-

Freddie Mac is broadening its capital markets vehicles with its first offering of participation certificate securities backed by multifamily tax exempt loans.

December 13 -

Just over half of the collateral for the $883 million deal is eligible to be purchased by Fannie or Freddie; the bank itself contributed nearly half.

December 12 -

The $1.5 billion FREMF 2017-K1 has a in-trust stressed loan-to-value ratio of 120%, as measured by Kroll; that's projected to fall to 108.7% when the deal matures.

December 12 -

Fannie Mae and Freddie Mac will suspend the evictions of foreclosed single-family properties during the holiday season, according to the government-sponsored enterprises.

December 11 -

Until recently, there was a consensus among policymakers that Fannie Mae and Freddie Mac needed to be eliminated. That just changed. Here's why.

December 8 -

Freddie Mac on Thursday priced the first transaction to result from its pilot in the single-family rental market.

December 7 -

Mortgage rates ticked up this week, but a larger rise is possible next week depending on what Congress does about tax reform and the budget.

December 7 -

House Financial Services Committee Jeb Hensarling shifted tactics on housing finance reform Wednesday, acknowledging that a bill he’s pushed for years to virtually eliminate the government’s role in the mortgage market lacks the support to become law.

December 6 -

Testing of the common securitization platform is taking longer than expected, but the Federal Housing Finance Agency said it won't delay the 2019 launch of Fannie Mae and Freddie Mac's new single "uniform mortgage-backed security."

December 4 -

A provision in the original Senate tax reform bill would have required companies acquiring mortgage servicing rights to pay taxes upfront for their anticipated servicing income.

December 1 -

Borrowers will be able to take out a substantially bigger home loan backed by Fannie Mae and Freddie Mac next year, thanks to a 6.8% increase in home prices nationwide.

November 30 -

The Federal Housing Finance Agency's final guidelines for evaluating "duty to serve" activities create new ways for Fannie Mae and Freddie Mac to get extra credit for going above mandatory levels of lending to underserved markets.

November 30 -

Mortgage rates moved lower this week, but strong economic data and comments by the outgoing Federal Reserve chair left many anticipating higher rates, according to Freddie Mac.

November 30 -

The financial services industry has cheered a proposed reduction in the corporate tax rate, but a lower rate could force Fannie Mae and Freddie Mac to write down assets, increasing the odds that the companies will need Treasury support.

November 29 -

New Residential Investment Corp. is planning to purchase Shellpoint Partners in the first half of next year for $190 million with an additional earn-out over the next three years.

November 29 -

Conforming loan limits for mortgages bought by Fannie Mae and Freddie Mac will increase for the second consecutive year in response to the rapid rise in home prices, the Federal Housing Finance Agency said.

November 28 -

Nonprofit agencies looking to purchase unsubsidized affordable housing properties can use a new impact gap financing program from Freddie Mac to fund the acquisition.

November 28 -

The Show Me State passed legislation enabling residential and commercial PACE financing in 2010; however, Renovate America only started funding assessments through the Missouri Clean Energy District three months ago, in August 2017.

November 27 -

Sometimes reaching underserved borrowers takes experimenting with changes to the mortgage finance system. That's why Fannie Mae and Freddie Mac are working with lenders to test innovative loan products that meet borrowers' evolving needs.

November 24 -

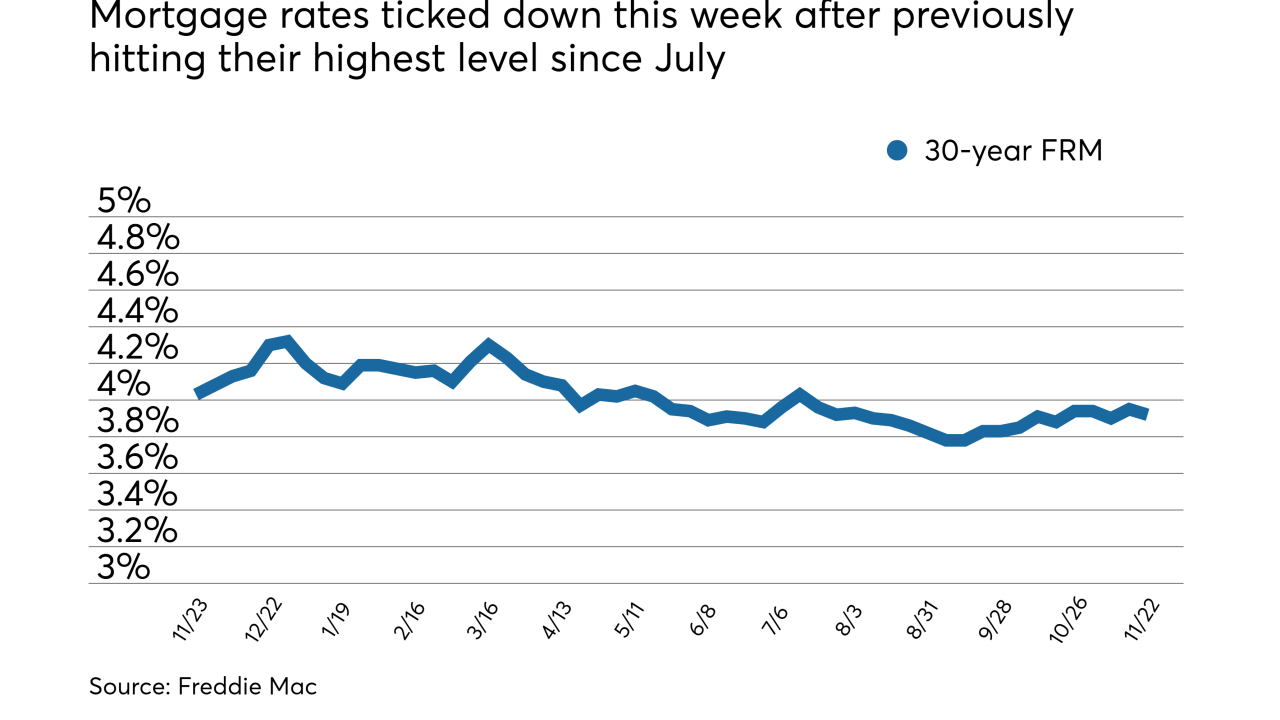

Mortgage rates ticked down this week after previously hitting their highest level since July, according to Freddie Mac.

November 22