-

Lower-than-expected rates will drive mortgage production this year, but they’ll have less of an impact in 2021.

October 14 -

Forbearance rates dropped below 7% for the first time in six months, but the decrease is largely due to the ending of the initial six-month term of forbearance granted by the legislation, according to the Mortgage Bankers Association.

October 13 -

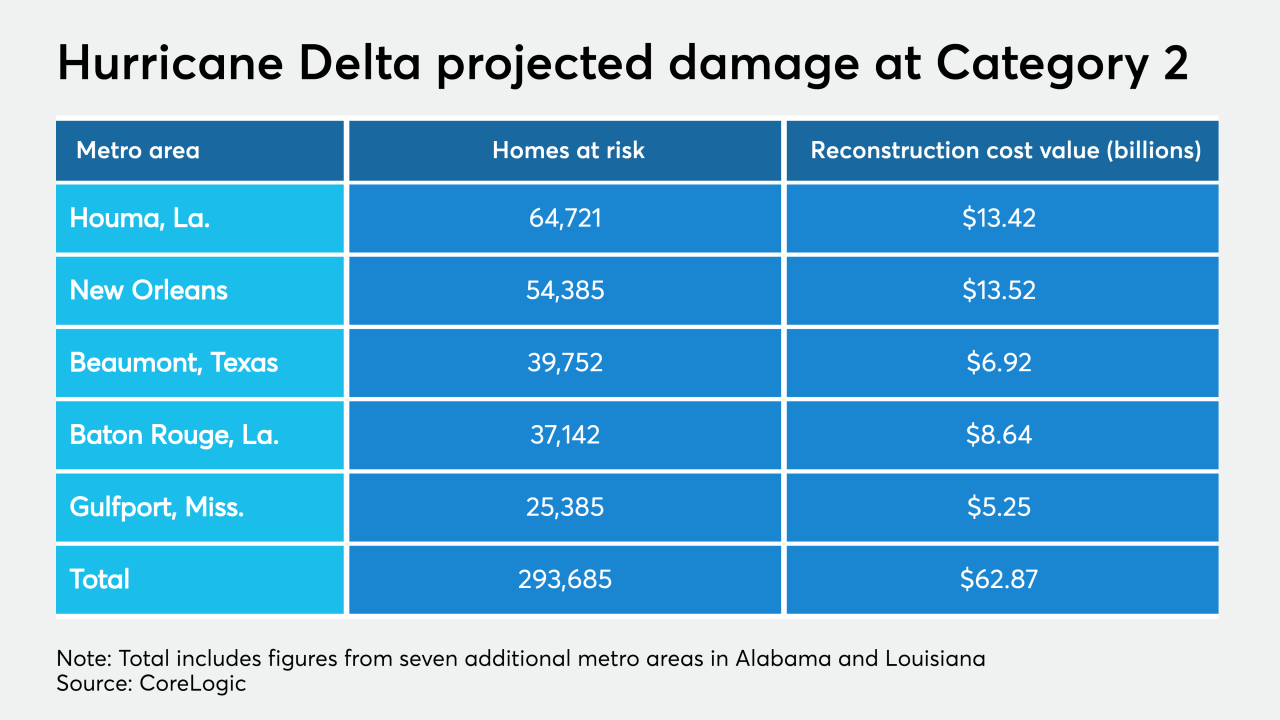

Expected to make landfall as a Category 2 storm, Hurricane Delta's surge is estimated to cause damage to 293,685 residential properties across Alabama, Louisiana, Mississippi and Texas, according to CoreLogic.

October 9 -

The expanded relief on tax income data will become accessible this fall, according to a press release LoanBeam issued this week during Freddie Mac's Connect client conference.

October 9 -

Mortgage rates remained flat this week, a sign that the bottom has possibly been reached, but the housing market looks to remain strong for the near future, according to Freddie Mac.

October 8 -

GSE mortgages in forbearance fell for the 17th straight week, spearheading the overall downtrend, according to the Mortgage Bankers Association.

October 5 -

The government-sponsored enterprise's first multifamily sustainability bond transaction, totaling $600 million, is part of Freddie's K-Deal program.

October 1 -

Mortgage rates fell back toward their all-time low this week, increasing purchasing power for homebuyers. But the lack of homes for sale drives up prices and reduces affordability, according to Freddie Mac.

October 1 -

Student housing and assisted/independent living centers were small portions of Freddie's multifamily securitizations prior to COVID, but Kroll noticed they've been missing in most rated deals since spring.

September 30 -

Approximately 75% of the quarter-to-quarter growth came from multifamily mortgage originations.

September 29 -

The Financial Stability Oversight Council said the mortgage giants may need a bigger capital cushion than their regulator has proposed, but stopped short of designating them as “systemically important financial institutions.”

September 25 -

Mortgage rates experienced a marginal uptick this week, rising three basis points. But they remained near record lows and possibly soon could track down again, according to Freddie Mac.

September 24 -

Remote, homeowner-assisted appraisals used amid the coronavirus could be a useful tool post-pandemic, in limited circumstances.

September 18 -

Mortgage rates remained relatively flat, rising a single basis point off of last week's record low, according to Freddie Mac.

September 17 -

Fannie Mae and Freddie Mac have been slammed for planning an additional refinancing charge to cover COVID-related losses, but the head of the Federal Housing Finance Agency defended the policy in House testimony.

September 16 -

The government-sponsored enterprise’s seller/servicer guide is now integrated into the online portal. Freddie also improved the readability of loan-level reporting it provides, and has further changes in the works.

September 15 -

After flattening over the three prior weeks, the number of loans going into coronavirus-related forbearance dove at a rate not seen since early August, according to the Mortgage Bankers Association.

September 15 -

Mortgage rates fell 7 basis points this week to yet another record low in the 49-year history of the Freddie Mac Primary Mortgage Market Survey, as stock market indicators sank during the period.

September 10 -

"The current economic crisis continues to disproportionately impact borrowers with FHA and VA loans," said Mike Fratantoni, the MBA's senior vice president and chief economist.

September 8 -

The Federal Housing Finance Agency's proposal could undermine the companies’ mission to support the housing market and penalize consumers in underserved communities, industry and consumer groups say.

September 8