-

The government-sponsored enterprises sold fewer nonperforming loans in the first half, but the drop-off in the number of sales year-to-year is less severe than it was in 2017 as a whole.

December 5 -

Reps. Lacy Clay and Emanuel Cleaver, both from Missouri, have shown interest in running the panel that could be a focal point in efforts to reform Fannie Mae and Freddie Mac.

December 5 -

The performance of loans included in commercial mortgage-backed securities improved for the fifth consecutive quarter, with delinquencies down 179 basis points over the time frame, according to the Mortgage Bankers Association.

December 4 -

The Democrat, who will likely head the Financial Services Committee, has signaled she'll make expanded housing opportunities for lower-income consumers a top priority.

December 3 -

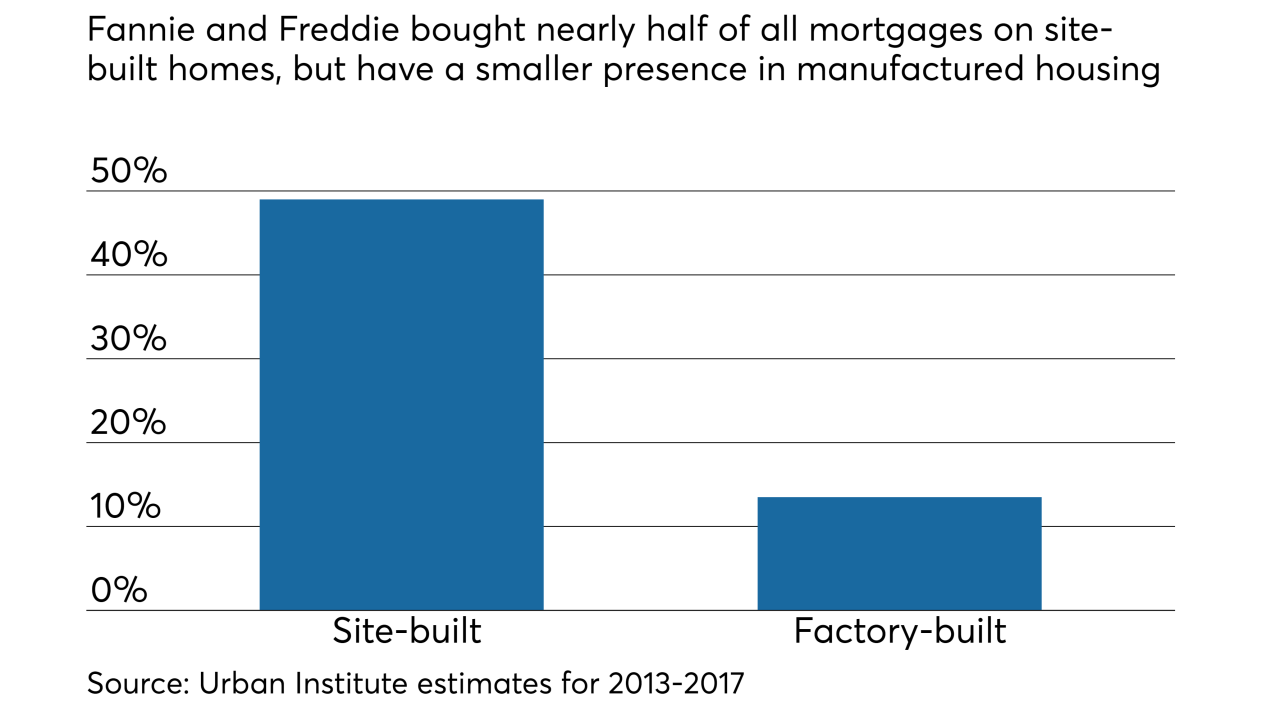

A new Freddie Mac pilot program will offer mortgages on manufactured housing with terms that more closely resemble conventional financing for site-built homes.

November 30 -

Mortgage rates held steady this week, remaining near their lowest levels in more than a month, according to Freddie Mac.

November 29 -

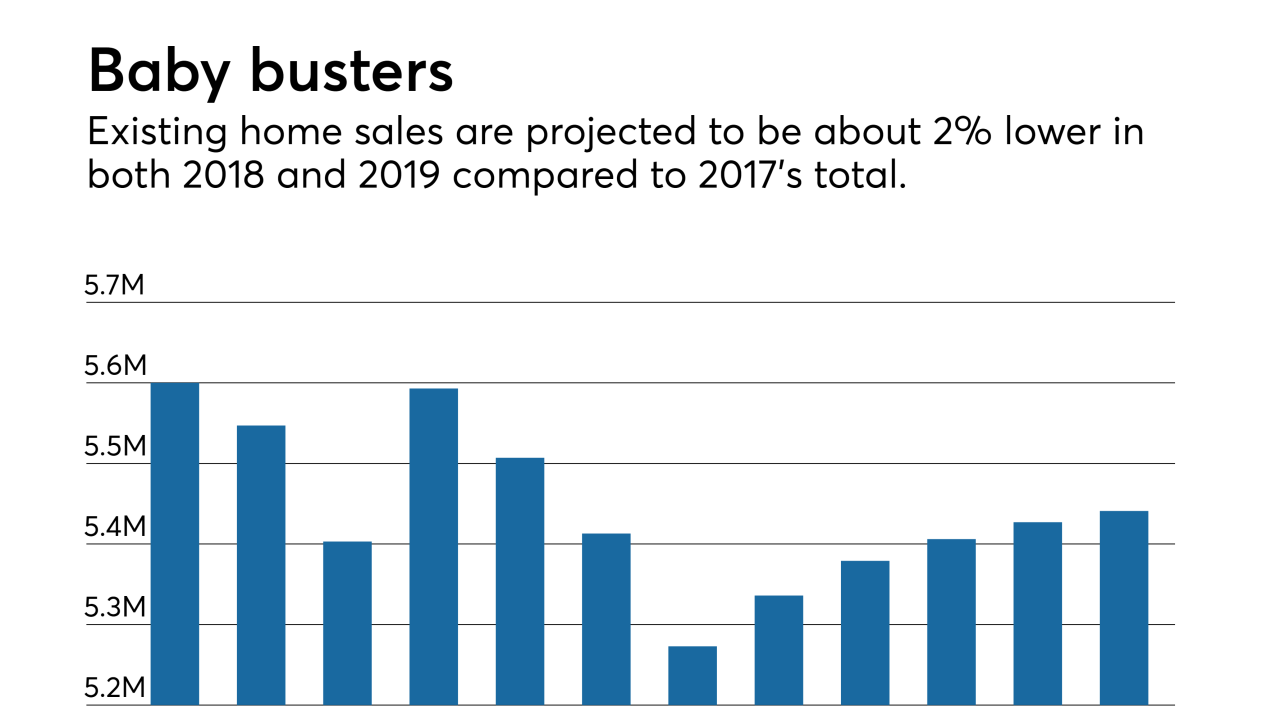

Existing-home sales are on pace to fall 2.3% year-over-year in 2018, and the baby boomer generation is a big reason why, according to Fannie Mae Chief Economist Doug Duncan.

November 29 -

The sustained rise in home values will boost Fannie Mae and Freddie Mac's loan limits for 2019, marking the second consecutive year in which it increased by nearly 7%.

November 27 -

New financing options and better inventory have bolstered the manufactured housing sector. Is this the answer to lenders' purchase-market woes?

November 27 -

The proposal by Fannie and Freddie’s regulator to impose bank-like capital requirements would be relevant only if the companies leave conservatorship. But that hasn’t stopped lenders from requesting changes.

November 26 -

Falling oil prices and continued volatility in the stock market resulted in the largest week-to-week decline in mortgage rates in over three years, according to Freddie Mac.

November 21 -

Freddie Mac is expanding its Home Possible loan program to allow borrowers in rural locations to use "sweat equity" for down payments and closing expenses.

November 20 -

The Trump administration should consider putting much of the subsidized mortgage lending done by the federal government under the government-sponsored enterprises to improve efficiency and transparency.

November 19Walker & Dunlop -

The end of one-party rule in Washington could move the needle on efforts to devise a new housing finance framework.

November 18 -

A U.S. regulator's plan to boost capital in the mortgage-finance giants won't work unless investors get "compensated" for the billions of dollars the government has collected from the companies in recent years, one shareholder said.

November 16 -

After last week's surge of 11 basis points, mortgage rates held steady due to a dip in energy costs, even with continued stock market volatility, according to Freddie Mac.

November 15 -

Borrowers will get more leeway to finance energy- and water-efficient improvements under a new program coming from Freddie Mac.

November 14 -

The 48,390 homes dubbed at extreme or high risk from the California wildfires burning through the state could cost $18 billion in reconstruction, according to a CoreLogic analysis.

November 14 -

The revised blueprint by Moelis & Co. LLC incorporates a pending regulatory capital plan for the mortgage giants.

November 9 -

Continued diversification of its business lines and better margins in its securitization activities helped Redwood Trust overcome steep mortgage origination declines and post nearly 14% annual growth in net income during the third quarter.

November 8