JPMorgan Chase

JPMorgan Chase is one of the largest and most complex financial institutions in the United States, with nearly $4 trillion in assets. It is organized into four major segmentsconsumer and community banking, corporate and investment banking, commercial banking, and asset and wealth management.

-

Rocket Cos. profits were over 35 times greater than what it disclosed for the first quarter.

July 17 -

The Minneapolis company said 75% transactions have been handled online since the pandemic hit.

July 15 -

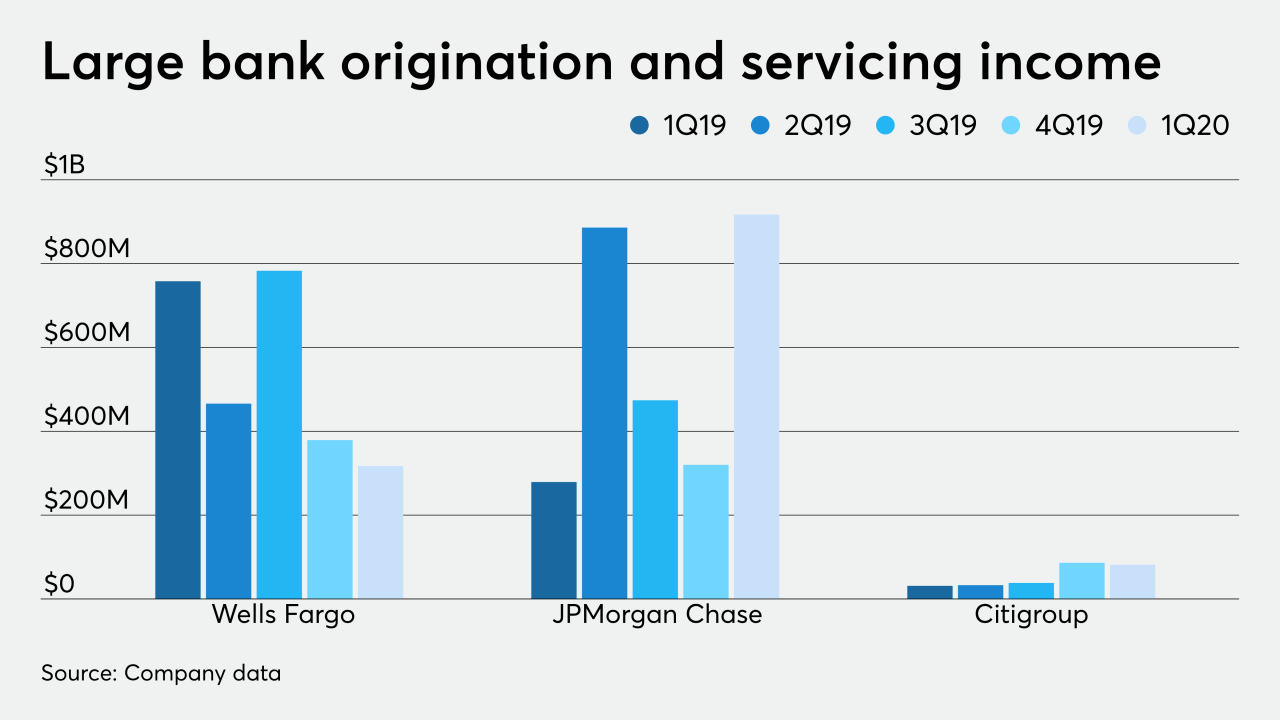

The banks logged strong year-over-year growth in gain-on-sale margins for mortgage loans.

July 14 -

As protesters continue to take to the streets to express outrage over racial injustice and inequality, banks — for the first time — will commemorate the date that marks the end of slavery in the U.S.

June 16 -

As they prepare to exit government conservatorship, Fannie Mae and Freddie Mac have enlisted the investment banks to help them boost capital and evaluate market opportunities.

June 15 -

Lenders are cautioning not only that second-quarter provisions might exceed the spike seen earlier this year, but also that credit costs could be elevated into 2021 if the economic slowdown drags on or fears of a second coronavirus wave are borne out.

June 11 -

Kalahari Resorts defaulted on a $347 million mortgage originated by JPMorgan Chase

May 27 -

JPMorgan Chase's asset-management unit and joint-venture partner American Homes 4 Rent are betting on the Las Vegas rental market.

May 14 -

A negative Federal Reserve policy rate is still improbable, but if it were to happen it could be a net benefit, according to a note from JPMorgan Chase.

May 13 -

Wells Fargo will temporarily stop accepting applications for home equity lines of credit, following a similar move by rival JPMorgan Chase.

April 30 -

Is JPMorgan Chase an outlier or the canary in the coal mine when it comes to home equity lending during the coronavirus spread?

April 28 -

The nation's largest bank is temporarily reducing its exposure to the mortgage market amid rising unemployment and estimates that home prices could drop by 10%.

April 16 -

Declines in mortgage servicing rights valuations at JPMorgan Chase and Wells Fargo point to the resurgence of a dilemma that came up during the last downturn.

April 15 -

The worsening economy brought on by the coronavirus pandemic has big banks rethinking who they will lend to.

April 2 -

JPMorgan Chase, Wells Fargo, Citigroup and U.S. Bancorp, along with 200 state-chartered banks and credit unions, have agreed to let borrowers skip payments for 90 days if their finances have been upended by the pandemic.

March 25 -

JPMorgan Chase is planning to implement a staggered work-from-home plan for its New York-area employees to help slow the spread of the coronavirus. The plan applies to most corporate employees, but not to branch workers or traders.

March 12 -

JPMorgan Chase & Co. is shifting workers to handle an expected surge in demand for home loans as the American housing market looks forward to its strongest spring in at least a decade and the coronavirus sends mortgage rates lower.

February 28 -

With interest rates and unemployment at rock-bottom lows and home values rising, the part of JPMorgan's retail business that sells home loans to consumers made money last month, marking the first profitable January in five years, according to people familiar with the matter.

February 24 -

Mike Weinbach will lead consumer lending as part of a reorganization that will change the responsibilities of three longtime bank executives.

February 11 -

Banks' lowering of origination fees and loosening of underwriting standards often foreshadow a downturn.

February 11