Federal Reserve

Federal Reserve

-

The federal banking agencies will not hold a hearing on a proposal to reduce the number of residential real estate transactions that require an appraisal.

February 22 -

As expected economic growth remains at 2.2% — down from 2018's 3.1% — 2019 should only be accompanied by a solitary rate hike from the Federal Reserve, according to Fannie Mae.

February 21 -

Sentiment among homebuilders rose in February for a second month, exceeding all forecasts, as lower mortgage rates and a strong labor market help stabilize demand.

February 19 -

Recent data from the Federal Reserve suggests lenders are growing pessimistic about the credit environment. But is that a sign of trouble ahead, or just sound risk management?

February 18 -

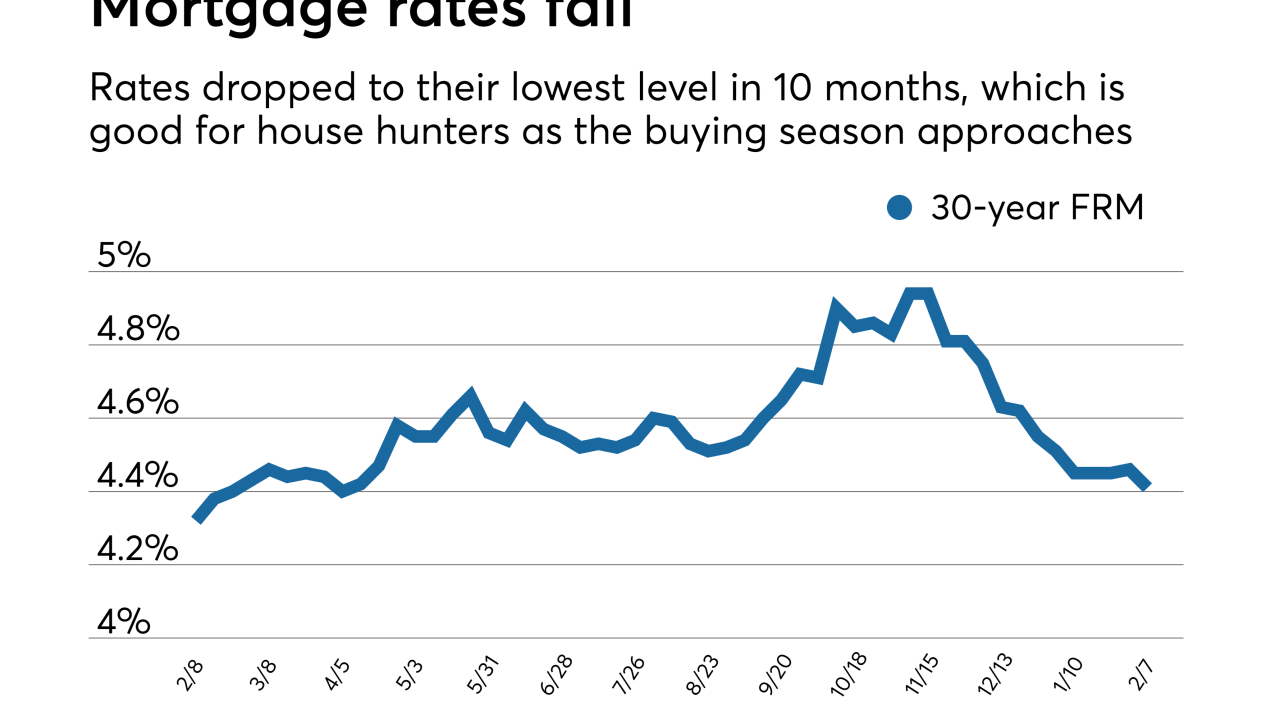

Mortgages rates fell to their lowest levels since early 2018, but positive news involving trade and no new shutdown could send them rising again, according to Freddie Mac.

February 14 -

Depository mortgage lenders are optimistic the final version of a regulation designed to open up the flood insurance market will make it easier for them to comply with a rule requiring them to accept private carrier policies.

February 11 -

The comptroller of the currency also addressed, in his role as acting FHFA head, whether Congress or the Trump administration will spearhead GSE reform.

February 7 -

The combined bank will move into a more demanding supervisory class under the Fed’s regime, but analysts also see a regulatory upside from the deal.

February 7 -

Mortgage rates fell to their lowest level in 10 months, bringing good news for house hunters as spring's home buying season approaches, according to Freddie Mac.

February 7 -

The House Financial Services Committee will hold a hearing Feb. 26 on "holding credit bureaus accountable" — one of seven hearings scheduled by the panel for the month.

February 6 -

Federal Reserve Board Gov. Lael Brainard said public comments demonstrate a desire among stakeholders for reforms to be implemented consistently across the Fed, OCC and FDIC.

February 1 -

As suspense builds over which firm will be the first to seek the special-purpose charter, a side discussion has emerged over which financial services sector has the most to gain — or lose — from the new option.

January 27 -

While the London interbank offered rate won't go dark until 2021, the commercial real estate finance industry should start preparing for the transition now, says the Mortgage Bankers Association.

January 24 -

Slower growth to interest rates and home prices will boost housing affordability in 2019, according to Fannie Mae.

January 22 -

Mortgage rates remained flat after dropping for six consecutive weeks as negative economic news was balanced with a more positive outlook on housing, according to Freddie Mac.

January 17 -

American homeownership has been on the decline, and Federal Reserve researchers point to the high cost of college as one culprit.

January 16 -

Purchase mortgage application volume reached its highest level in almost nine years as homebuyers took advantage of what might be a fleeting window for lower interest rates.

January 16 -

Average mortgage rates continued the downward spiral that started before Thanksgiving and in the past week that finally boosted mortgage application activity, according to Freddie Mac.

January 10 -

The agencies are weighing a plan to reduce the scope of residential real estate transactions requiring an appraisal, but appraisers have warned that the proposal could have consequences.

January 3 -

Mortgage rates started 2019 by continuing their decline but as consumers worry about the broader economy that might not help to increase home sales, according to Freddie Mac.

January 3