Federal Reserve's $2.3 trillion loan stimulus includes plans for outstanding commercial mortgage-backed securities and newly issued collateralized loan obligations.

April 9