-

The volume of COVID-19 forbearance requests has risen rapidly as operational processing has improved and hold times have contracted, according to the Mortgage Bankers Association.

April 14 -

Purchase originations will recover somewhat in the third and fourth quarters as home sales pick up.

April 14 -

FHFA head Mark Calabria and his FSOC counterparts need to sit down with the Treasury and fashion an emergency capital plan for the GSEs.

April 13 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Tenants have threatened to suspend payments during the pandemic to pressure officials into providing rental assistance, but the effects on multifamily loans would compound concerns about servicers' liquidity and, ultimately, lenders' performance.

April 13 -

Mortgage rates remained flat from last week, but are expected to fall further as they continue to lag changes in 10-year Treasury yields, according to Freddie Mac.

April 9 -

A bipartisan group of lawmakers wrote in a letter to the Treasury secretary that the Financial Stability Oversight Council should create a liquidity facility to deal with a flood of forbearance requests brought on by the coronavirus pandemic.

April 8 -

The coronavirus relief legislation could result in private mortgage insurers having to hold more capital, a B. Riley FBR analyst report said.

April 6 -

Ginnie Mae and the FHA provided temporary liquidity relief for mortgage servicers bracing for higher delinquencies, but the industry continues to pressure Treasury and the Fed to provide more comprehensive support.

April 6 -

Community banks and credit unions could carve out an opportunity by refinancing mortgages from larger institutions.

April 3 Finastra

Finastra -

Mortgage rates dropped for the second consecutive week, falling 17 basis points, but that is not attracting homebuyers back into an uncertain market, according to Freddie Mac.

April 2 -

Federal Housing Finance Agency Director Mark Calabria said a virus-induced financial crisis might give rise to more delinquencies and foreclosures than the 2007 subprime mortgage meltdown.

April 1 -

The actions taken by the Federal Reserve to calm the financial markets was key to the drop in mortgage rates this week, according to Freddie Mac.

March 26 -

With ambiguity surrounding the length of the COVID-19 outbreak and damage it will cause, consumers are becoming diffident in taking out a mortgage for a major purchase, according to Zillow.

March 25 -

With economists fearing high unemployment stemming from the pandemic, the housing finance system is grappling with how it will recoup lost revenue from delinquencies, forbearance plans and other tremors.

March 24 -

Forbearance and loan-modifications programs implemented after the financial crisis left borrowers bewildered and angry. Now the mortgage industry wants to create a common standard for providing relief to homeowners whose livelihoods have been upended by the coronavirus pandemic.

March 19 -

Mark Calabria said Fannie Mae and Freddie Mac are currently equipped to handle elevated delinquencies, but they might need congressional or Federal Reserve help if fallout from the coronavirus persists.

March 19 -

As financial hardships mount with the COVID-19 outbreak, Fannie Mae and Freddie Mac released their plans for mortgage borrowers impacted by the pandemic.

March 19 -

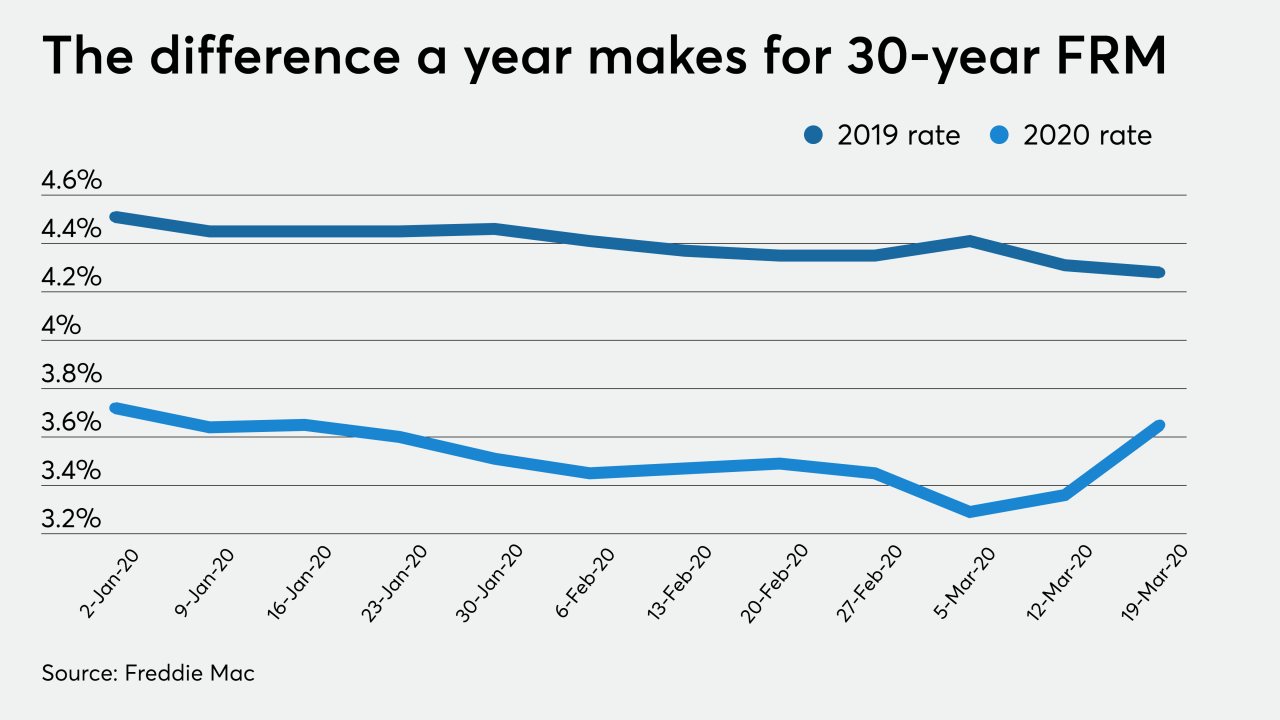

Mortgage rates rose sharply this week as originators looked to manage the overwhelming demand from consumers, according to Freddie Mac.

March 19 -

FHFA Director Mark Calabria said the health crisis will complicate the release of a proposal establishing new capital requirements for Fannie Mae and Freddie Mac.

March 18 -

A national moratorium would be costly to lenders and servicers, but proponents say it's needed to help cushion the economic blow of the pandemic.

March 15

![“We are delaying the opening of ... [the] comment period until we have some certainty on what the current overall situation is,” said FHFA Director Mark Calabria.](https://arizent.brightspotcdn.com/dims4/default/339407b/2147483647/strip/true/crop/4182x2352+0+0/resize/1280x720!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2F24%2F4f%2F09d186a142899167373b7d4166b7%2Fcalabria-mark-bl-031820.jpg)