-

The Trump administration wants to work with Congress on freeing Fannie Mae and Freddie Mac from government control, though it's considering pursuing some changes on its own, Treasury Secretary Steven Mnuchin said Tuesday.

December 18 -

Mortgage rates dropped significantly due to economic fears driving the markets following several weeks of little or no movement, according to Freddie Mac.

December 13 -

Texas Capital Bank, which already provides warehouse financing for e-mortgages, will now purchase these loans off those lines as it looks to increase liquidity for this product.

December 12 -

The White House confirmed that it plans to nominate Mark Calabria as the next director of the Federal Housing Finance Agency.

December 12 -

Fannie Mae and Freddie Mac charged lenders slightly lower guarantee fees in 2017 for mortgages with riskier characteristics, according to a Federal Housing Finance Agency report.

December 10 -

The administration’s reported interest in having the White House aide run Fannie Mae and Freddie Mac's regulator signals a focus on constraining the mortgage giants’ role in the housing market.

December 10 -

The government-sponsored enterprises are suspending eviction lockouts for the holiday season.

December 10 -

Another adjustable-rate mortgage index is going away as the Federal Home Loan Bank of San Francisco will no longer publish the monthly Eleventh District Cost of Funds Index after January 2020.

December 10 -

The gap between supply and demand in the housing market is contributing to affordability constraints that are likely to limit homeownership long-term, according to Freddie Mac.

December 6 -

Mortgage rates dropped this past week as investors pulled money from the stock market over global trade worries and instead purchased bonds, according to Freddie Mac.

December 6 -

The government-sponsored enterprises sold fewer nonperforming loans in the first half, but the drop-off in the number of sales year-to-year is less severe than it was in 2017 as a whole.

December 5 -

Reps. Lacy Clay and Emanuel Cleaver, both from Missouri, have shown interest in running the panel that could be a focal point in efforts to reform Fannie Mae and Freddie Mac.

December 5 -

The performance of loans included in commercial mortgage-backed securities improved for the fifth consecutive quarter, with delinquencies down 179 basis points over the time frame, according to the Mortgage Bankers Association.

December 4 -

The Democrat, who will likely head the Financial Services Committee, has signaled she'll make expanded housing opportunities for lower-income consumers a top priority.

December 3 -

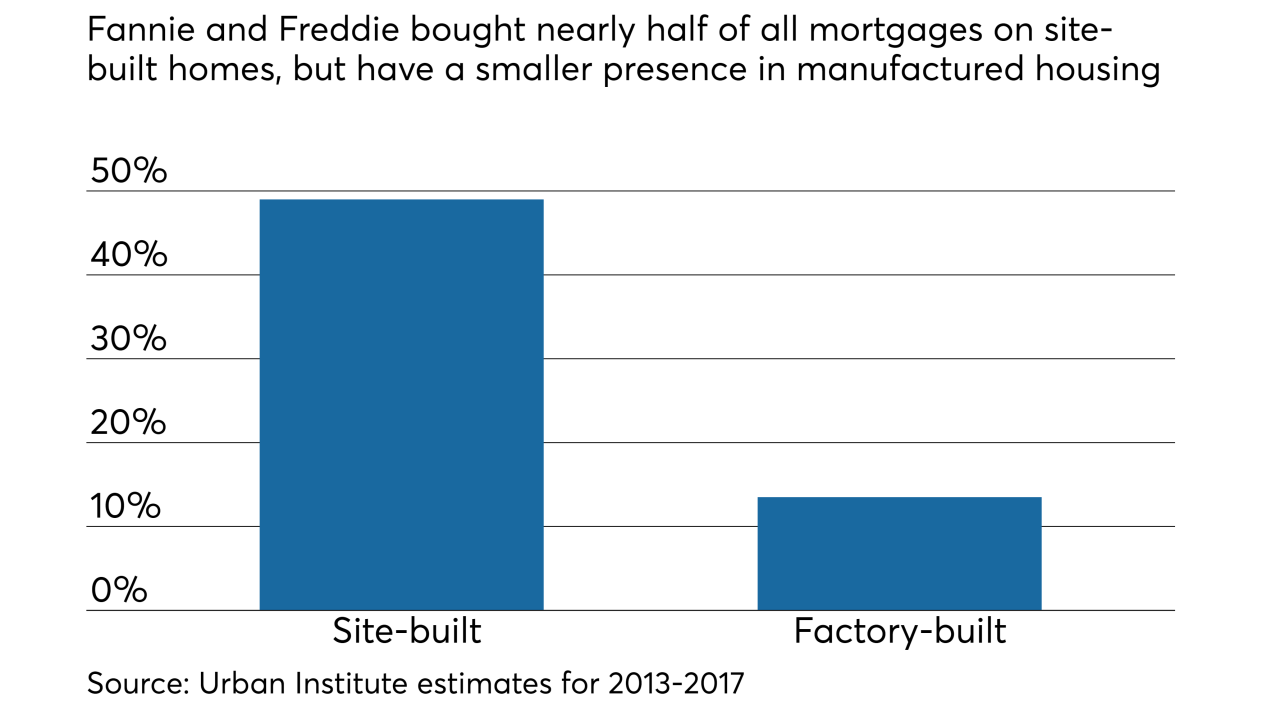

A new Freddie Mac pilot program will offer mortgages on manufactured housing with terms that more closely resemble conventional financing for site-built homes.

November 30 -

Mortgage rates held steady this week, remaining near their lowest levels in more than a month, according to Freddie Mac.

November 29 -

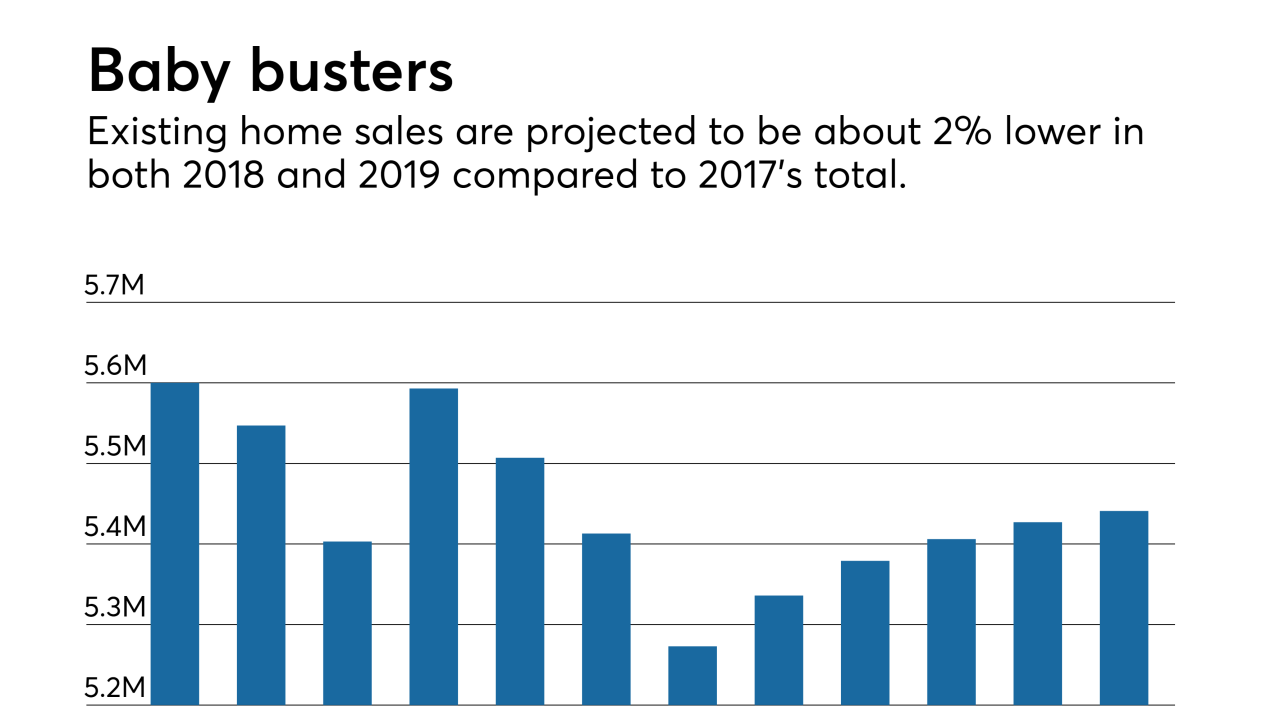

Existing-home sales are on pace to fall 2.3% year-over-year in 2018, and the baby boomer generation is a big reason why, according to Fannie Mae Chief Economist Doug Duncan.

November 29 -

The sustained rise in home values will boost Fannie Mae and Freddie Mac's loan limits for 2019, marking the second consecutive year in which it increased by nearly 7%.

November 27 -

New financing options and better inventory have bolstered the manufactured housing sector. Is this the answer to lenders' purchase-market woes?

November 27 -

The proposal by Fannie and Freddie’s regulator to impose bank-like capital requirements would be relevant only if the companies leave conservatorship. But that hasn’t stopped lenders from requesting changes.

November 26