-

Mortgage rates moved up slightly after weeks of moderating, but are still low enough not to affect the upcoming prime home buying period, according to Freddie Mac.

January 31 -

It's not clear exactly what might pull investor sentiment and 10-year Treasury yields, which rates for the 30-year mortgage are benchmarked to, off the current lows.

December 31 -

Mortgage rates continued to drop this week with the positive effects already aiding housing, according to Freddie Mac.

December 20 -

Fannie Mae made a slight increase to its origination forecast, expecting housing affordability to improve in 2019 as mortgage rates remain flat and home price appreciation moderates.

December 14 -

Mortgage rates dropped significantly due to economic fears driving the markets following several weeks of little or no movement, according to Freddie Mac.

December 13 -

Interest rates are nearing the neutral level — the rate that neither stimulates nor restrains economic growth — Federal Reserve Board Chair Jerome Powell said Wednesday.

November 28 -

Falling oil prices and continued volatility in the stock market resulted in the largest week-to-week decline in mortgage rates in over three years, according to Freddie Mac.

November 21 -

After last week's surge of 11 basis points, mortgage rates held steady due to a dip in energy costs, even with continued stock market volatility, according to Freddie Mac.

November 15 -

Rising interest rates, both current and the prospect for future increases, took a toll on consumers' outlook on the housing market during September, according to Fannie Mae.

October 9 -

Mortgage application activity was relatively flat compared with the previous week, as long-term interest rates held steady following the recent Fed rate hike, according to the Mortgage Bankers Association.

October 3 -

Mortgage rates rose to their highest level since late June, going up for the third time in the past nine weeks, according to Freddie Mac.

July 26 -

Mortgage rates slid over the past week and have now declined in three of the past four weeks, according to Freddie Mac.

June 21 -

While rising mortgage rates are top of mind for the industry after last week's increase in the federal funds rate, the housing market should be more concerned about limited home inventory, according to First American Financial Corp.

June 18 -

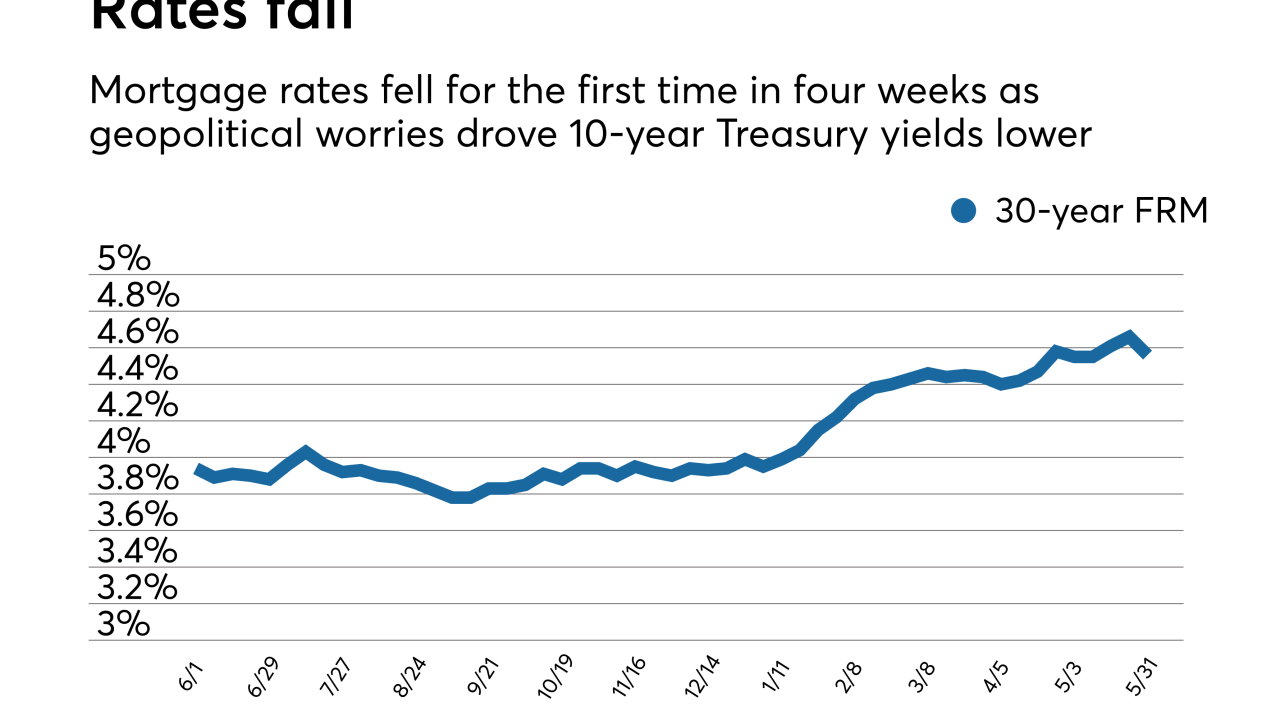

Mortgage rates fell for the first time in four weeks, dropping 10 basis points as investors' concerns over a government crisis in Italy drove bond yields lower.

May 31 -

Mortgage applications decreased 2.9%, falling for the eighth consecutive week even as interest rates came down from their recent highs, according to the Mortgage Bankers Association.

May 30 -

Mortgage rates have reversed course and reached a new high last seen seven years ago as the yield on the 10-year Treasury crossed the 3% threshold this week, according to Freddie Mac.

May 17 -

Mortgage rates were unchanged over the past week, but appear to be headed higher with a robust summer home sales season expected, according to Freddie Mac.

May 10 -

Fannie Mae increased its second-quarter mortgage origination projection by $7 billion as refinance volume is remaining stronger than previously expected.

April 16 -

Mortgage rates held largely steady for the week, dropping only 1 basis point, according to Freddie Mac.

March 29 -

Mortgage rates posted a slight increase this week following the Federal Open Markets Committee's decision to boost short-term rates by 25 basis points, according to Freddie Mac.

March 22