-

The acting head of the Federal Housing Finance Agency has promised substantial changes for Fannie Mae and Freddie Mac, but the exact mechanics and timeline of an administration plan are still a mystery.

January 28 -

Recent comments attributed to the acting head of the Federal Housing Finance Agency (who is also comptroller of the currency) have stoked speculation about the Trump administration’s housing finance policy.

January 25 -

While Fannie Mae's multifamily origination volume took a step back from 2017's record high of $67 billion, its delegated underwriting and servicing program provided $65 billion in financing in 2018, led by Wells Fargo.

January 25 -

The 30-year fixed-rate mortgage remained unchanged for the third consecutive week, according to Freddie Mac, even with political uncertainty affecting the overall economic outlook.

January 24 -

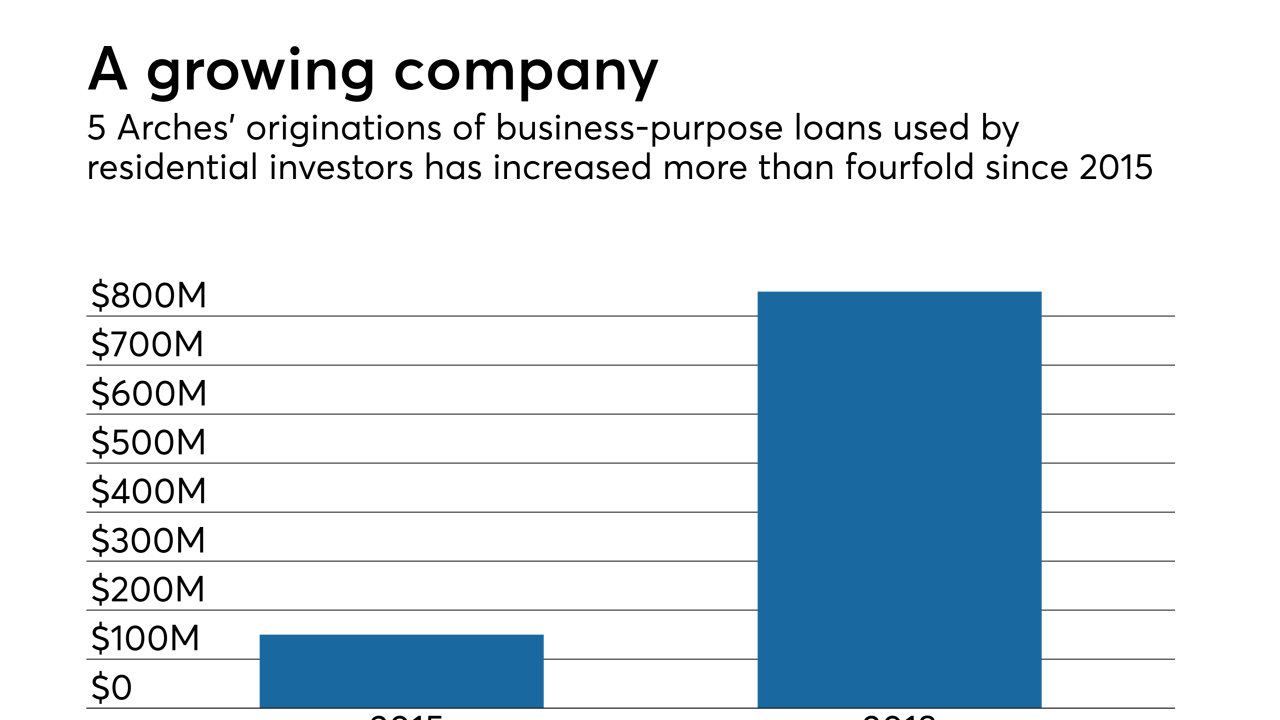

Redwood Trust has exercised its option to expand its minority stake in 5 Arches to 100%, increasing Redwood's exposure to loans used for house flipping and other types of residential investment.

January 23 -

Fannie Mae and Freddie Mac shares soared Friday amid fresh reports that the Trump administration is working on proposal that would recommend freeing the mortgage-finance giants from government control.

January 18 -

The Milken Institute's plan to address the housing finance system proposes a number of measures that could be carried out by regulators, after years of stalled legislative attempts.

January 17 -

Fannie Mae and Freddie Mac are adding another round of new underwriting requirements and a workaround for employment verification in response to the prolonged government shutdown.

January 17 -

Mortgage rates remained flat after dropping for six consecutive weeks as negative economic news was balanced with a more positive outlook on housing, according to Freddie Mac.

January 17 -

A federal appeals court ruling that found the leadership structure of the FHFA unconstitutional will face an "en banc" review later this month.

January 16 -

High home prices and expected interest rate hikes should lead to continued growth in multifamily mortgage origination volume in 2019, according to Freddie Mac.

January 14 -

Average mortgage rates continued the downward spiral that started before Thanksgiving and in the past week that finally boosted mortgage application activity, according to Freddie Mac.

January 10 -

Cascade Financial Services has become the only manufactured housing loan-focused servicer currently rated by Fitch, adding signs of a rebound in factory-built home financing that could lead to new private securitization.

January 9 -

The White House has officially nominated Mark Calabria as the next director of the Federal Housing Finance Agency.

January 8 -

As the government shutdown enters its third week, mortgage servicers are activating the response plans they normally use during hurricanes and wildfires to assist federal workers who may have trouble paying their mortgages.

January 4 -

Freddie Mac completed its first multifamily credit risk transfer transaction that used an insurance/reinsurance structure.

January 4 -

Mortgage rates started 2019 by continuing their decline but as consumers worry about the broader economy that might not help to increase home sales, according to Freddie Mac.

January 3 -

Falling mortgage rates have reached the point where they are spurring speculation about a possible resurgence in refinancing.

January 2 -

The expected decline in conventional mortgage volume may open the door for more non-qualified mortgage lending as secondary market investors seek new opportunities to deploy capital, says Tom Millon, CEO of Capital Markets Cooperative.

December 28 -

The single-family rental market could benefit from more consistent loan terms and expanded secondary mortgage market opportunities, Freddie Mac found in a preliminary test of expanded involvement in the sector.

December 28