-

A securities settlement, portfolio asset sales and greater interest among smaller lenders helped Freddie Mac compensate for potential losses from the catastrophic hurricane season.

October 31 -

Fannie Mae is testing a conforming loan product that makes use of a New Hampshire law that lets manufactured housing in resident-owned communities get treated like units in a co-operative building.

October 27 -

Rents have increased rapidly across housing markets as the share of renting households has risen faster than the number of new units.

October 27 -

Mortgage rates reached their highest level since July and are closing in on 4%, according to Freddie Mac.

October 26 -

Most secondary market outlets, along with the non-qualified mortgage lenders, remain reluctant to lend to legal cannabis workers because of the source and nature of their compensation, but opportunities are beginning to emerge.

October 25 -

Cannabis businesses are legal in 29 states, but compliance questions on the federal level are keeping mortgage lenders from making loans to the industry's workers.

October 23 -

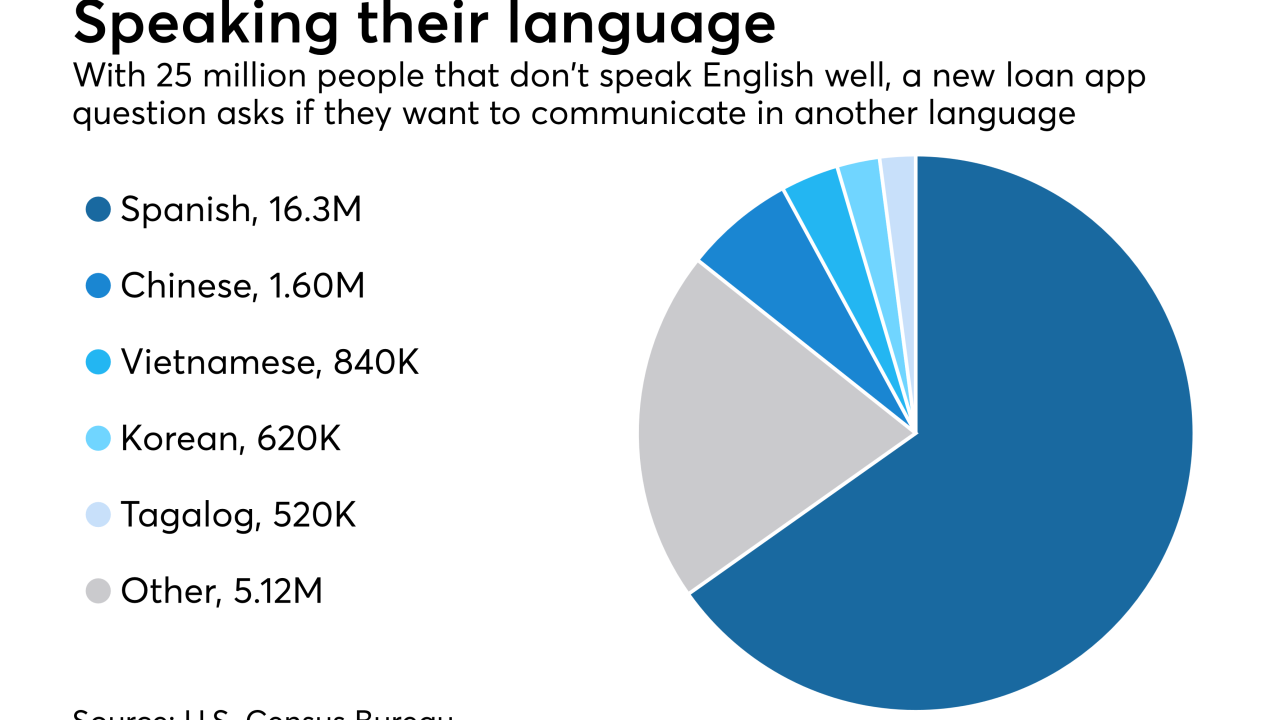

The Federal Housing Finance Agency added a language preference question to the loan application, rejecting the mortgage industry's wishes.

October 20 -

Mortgage rates ticked down for the first time in two weeks as the 10-year Treasury yield fell to its lowest point in October, according to Freddie Mac.

October 19 -

The way lenders need to submit payment information on certain student loans in order to calculate a borrower's monthly debt-to-income ratio is changing at Freddie Mac.

October 19 -

In a moment of rare unity, the Independent Community Bankers of America and National Association of Federally-Insured Credit Unions sent a joint letter to FHFA arguing to stop the GSEs' profit sweep.

October 19 -

Called Structured Agency Credit Risk Securitized Participation Interests, the new securities are backed by mortgage loans, and are not general obligations of the government-sponsored enterprise.

October 18 -

Many of the prime jumbo loans backing the transaction, JP Morgan 2017-4, were contributed by originators with limited history in that product, according to DBRS.

October 18 -

From debating the future compliance landscape to developing a digital mortgage strategy, here's a preview of the top issues, ideas and themes on tap when the industry convenes in Denver for the Mortgage Bankers Association's Annual Convention & Expo.

October 17 -

Government-sponsored enterprises Fannie Mae and Freddie Mac's guarantee fee pricing last year kept the playing field fairly level for different-sized lenders.

October 17 -

Sens. Dean Heller and Catherine Cortez Masto of Nevada called on mortgage industry leaders to provide relief and financial assistance to victims of the Oct. 1 mass shooting at the Route 91 Harvest Festival in Las Vegas.

October 16 -

Mortgage rates posted their biggest week-over-week increase since July and the 10-year Treasury yield also rose, according to Freddie Mac.

October 12 -

Fannie Mae and Freddie Mac were not affected by a hacking incident against the accounting giant Deloitte, the companies said Tuesday, after a British newspaper alleged a server containing emails from government agencies was compromised.

October 10 -

Mortgage rates ticked up to their highest mark in six weeks, reflecting the 20-basis-point rise in the 10-year Treasury yield during September, according to Freddie Mac.

October 5 -

Incenter Mortgage Advisors is brokering on behalf of an unnamed mortgage banker an almost $10 billion mortgage servicing rights package that includes $870 million in loans with hurricane exposure.

October 5 -

Though FHFA Director Mel Watt stopped short of saying he would break with a Treasury agreement that forces all profits of the GSEs to go to the government, he emphasized that it couldn’t continue indefinitely.

October 3