-

The regulator of Fannie Mae and Freddie Mac discussed steps the companies have already taken to limit their risk, as well as efforts to prevent housing market “overlap” with the FHA.

October 28 -

The government-sponsored enterprises are moving ahead with a new mortgage application that omits a previously planned language question, but are looking to serve limited English proficiency borrowers in another way.

October 24 -

The credit union regulator has spent 20 years asking lawmakers for greater oversight of third-party vendors. Here's why it might finally happen.

October 24 -

At a House hearing covering a whole host of housing finance reform topics, Fannie Mae and Freddie Mac's regulator said "if the circumstances" call for eliminating investors, "we will."

October 22 -

Allowing the mortgage giants to retain profits resolves a short-term capital shortfall, but how much capital they would need after exiting conservatorship is still the bigger question.

October 4 -

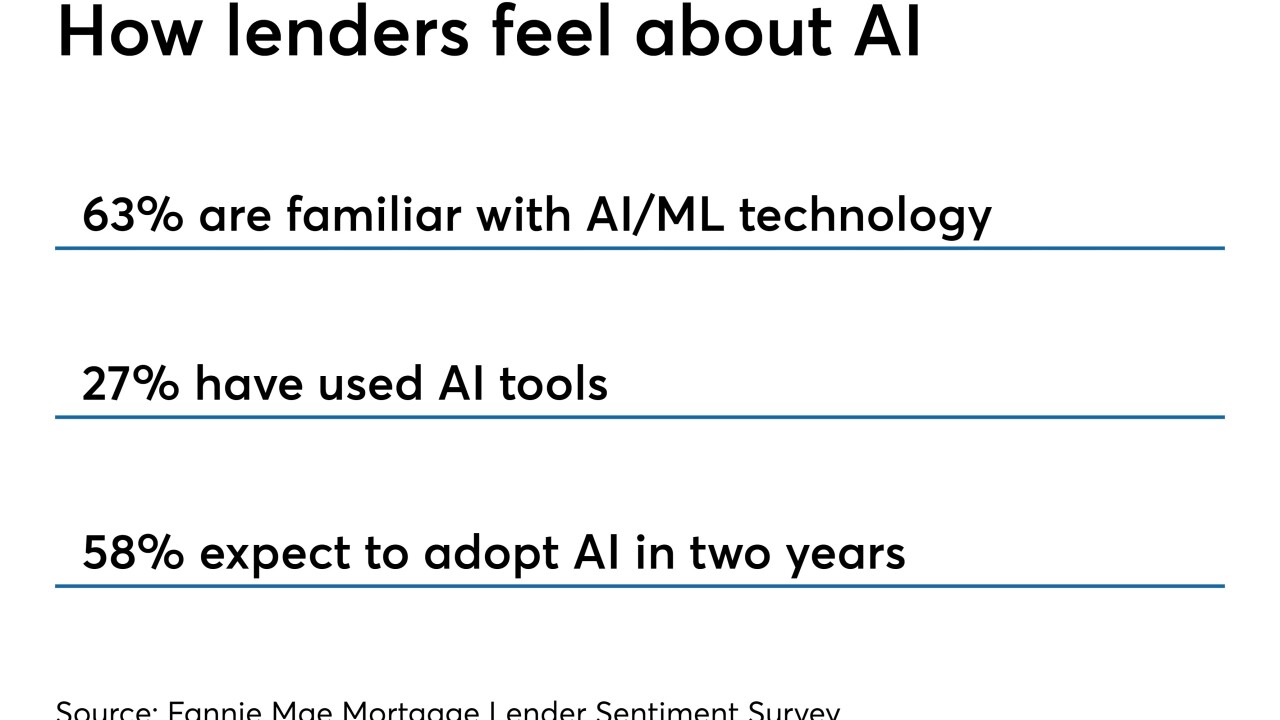

Freddie Mac's test of artificial intelligence to make lending decisions could be a significant turning point in broadening the use of the technology.

October 2 -

The move to alter the government's preferred stock purchase agreements is the first major one under FHFA Director Mark Calabria's tenure to wind down the conservatorship of the government-sponsored enterprises.

September 30 -

Simone Grimes had alleged former FHFA Director Mel Watt made inappropriate advances toward her and she was paid less than the man who had previously held her position.

September 27 -

The shareholders' claims against Fannie Mae and Freddie Mac's regulator mirror arguments in cases challenging the Consumer Financial Protection Bureau.

September 26 -

Freddie Mac's efforts to improve underwriting could include the use of a technology firm's artificial intelligence-driven consumer-risk modeling software that can expand access to credit, according to the Wall Street Journal.

September 26 -

The recapitalization of Fannie Mae and Freddie Mac prior to the 2020 election is unlikely even if the net worth sweep ends, according to a Keefe, Bruyette & Woods report.

September 23 -

The Federal Housing Finance Agency is ending a Freddie Mac pilot that posed a competitive threat to the private market for mortgage servicing rights financing.

September 19 -

The FHFA can go beyond a recent Trump administration report to level the playing field between the private sector and Fannie Mae and Freddie Mac.

September 17 American Enterprise Institute Housing Center

American Enterprise Institute Housing Center -

The Federal Housing Finance Agency is revising the multifamily loan purchase caps for the mortgage giants Fannie Mae and Freddie Mac to increase affordable housing.

September 13 -

Whether Congress and/or the mortgage industry is able to untangle two opposing threads in the Trump administration's plans is anyone's guess.

September 12 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The regulator for Fannie Mae and Freddie Mac suggested that a finalized capital framework for the two mortgage giants could be published by the end of the year.

September 11 -

Federal appeals court judges in New Orleans on Friday appeared to back claims by investors that Treasury's "net worth sweep" is illegal.

September 10 -

The Treasury secretary said he hopes lawmakers will back reforms of Fannie Mae and Freddie Mac within three to six months.

September 9 -

The Trump administration raised the goal posts for ending the conservatorships of Fannie Mae and Freddie Mac, but how officials get there is still highly uncertain.

September 6 -

The Treasury Department made clear in a much-anticipated report that it prefers Congress take up reform of the government-sponsored enterprises, but it also recommended steps that federal agencies could take without legislation.

September 5