-

The Supreme Court is ready to weigh in on the CFPB’s leadership structure, but both agencies are facing similar constitutional challenges, suggesting a broader impact of any decision.

November 4 -

The Federal Housing Finance Agency is seeking comment on a proposal that could pave the way for potential Fannie Mae and Freddie Mac competitors to use the uniform mortgage-backed security structure.

November 4 -

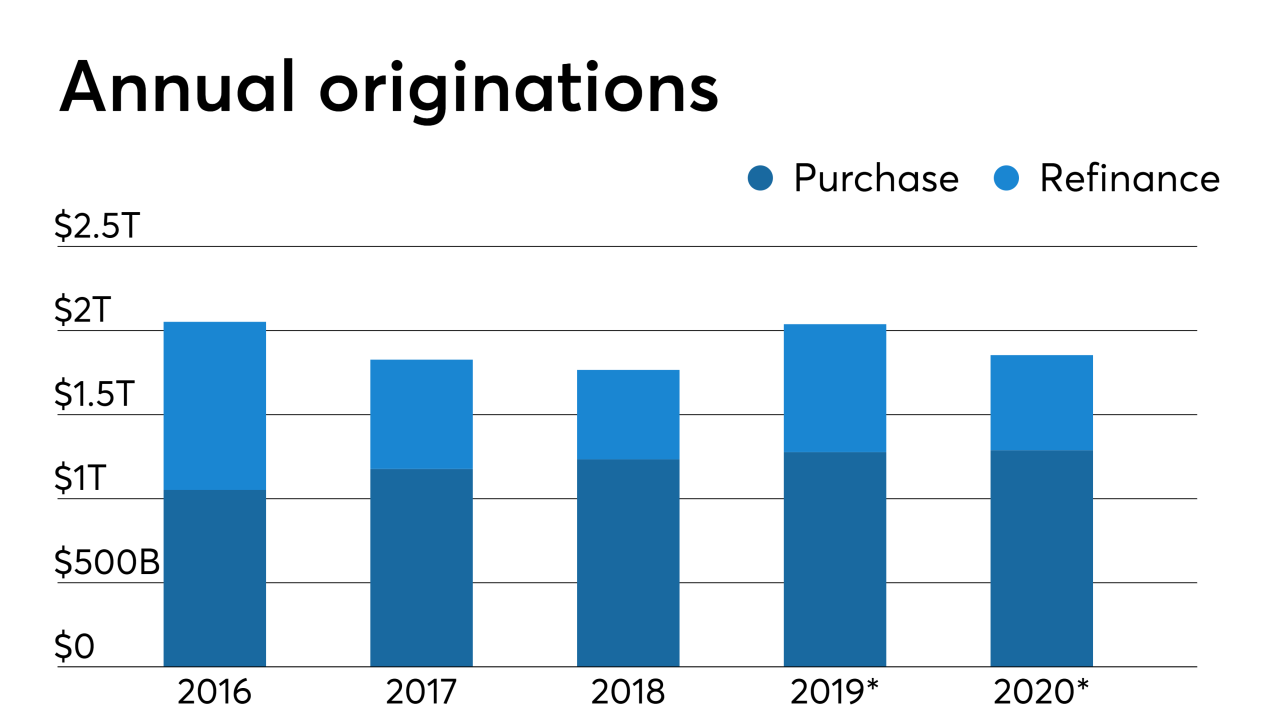

Freddie Mac is now forecasting back-to-back years of $2 trillion in mortgage loan originations rather than a drop-off in 2020.

November 1 -

A risk management model revision that decreased single-family loan-loss allowances and a strong mortgage lending environment contributed to consistent earnings results at Fannie Mae in the third quarter.

October 31 -

Recent Fannie Mae and Freddie Mac activities are “not the kind of day-to-day behavior that you would expect from companies” under federal control, the head of the Federal Housing Finance Agency said.

October 31 -

Mortgage rates rose for the third straight week — which hasn't happened since April — driven by investors' reaction to positive news regarding trade, according to Freddie Mac.

October 31 -

Freddie Mac will make haste to leave conservatorship in line with new regulatory directives, but it's uncertain how quickly it can move, CEO David Brickman said in an earnings call.

October 30 -

A lower court “erred” when it sided with Fannie Mae and Freddie Mac’s investors, the Justice Department said in its petition to the high court.

October 30 -

Home lenders will benefit from elevated refinance activity through the first half of next year, but volume may then fall off quickly, according the Mortgage Bankers Association's latest forecast.

October 30 -

VantageScore totaled 12.3 billion scores across consumer credit loan categories over a 12-month period between 2018 and 2019 with minimal mortgage volume, leaving potential for a major ramp up.

October 29 -

When it comes to possible new competitors in the secondary market, the heads of the two current outlets more than welcomed the possibility of additional players in their space because of housing finance reform.

October 28 -

The regulator of Fannie Mae and Freddie Mac discussed steps the companies have already taken to limit their risk, as well as efforts to prevent housing market “overlap” with the FHA.

October 28 -

The government-sponsored enterprises are moving ahead with a new mortgage application that omits a previously planned language question, but are looking to serve limited English proficiency borrowers in another way.

October 24 -

Economic uncertainty continued to affect mortgage rates, which rose to their highest level in 12 weeks, according to Freddie Mac.

October 24 -

Renovation spending is decelerating faster than expected this year, but could slow with more deliberation than previously anticipated next year, according to Harvard University's Joint Center for Housing Studies.

October 18 -

Single-family mortgage production this year is expected to be 3% higher than anticipated last month, according to Fannie Mae, which revised its estimates based partly on a stronger housing outlook.

October 17 -

Strong economic trends like an improved employment outlook and rising homebuilder sentiment helped to drive average mortgage rates up 12 basis points from a week ago, according to Freddie Mac.

October 17 -

Freddie Mac is postponing the date it will make using its Servicing Gateway platform mandatory, and adding new requirements related to chargeoffs and interactions with document custodians.

October 11 -

Weaker-than-expected economic data led to a decline in mortgage rates this week, although consumer attitudes remain strong, and should continue to drive increased home purchase demand, according to Freddie Mac.

October 10 -

A year after Fannie Mae launched its first credit-risk transfer securitization using a real estate mortgage investment conduit, Freddie is now electing to also opt for a REMIC format in offloading the credit risk to private investors.

October 10