-

The Mortgage Bankers Association's annual convention rolled through Austin, Texas, this year, leaving behind important announcements and implications for the future of the mortgage industry.

October 30 -

When it comes to possible new competitors in the secondary market, the heads of the two current outlets more than welcomed the possibility of additional players in their space because of housing finance reform.

October 28 -

The government-sponsored enterprises are moving ahead with a new mortgage application that omits a previously planned language question, but are looking to serve limited English proficiency borrowers in another way.

October 24 -

From discussing the future of mortgage tech to discussing the ever-churning tides of political policies, here's a preview of the big issues, topics and ideas when the industry gathers in Austin, Texas, for the Mortgage Bankers Association's Annual Convention & Expo.

October 23 -

Interest rate swings during this past week resulted in a decline in both refinance and purchase mortgage applications compared with the previous period, according to the Mortgage Bankers Association.

October 23 -

The housing finance industry supports a proposed rule revision that would exempt banks regulated by the Federal Deposit Insurance Corp. from an RMBS disclosure requirement.

October 22 -

As lawmakers tackle Fannie Mae and Freddie Mac, any revamp must lessen risk to the mortgage system and U.S. taxpayers.

October 21 Treliant Risk Advisors

Treliant Risk Advisors -

Mortgage applications to purchase new homes dropped 8% in September from August, as ongoing uncertainty over interest rate movements and economy likely kept buyers out of the market, the Mortgage Bankers Association said.

October 17 -

Mortgage applications increased 0.5% from one week earlier, although interest rate instability affected consumers' ability to get the best price for their loan, according to the Mortgage Bankers Association.

October 16 -

Mortgage applications jumped 5.2% from one week earlier as a drop in rates caused another surge in refinances, according to the Mortgage Bankers Association.

October 9 -

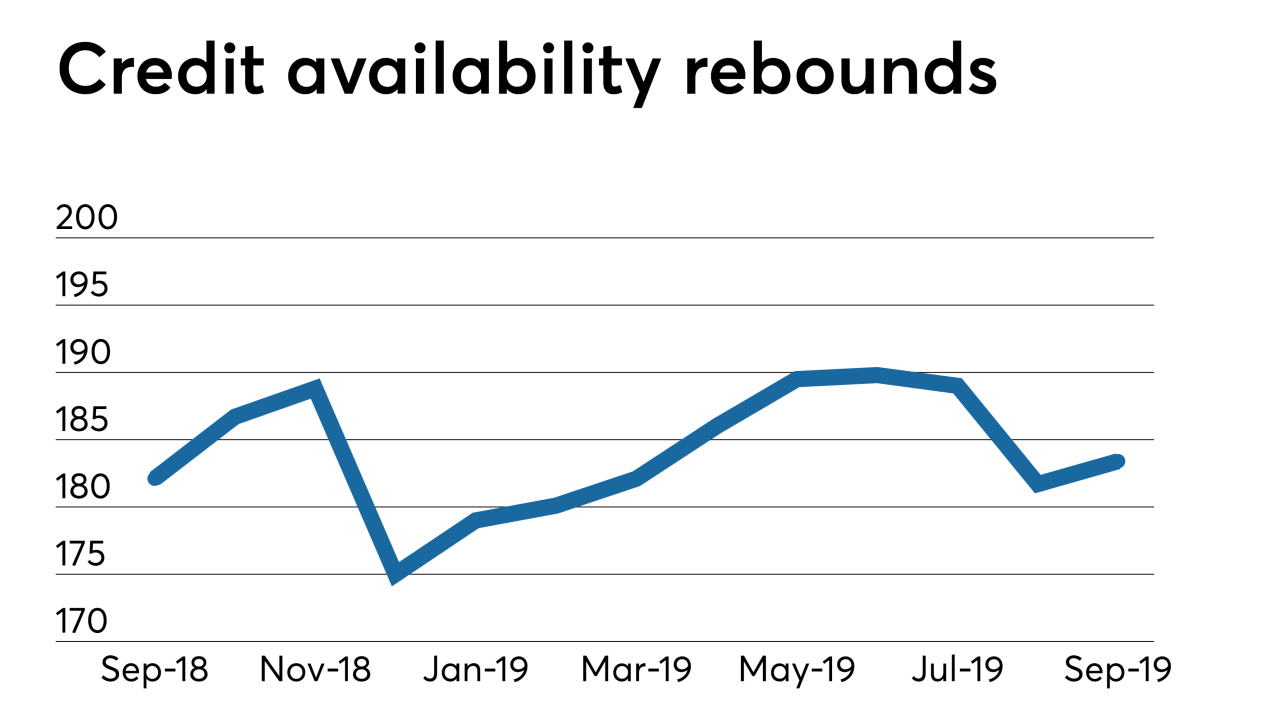

September's increase in mortgage credit availability was driven by the expansion of jumbo products to record levels, which overcame a retrenchment in both conforming and government programs, the Mortgage Bankers Association said.

October 8 -

Mortgage applications increased 8.1% from one week earlier as conventional mortgage rates fell under 4% again, according to the Mortgage Bankers Association.

October 2 -

As the affordable housing crisis comes to a head, the Mortgage Bankers Association put up opposition to the "not in my backyard" mindset by getting behind the Yes, In My Backyard bill introduced in the House of Representatives.

September 30 -

Rising demand and plummeting mortgage rates pushed multifamily origination dollar volume above 2017's record to a new peak, according to the Mortgage Bankers Association.

September 27 -

The recent run of lower interest rates may bode well for today's commercial mortgage-backed securities, unless it's undermined by an increase in leverage, according to Fitch Ratings.

September 25 -

The recent spike in mortgage interest rates reduced home purchase application activity last week, contributing to a 10.1% decline in total activity, according to the Mortgage Bankers Association.

September 25 -

Commercial and multifamily mortgage delinquency rates should stay at historically low levels in the near future even as economic uncertainty over trade affects U.S. businesses, according to the Mortgage Bankers Association.

September 24 -

Mortgage applications decreased 0.1% from one week earlier as conforming and jumbo interest rates climbed back above 4%, which slowed refinance activity, according to the Mortgage Bankers Association.

September 18 -

The low mortgage rates of August drove new homebuyers to cannonball into the purchase market compared to the year before, according to the Mortgage Bankers Association.

September 17 -

With the ongoing issue of the affordable housing crisis, the Mortgage Bankers Association got behind the Build More Housing Near Transit Act, a bipartisan bill introduced in the House of Representatives.

September 16