-

The White House and congressional GOP leaders are eyeing a tight window between tax reform passage and the 2018 midterms to pass housing finance reform. And with key policymakers readying their exit, the effort could be the most concerted push yet.

November 17 -

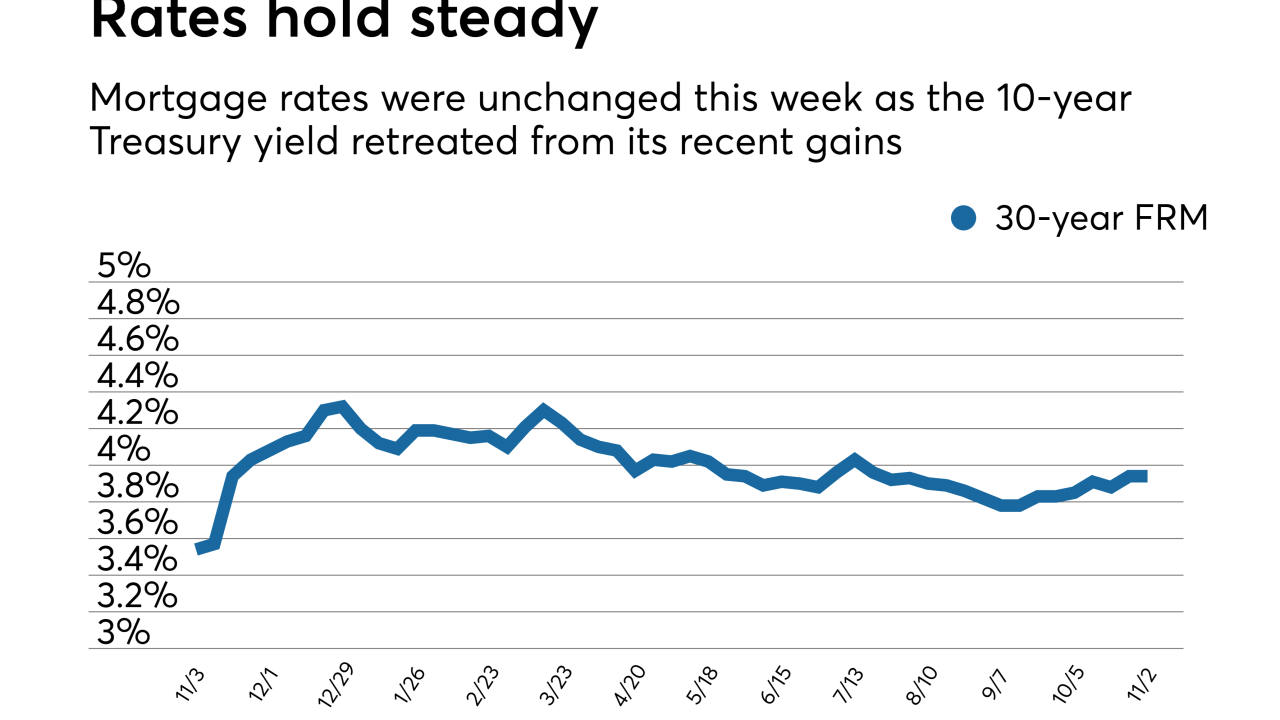

Mortgage rates moved to their highest mark since July and the 10-year Treasury yield ticked up 6 basis points, according to Freddie Mac.

November 16 -

That’s an about-face from the bank’s previous transaction, completed in October, which was backed by fixed-rate mortgages, nearly half of which were underwritten to standards for purchase by Fannie Mae or Freddie Mac.

November 16 -

Mortgage rates fell slightly across the board after the release of the Republican Party tax plan and the nomination of a new Federal Reserve chairman.

November 9 -

So long as the current monetary regime survives, homeowners — present and potential — can expect higher average prices interspersed with wild rides up and down.

November 8 Mitsubishi UFJ Securities International

Mitsubishi UFJ Securities International -

Lenders selling loans through Freddie Mac's system experienced access difficulties Monday afternoon, when the government-sponsored enterprise sent out an alert to lenders about the problem.

November 6 -

Growth in loans with higher debt-to-income ratios is reviving focus on a regulatory exemption for Fannie Mae, Freddie Mac and other federal agencies that back mortgages.

November 3 -

The Federal Housing Finance Agency must set fees equal to the cost of capital that private banks hold against similar risk, not just the amount of capital that Fannie and Freddie think are right for themselves.

November 3

-

Mortgage rates were unchanged or up slightly this week even as the 10-year Treasury yield retreated from its recent gains, according to Freddie Mac.

November 2 -

Mark Calabria, the chief economic adviser to Vice President Mike Pence, said the administration is focused for now on more pressing issues than GSE reform, including addressing housing damage from recent hurricanes.

November 1 -

A securities settlement, portfolio asset sales and greater interest among smaller lenders helped Freddie Mac compensate for potential losses from the catastrophic hurricane season.

October 31 -

Fannie Mae is testing a conforming loan product that makes use of a New Hampshire law that lets manufactured housing in resident-owned communities get treated like units in a co-operative building.

October 27 -

Rents have increased rapidly across housing markets as the share of renting households has risen faster than the number of new units.

October 27 -

Mortgage rates reached their highest level since July and are closing in on 4%, according to Freddie Mac.

October 26 -

Most secondary market outlets, along with the non-qualified mortgage lenders, remain reluctant to lend to legal cannabis workers because of the source and nature of their compensation, but opportunities are beginning to emerge.

October 25 -

Cannabis businesses are legal in 29 states, but compliance questions on the federal level are keeping mortgage lenders from making loans to the industry's workers.

October 23 -

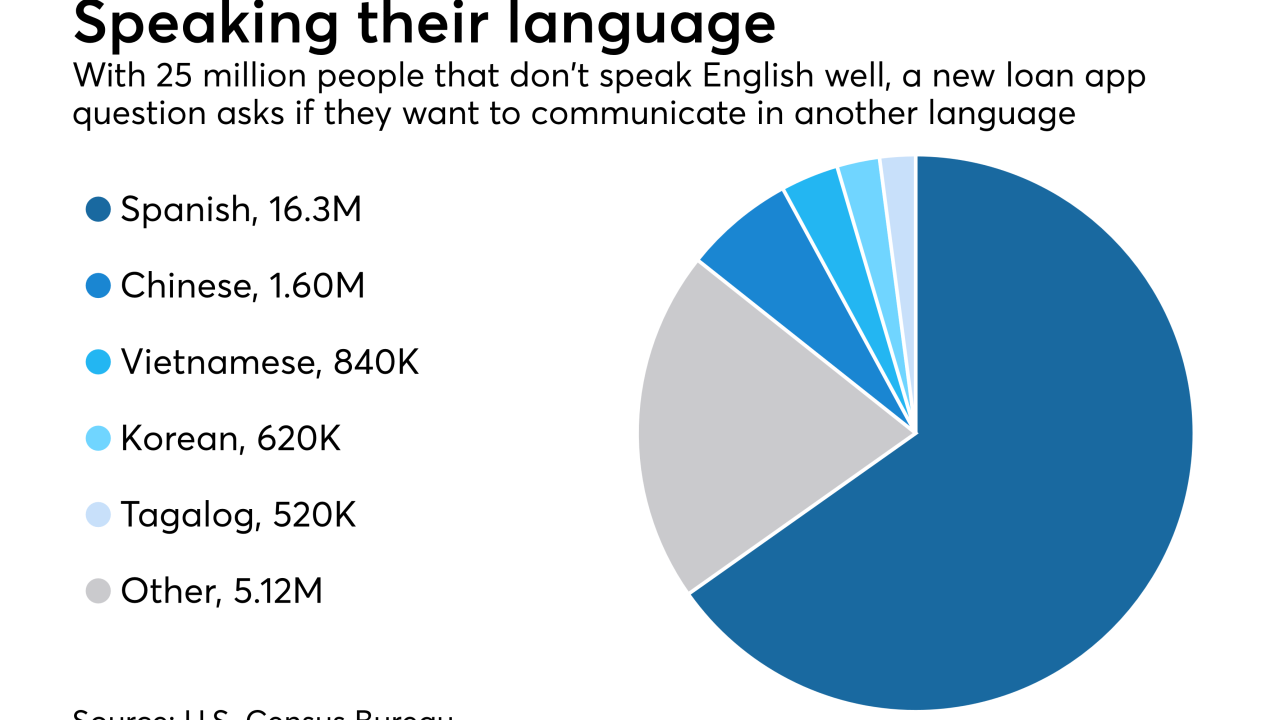

The Federal Housing Finance Agency added a language preference question to the loan application, rejecting the mortgage industry's wishes.

October 20 -

Mortgage rates ticked down for the first time in two weeks as the 10-year Treasury yield fell to its lowest point in October, according to Freddie Mac.

October 19 -

The way lenders need to submit payment information on certain student loans in order to calculate a borrower's monthly debt-to-income ratio is changing at Freddie Mac.

October 19 -

In a moment of rare unity, the Independent Community Bankers of America and National Association of Federally-Insured Credit Unions sent a joint letter to FHFA arguing to stop the GSEs' profit sweep.

October 19